Is Marston's PLC (LON:MARS) Potentially Underrated?

Marston's PLC (LON:MARS) is a company with exceptional fundamental characteristics. Upon building up an investment case for a stock, we should look at various aspects. In the case of MARS, it is a notable dividend-paying company with a strong track record of delivering benchmark-beating performance. In the following section, I expand a bit more on these key aspects. If you're interested in understanding beyond my broad commentary, read the full report on Marston's here.

Solid track record average dividend payer

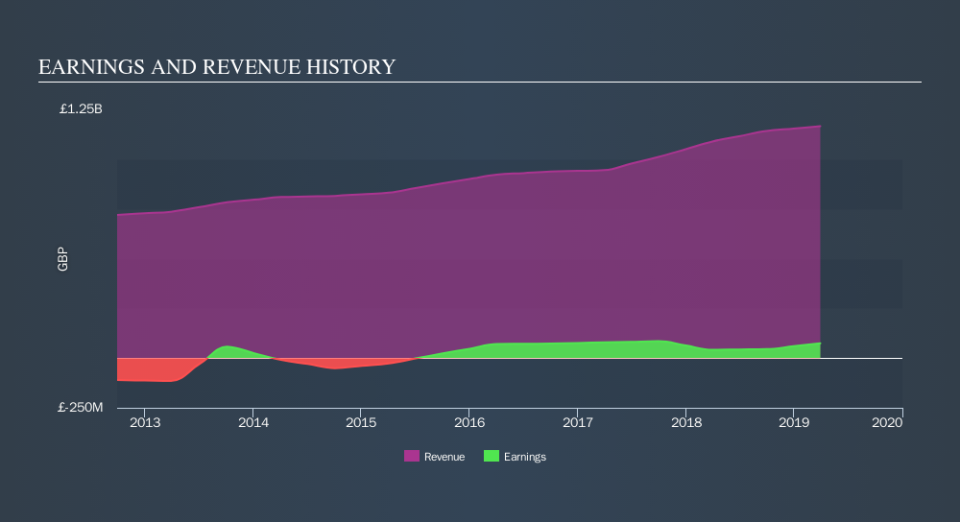

Over the past year, MARS has grown its earnings by 77%, with its most recent figure exceeding its annual average over the past five years. Not only did MARS outperformed its past performance, its growth also surpassed the Hospitality industry expansion, which generated a 5.5% earnings growth. This paints a buoyant picture for the company.

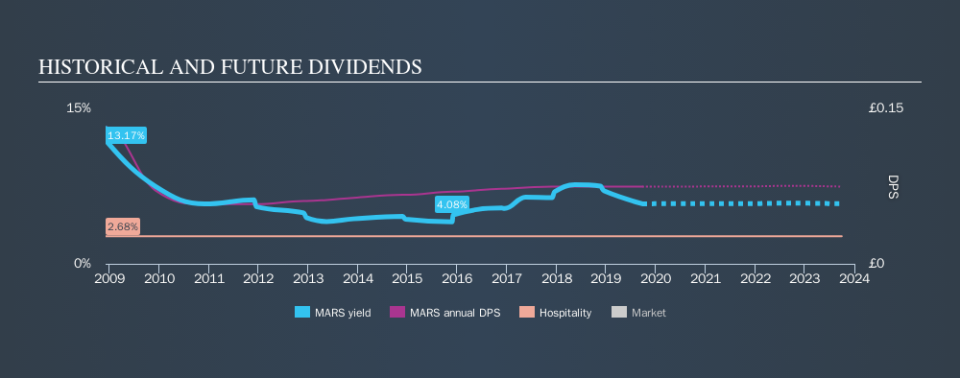

MARS's high dividend payments make it one of the best dividend stocks on the market, and its profitability ensures that dividends are well-covered by its net income.

Next Steps:

For Marston's, there are three key aspects you should further examine:

Future Outlook: What are well-informed industry analysts predicting for MARS’s future growth? Take a look at our free research report of analyst consensus for MARS’s outlook.

Financial Health: Are MARS’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of MARS? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance