Mastercard Is a Great Growth Compounder

Mastercard Inc. (NYSE:MA) has proven to be one of the best growth compounding stocks over the years. With the company set to enter the Chinese domestic market, it looks poised to continue to perform well.

Company profile

Mastercard is one of the world's largest global payment networks, where it authorizes, clears and settles transactions made through credit, debit and prepaid cards, as well as digital payments. It can also handle automated clearing house transactions. Its brands include Mastercard, Maestro and Cirrus.

The company earns money by collecting a percentage of the gross dollar value on its branded cards that run through its payment network. It also earning fees from value-added services it provides.

Opportunities and risks

Mastercard is the third-largest credit card processor in world, behind Visa (NYSE:V) and China's UnionPay, and the second largest in the U.S. Together Visa, UnionPay and Mastercard handle nearly 97% of all global transactions.

Being part of a triopoly, and a duopoly in many places in the world, Mastercard is in an envious position. While it can gain or lose market share, in general it benefits from the natural rise of global consumer spending. It also benefits from the secular shift away from cash toward electronic payments, especially in emerging markets, as well as increased cross-border spending.

Meanwhile, the company has had an edge over larger rival Visa in Europe. Mastercard has taken share across the pond as Visa has had to modernize its European network after buying it in 2016. The company has been able to secure portfolios from large European banks over the last few years, and has greatly closed the gap between the two companies in Europe.

Looking ahead, China is an opportunity for the company as well. Mastercard recently had a joint venture in the country receive approval for domestic bank card clearing. It has operated in the country on the cross-border side of the business and will now look to make inroads with Chinese banks and credit card issuers. Earlier this year, the company also began to enable inbound acceptance from Tencent and Alipay wallets. This is important because China is largely a digital payment society and it allows international travelers to pay at QR code payment points like locals.

I would not expect Mastercard to gain a lot of market share in China, but given how massive the Chinese economy is, even capturing a small percentage could be meaningful. China's gross domestic product is over $18 trillion, with over half of that from consumer consumption. Capturing just a 1% market share with a 1.50% swipe fee would be about a $1.30 billion opportunity.

The company has also been very good at growing its value-added services business, which included things such as fraud protection, identity verification and data analytics. In the fourth quarter, value-added services was its fastest-growing segment, with revenue rising 19%, or 17% in constant currencies, to $2.66 billion, outpacing the 9% growth, or 7% in constant currencies, to $3.89 billion of its payment network.

Looking to continue to grow the value-added service side of its business, Mastercard is investing in generative artificial intelligence to help in the areas of personalized real-time assistance and data analytics. Among the products it is introducing are an AI-driven conversational shopping tool and a personalized AI assistant to business owners.

When it comes to risk, the global economy is front and center. Mastercard's growth comes from increasing consumption growth, so if that grows less than expected or falls, it would be a negative for the company. The company also said it is monitoring risks from credit availability and delinquency rates, which could cause credit card issuers to pullback issuing cards or consumers spending less.

There also could be some competitive risk with Capital One Financial (NYSE:COF) acquiring Discover Financial Services (NYSE:DFS), which runs a small payments network. Capital One is a Mastercard client, so it could potentially look to issue more cards from Discover and run it through its soon to be acquired payment network.

Asked about the deal at a recent Citi Fintech conference last month, Mastercard President of the Americas Linda Kirkpatrick said:

Our relationship with Capital One has been a strong and important one for many, many years, both in the context of their cards business as well as their services business. That is true before the announcement that remains true after the announcement. You've heard them say publicly, and we've talked to them right after they made their announcement and they value the relationship that they have with us as a network. They value our services and our international acceptance and our brand. And they don't anticipate that changing. So, I believe that for the long term, we will be partnering with Capital One across a variety of topics. But what I really believe is this is a very strong demonstration that competition within our markets is incredibly robust. Whether it's this announcement or the proliferation of alternative payment methods, buy now, pay later providers, digital wallets, digital currencies, account-to-account, real-time payments, competition has never been more robust, and that is clear. But with respect to Capital One, there's a lot that still remains to be decided and concluded. I am confident that we will work with them into the long run.

Clearly the company expects to remain a Capital One customer, but it also wants to give the illusion there is a lot of competition in the space. And the reason behind that can be seen on the regulation front.

Mastercard and Visa just settled a $30 billion anti-trust lawsuit with the U.S. government. In addition to the fine, the companies agreed to reduce swipe fees by at least 4 basis points over the next three years and to for them to average 7 basis points lower of the next five years. If Mastercard extended the swipe fee reductions globally, it looks like it would only be about an $11 million impact to yearly revenue.

Valuation

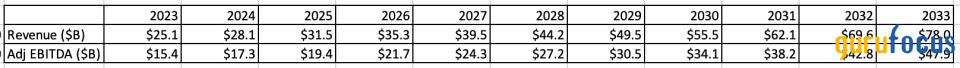

Mastercard trades over 26 times the 2024 consensus adjusted Ebitda of $17.27 billion and 23 times the 2025 consensus of $19.76 billion.

The company is projected to grow its revenue 12% in 2024 and about 12.60% in 2025.

Mastercard trades at a premium to Visa, which stands at around 21.50 times 2024 Ebitda, while seeing just slightly less revenue growth at 10%.

Prior to the pandemic, Mastercard stock traded at an enterprise value/Ebitda multiple of between 17.50 and 30. Based on that range, a fair value for the stock based on 2025 Ebitda would be between $370 and $633.

Projecting 12% growth annual growth out the next 10 years, keeping its adjusted Ebitda margins and placing a 20 times multiple on the stock would give you a $1,020 stock. Discount that back using a 5% rate would give you a $626 present valuation on the stock.

Conclusion

Mastercard is a tremendous business that should see secular trends working in its favor for years to come. Meanwhile, it has an opportunity to bolster its business even more by getting into the domestic China card clearing business and through further innovations in valued-added services.

The company is a great growth compounder that consistently sees its revenue climb in the low to high teens during typical economic environments. Thus, while the stock is not traditionally cheap, it looks attractive over the long term.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance