Maximus Inc (MMS) Surpasses Analyst Revenue Forecasts with Strong Q2 Performance

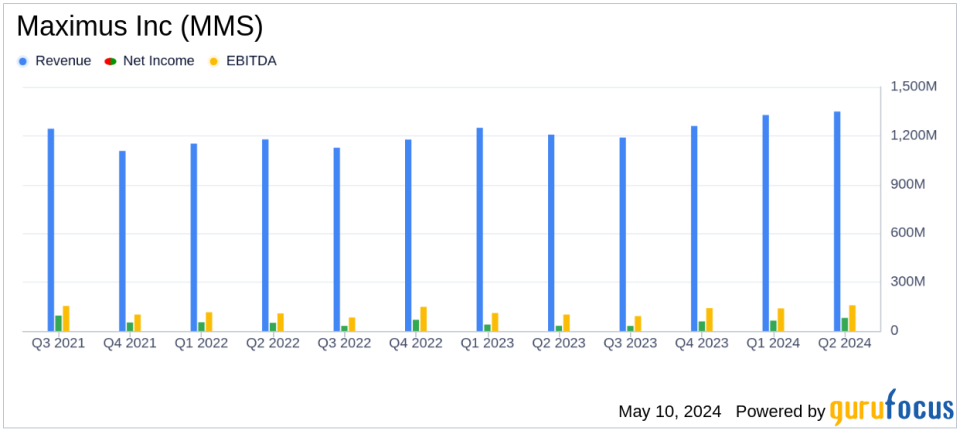

Revenue: Reported at $1.35 billion for the quarter, an increase of 11.7% year-over-year, surpassing the estimated $1.256 billion.

Earnings Per Share (EPS): Diluted EPS reached $1.31, significantly exceeding the estimated $0.94.

Net Income: Achieved $80.51 million, substantially above the estimated $67.56 million.

Free Cash Flow: Generated $105.2 million in free cash flow during the quarter, indicating strong operational efficiency.

Operating Margin: Improved to 9.5% from 5.2% in the prior year period, reflecting enhanced profitability.

Dividend: Announced a quarterly cash dividend of $0.30 per share, payable on May 31, 2024, to shareholders of record as of May 15, 2024.

FY24 Guidance: Raised revenue expectations to between $5.15 billion and $5.25 billion and adjusted EPS forecast to between $5.65 and $5.85, reflecting confidence in continued strong performance.

On May 8, 2024, Maximus Inc (NYSE:MMS) released its 8-K filing, announcing financial results for the second quarter of fiscal year 2024. The company reported significant growth, with revenue reaching $1.35 billion, an 11.7% increase from the previous year, surpassing the estimated $1.256 billion. This performance was primarily driven by expanded programs in U.S. Federal Services and resumed Medicaid-related activities.

Maximus Inc, a global leader in delivering government health and human services, operates across multiple countries including the U.S., U.K., Canada, Australia, and Saudi Arabia. The company's expertise in managing government-sponsored programs such as Medicaid and Medicare is reflected in its robust financial outcomes and operational efficiencies.

Financial and Operational Highlights

The company's diluted earnings per share (EPS) for the quarter stood at $1.31, significantly exceeding the estimated EPS of $0.94. This marks a substantial improvement from $0.52 in the same quarter last year. Adjusted EPS also saw a rise to $1.57 from $0.81. The impressive earnings performance can be attributed to strong organic growth of 12.6% and effective cost management across its segments.

Maximus also announced an increase in its fiscal year 2024 guidance, reflecting confidence in its operational capabilities and future financial performance. The company now expects revenue to range between $5.15 billion and $5.25 billion, with adjusted operating income projected between $540 million and $560 million. Adjusted EPS is forecasted to be between $5.65 and $5.85.

Segment Performance

The U.S. Federal Services segment was a standout, with revenue up 20.1% to $701.7 million, driven by volume growth in Veterans Affairs Medical Disability Exams. The segment's operating margin improved to 11.9% from 8.2% in the prior year, indicating enhanced operational efficiency.

The U.S. Services segment also reported growth, with revenue increasing by 8.1% to $486.1 million. This was primarily due to expanded assessment services and the resumption of Medicaid redeterminations. The operating margin in this segment rose to 14.0%, reflecting higher profitability from increased volumes.

Conversely, the Outside the U.S. segment experienced a revenue decline of 7.2% to $160.5 million, primarily due to divestitures. However, the segment turned around from an operating loss last year to a profit of $0.7 million, showing signs of stabilization and improved management focus.

Financial Position and Future Outlook

Maximus's balance sheet remains strong with $77.4 million in cash and cash equivalents and a reduced net debt to EBITDA ratio of 1.7 times. The company's commitment to returning value to shareholders is evident from its quarterly cash dividend of $0.30 per share, payable on May 31, 2024.

The company's robust pipeline and strategic initiatives position it well for sustained growth. With a book-to-bill ratio of 1.1x and a sales pipeline totaling $37.8 billion, Maximus is well-equipped to navigate the evolving demands of government service provision and leverage technology to enhance service delivery.

As Maximus continues to execute its strategy with an emphasis on operational excellence and innovative solutions, it remains a compelling entity within the business services sector, poised for continued success in improving government program outcomes globally.

Explore the complete 8-K earnings release (here) from Maximus Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance