Match Group (MTCH) Posts Q4 Earnings Loss, Sees Revenue Rise Y/Y

Match Group MTCH reported a fourth-quarter 2021 loss of 60 cents per share against earnings of 50 cents reported in the year-ago quarter.

The Zacks Consensus Estimate for fourth-quarter 2021 earnings was pegged at 64 cents per share.

Revenues of $806 million increased 24% year over year but lagged the Zacks Consensus Estimate of $819 million.

Excluding the forex, the top line increased 26% year over year to $817.9 million.

Activity and engagement across all brands have been high since the COVID-19 outbreak. However, Match Group noted that some countries in Asia like Japan, which are important markets, were witnessing a slow COVID recovery. Also, the emergence of the new variant Omnicron reduced mobility in many markets starting early December.

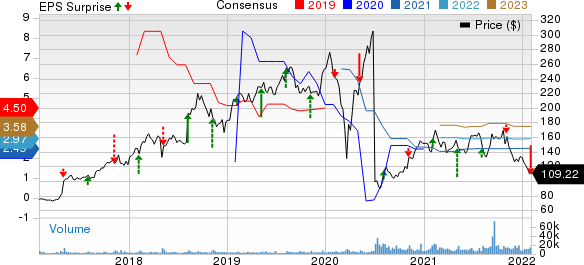

Match Group Inc. Price, Consensus and EPS Surprise

Match Group Inc. price-consensus-eps-surprise-chart | Match Group Inc. Quote

Quarter in Detail

In the fourth quarter, the number of total payers increased 15% to 16.2 million. The number of total payers from the Americas, Europe, and the Asia Pacific (APAC) and Other increased 10%, 10% and 36%, respectively, on a year-over-year basis.

Total revenue per payer (RPP) increased 8% year over year to $16.16 million. Region-wise, RPP from the Americas, Europe, and APAC and Other increased 10%, 6% and 7%, respectively.

Direct revenues from the Americas were up 21% to $399.8 million. Direct revenues from Europe increased 16% to $218.5 million, while APAC and Other reported a 46% surge in direct revenues to $169.3 million.

Direct revenues from Tinder jumped 23% year over year. The total number of payers for Tinder rose 18% year over year to 10.6 million, while Tinder RPP increased 4% in the fourth quarter.

Direct revenues from non-Tinder brands collectively increased 26% on a year-over-year basis. Non-Tinder brands witnessed 9% growth in the total number of payers to 5.7 million as well as a 16% increase in RPP.

Operating Details

Total operating costs and expenses increased 31% year over year to $574.153 million in the fourth quarter. The upside can be attributed to the increased cost of revenues, selling and marketing expenses, product development, and general and administrative expenses.

As a percentage of revenues, total operating costs and expenses expanded 400 bps year over year to 71% in the reported quarter.

Adjusted operating income was $290 million, up 18% year over year. Adjusted operating margin contracted 200 basis points (bps) year over year to 36%.

Balance Sheet

As of Dec 31, 2021, Match Group had cash and cash equivalent balance of $815.38 million compared with $523.2 million as of Sep 30.

As of Dec 31, 2021, Match Group had a long-term debt of $3.829 billion compared with $3.848 billion as of Sep 30, 2021.

As of Dec 31, 2021, Match Group reported $1.3 billion of exchangeable senior notes and $750 million under its revolving credit facility. The amount was undrawn as of Dec 31.

Guidance

Match Group expects first-quarter 2022 revenues to be $790-$800 million, indicating 18-20% growth from the prior-year quarter’s reported number. The Zacks Consensus Estimate is currently pegged at $818.82 million.

Adjusted operating income for the first quarter is anticipated to be $260-$265 million.

For 2022, Match Group expects revenues to grow 15-20% from the year-earlier quarter’s reported figure. Revenues from HyperConnect are expected to grow 0.5-1%.

Zacks Rank & Stocks to Consider

Currently, Match Group has a Zacks Rank #3 (Hold).

Match Group’s shares have tumbled 18.8% compared with the Zacks Retail and Wholesale sector’s fall of 21.3% in the past year.

Sonic Automotive SAH, Asbury Automotive Group ABG and MYT Netherlands Parent MYTE are some of the better-ranked stocks that investors can consider in the broader sector. Sonic Automotive and Asbury Automotive sport a Zacks Rank #1 (Strong Buy) at present. MYT Netherlands Parent currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sonic Automotive’s shares have outperformed the Zacks Retail and Wholesale sector in the past year. SAH has returned 21%.

SAH is expected to report fourth-quarter 2021 results on Feb 16, 2022.

Asbury Automotive Group’s shares have outperformed the Zacks Retail and Wholesale sector in the past year. The stock has rallied 14.6%.

ABG is slated to report fourth-quarter 2021 results on Feb 15.

MYT Netherlands Parent’s shares have slumped 49% in the past year.

MYTE is scheduled to report second-quarter fiscal 2022 results on Feb 16.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sonic Automotive, Inc. (SAH) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

Match Group Inc. (MTCH) : Free Stock Analysis Report

MYT Netherlands Parent B.V. Sponsored ADR (MYTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance