Mattel Inc (MAT) Q1 2024 Earnings: Narrower Losses and Margin Expansion Despite Sales Dip

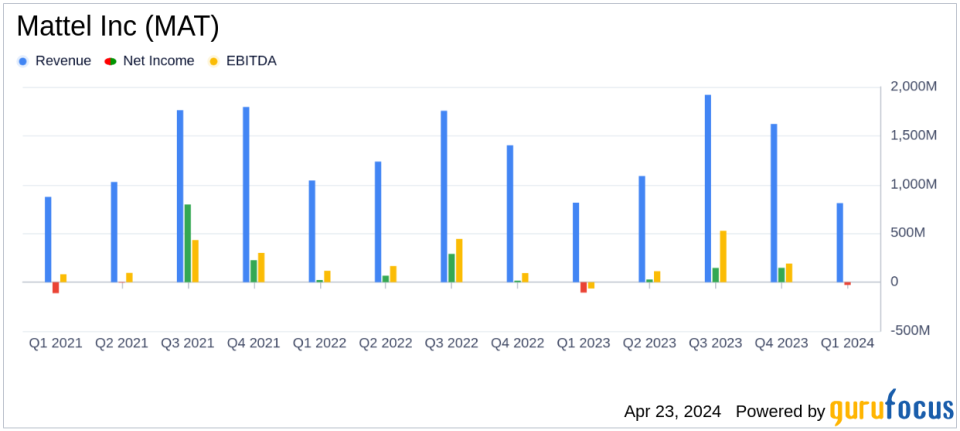

Revenue: Reported $810 million, a decrease of 1% year-over-year, falling short of estimates of $831.80 million.

Net Loss: Improved to $28 million, better than the estimated loss of $47.06 million.

Earnings Per Share (EPS): Reported a loss of $0.08 per share, surpassing the estimated loss of $0.13 per share.

Gross Margin: Increased significantly to 48.0%, up from 40.0% in the prior year, driven by lower inventory management costs and cost savings initiatives.

Operating Loss: Improved by $80 million to $36 million, reflecting strong margin expansion and cost management.

Adjusted EBITDA: Improved by $67 million to $54 million, indicating effective operational efficiency and cost control.

Share Repurchases: Executed $100 million in share repurchases, affirming confidence in financial stability and shareholder value enhancement.

Mattel Inc (NASDAQ:MAT) disclosed its financial results for the first quarter of 2024 on April 23, 2024, through its 8-K filing. The company reported a net loss of $28 million, showing a significant improvement from the previous year's loss, alongside an enhanced gross margin. However, net sales slightly declined by 1% to $810 million compared to the previous year, falling short of the estimated $831.80 million. The loss per share was $0.08, better than the estimated loss per share of $0.13.

Mattel, a leading toy manufacturer known for brands like Barbie, Hot Wheels, and Fisher-Price, operates a diversified business model focusing on both internal and external manufacturing. The company's significant market presence spans across North America, which accounts for more than 50% of its net sales, with the remainder spread across international markets.

Financial Highlights and Strategic Initiatives

The improved gross margin, which rose to 48.0% from 40.0% in the previous year, was primarily driven by reduced inventory management costs, cost deflation, and savings from the Optimizing for Profitable Growth program. Despite a slight decline in sales, Mattel's strategic initiatives appear to be yielding cost efficiencies and margin improvements. The company also repurchased $100 million of shares, reflecting confidence in its financial health and future prospects.

CEO Ynon Kreiz commented on the quarter's outcomes, highlighting the gross margin expansion and the positive trajectory in adjusted EBITDA, which stood at $54 million, up $67 million from the prior year. CFO Anthony DiSilvestro noted the strong bottom-line results driven by margin expansion and reiterated the company's commitment to meeting its full-year guidance.

Segment Performance and Market Challenges

Mattel's North America segment saw a modest increase in net sales by 2%, driven by growth in Vehicles and Action Figures. However, the International segment experienced a 4% decline in sales, attributed to weaker performance in Dolls and Preschool categories. The company faces ongoing challenges in the global toy market, including fluctuating consumer demand and economic uncertainties that could impact discretionary spending.

Outlook and Investor Relations

Looking ahead, Mattel maintains its 2024 full-year guidance, projecting an adjusted EPS of $1.35 to $1.45 and aiming for a free cash flow of approximately $500 million. The company plans to continue leveraging its iconic brand portfolio and expanding its entertainment offerings to outpace the industry and gain market share.

Mattel will host a conference call and live webcast to discuss these results and provide further insights into its strategy and outlook. The webcast can be accessed through Mattel's Investor Relations website.

Overall, Mattel's Q1 2024 results reflect a resilient operational strategy marked by significant improvements in profitability metrics, despite a slight downturn in sales. Investors may find reassurance in the company's robust margin expansion and share repurchase program, signaling a potentially favorable outlook for the coming periods.

Explore the complete 8-K earnings release (here) from Mattel Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance