Is Marshalls plc (LON:MSLH) Spending Too Much Money?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

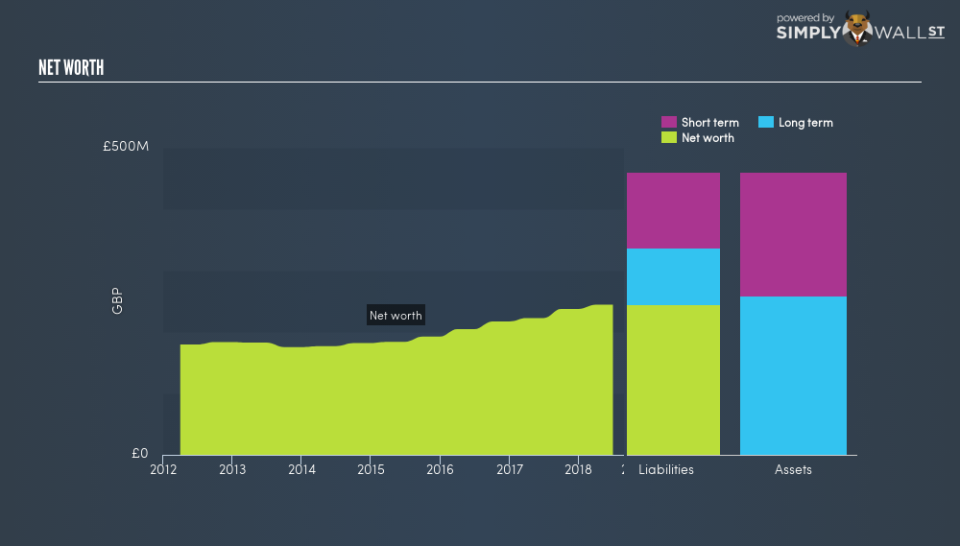

Marshalls plc (LON:MSLH) shareholders, and potential investors, need to understand how much cash the business makes from its core operational activities, as well as how much is invested back into the business. After investment, what’s left over is what belongs to you, the investor. This also determines how much the stock is worth. I’ve analysed below, the health and outlook of MSLH’s cash flow, which will help you understand the stock from a cash standpoint. Cash is an important concept to grasp as an investor, as it directly impacts the value of your shares and the future growth potential of your portfolio.

Check out our latest analysis for Marshalls

What is Marshalls’s cash yield?

Free cash flow (FCF) is the amount of cash Marshalls has left after it pays off its expenses, including its net capital expenditures, which is what the company needs to spend each year to maintain or grow its business operations.

The two ways to assess whether Marshalls’s FCF is sufficient, is to compare the FCF yield to the market index yield, as well as determine whether the top-line operating cash flows will continue to grow.

Free Cash Flow = Operating Cash Flows – Net Capital Expenditure

Free Cash Flow Yield = Free Cash Flow / Enterprise Value

where Enterprise Value = Market Capitalisation + Net Debt

Marshalls’s yield of 1.26% indicates its sub-standard capacity to generate cash, compared to the stock market index as a whole, accounting for the size differential. This means investors are taking on more concentrated risk on Marshalls but are not being adequately rewarded for doing so.

Does Marshalls have a favourable cash flow trend?

Can MSLH improve its operating cash production in the future? Let’s take a quick look at the cash flow trend the company is expected to deliver over time. Over the next few years, the company is expected to grow its cash from operations at a double-digit rate of 41%, ramping up from its current levels of UK£52m to UK£73m in two years’ time. Although this seems impressive, breaking down into year-on-year growth rates, MSLH’s operating cash flow growth is expected to decline from a rate of 23% next year, to 15% in the following year. However the overall picture seems encouraging, should capital expenditure levels maintain at an appropriate level.

Next Steps:

The company’s low yield relative to the market index means you are taking on more risk holding the single-stock Marshalls as opposed to the diversified market portfolio, and being compensated for less. Though the high operating cash flow growth in the future could change this. Now you know to keep cash flows in mind, I recommend you continue to research Marshalls to get a more holistic view of the company by looking at:

Valuation: What is MSLH worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether MSLH is currently mispriced by the market.

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Marshalls’s board and the CEO’s back ground.

Other High-Performing Stocks: If you believe you should cushion your portfolio with something less risky, scroll through our free list of these great stocks here.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance