Mastech Digital Inc (MHH) Q1 Earnings: A Mixed Bag with Revenue Decline but Improved Margins

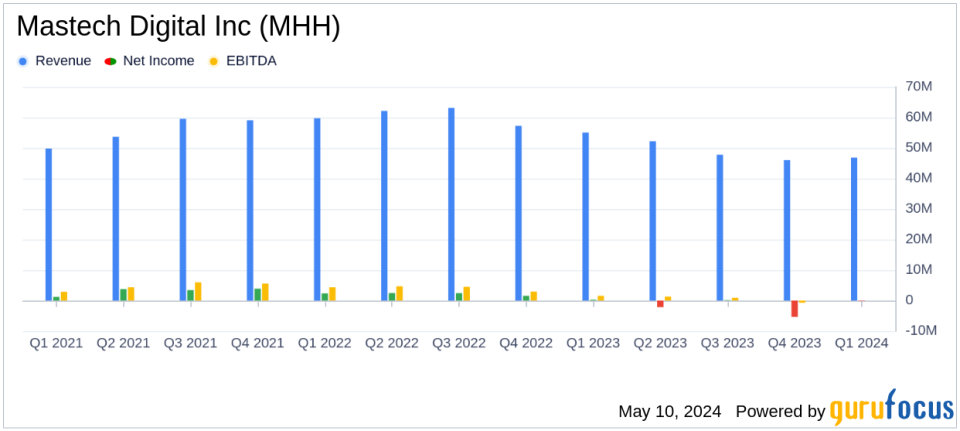

Revenue: $46.8 million, a decrease from $55.1 million in the same quarter last year, exceeding estimates of $46.50 million.

Net Income: GAAP net loss of $161,000, down from a net income of $261,000 in the prior year's quarter, below the estimated net income of $1.41 million.

Earnings Per Share (EPS): Non-GAAP EPS of $0.06, down from $0.12 year-over-year, below the estimated $0.12.

Gross Margin: Improved to 25.9% from 24.5% in the previous year, indicating enhanced profitability in cost management.

IT Staffing Services: Billable consultant base grew by 6%, contributing to sequential revenue growth from Q4 2023 to Q1 2024.

Operational Efficiency: Reduced Selling, General, and Administrative (SG&A) expenses by 3% compared to the same quarter last year.

Liquidity Position: Ended the quarter with $19.4 million in cash and no bank debt, maintaining strong financial stability.

Mastech Digital Inc (MHH), a prominent player in the Digital Transformation IT Services sector, released its 8-K filing on May 8, 2024, detailing its financial outcomes for the first quarter ended March 31, 2024. Despite a year-over-year revenue decrease, the company reported improved gross margins and a significant reduction in administrative expenses, reflecting a strategic response to shifting market dynamics.

Mastech Digital, headquartered in Pittsburgh, PA, operates primarily through two segments: Data and Analytics Services, and IT Staffing Services. The company has built a reputation for its comprehensive data management, analytics solutions, and IT staffing services, predominantly serving clients in the United States.

Financial Performance Overview

For Q1 2024, Mastech Digital reported revenues of $46.8 million, a decline from $55.1 million in the same quarter the previous year. However, the company saw an improvement in gross margins to 25.9% up from 24.5% in Q1 2023. This margin enhancement reflects effective cost management and operational efficiencies. Despite these gains, GAAP net income was a loss of $161,000, or $0.01 per diluted share, compared to a net income of $261,000, or $0.02 per diluted share, in the prior year's quarter.

The non-GAAP net income stood at $0.8 million, or $0.06 per diluted share, down from $1.4 million, or $0.12 per diluted share, year-over-year. This adjustment primarily accounts for non-cash expenses like stock-based compensation and amortization of acquired intangible assets, which are significant given the company's past acquisitions and ongoing equity-based employee compensation plans.

Operational Highlights and Strategic Adjustments

The first quarter of 2024 was marked by a 6% increase in the billable consultant base in the IT Staffing Services segment, contributing to sequential revenue growth compared to Q4 2023. This growth signifies a rebound in client activity and spending, particularly noted as the first such increase since the third quarter of 2022. The Data and Analytics Services segment also showed robust order bookings of $9.6 million, expected to convert to revenues over the next twelve months.

Management highlighted the improved market conditions and operational adjustments. "The first quarter of 2024 showed encouraging signs of market improvements in both of our business segments," stated Vivek Gupta, President and CEO of Mastech Digital. He also noted a strategic reduction in Selling, General, and Administrative (SG&A) expenses by 3% from the same quarter in 2023, enhancing the company's profitability framework.

Financial Health and Future Outlook

Jack Cronin, Mastech Digitals CFO, provided insights into the company's robust financial position, noting $19.4 million in cash balances, no bank debt, and substantial borrowing availability under the revolving credit facility. The company's Days Sales Outstanding (DSO) also improved, indicating efficient receivables management.

Despite the revenue dip, Mastech Digital's strategic maneuvers to enhance operational efficiency and margin profiles bode well for its resilience and adaptability in a competitive market. The company remains optimistic about its growth trajectory for the remainder of 2024, backed by solid financial health and an improving market environment.

For detailed financial tables and further information, refer to Mastech Digital's official earnings release and financial statements.

Explore the complete 8-K earnings release (here) from Mastech Digital Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance