May Growth Stock Picks

Capitol Health and Technology One can add profound upside to your portfolio. This is because the optimistic growth outlook for their profitability and returns make their high-growth potential appealing relative to their peers. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

Capitol Health Limited (ASX:CAJ)

Capitol Health Limited provides diagnostic imaging services to the healthcare market in Australia. Capitol Health was formed in 2006 and with the company’s market cap sitting at AUD A$233.73M, it falls under the small-cap group.

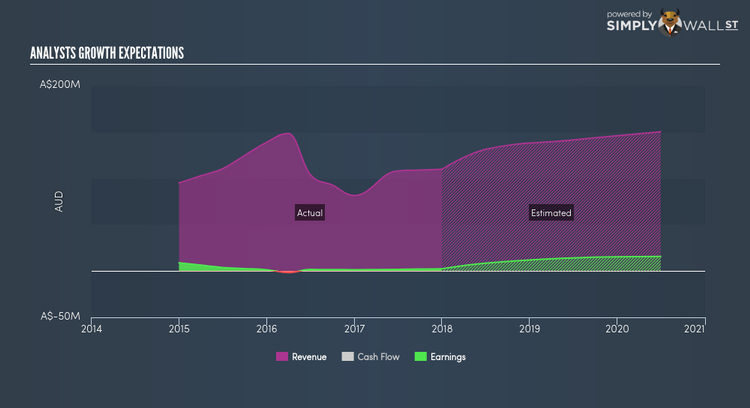

CAJ is expected to deliver a buoyant earnings growth over the next couple of years of 41.85%, driven by a positive double-digit revenue growth of 32.90% and cost-cutting initiatives. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 11.83%. CAJ’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Thinking of investing in CAJ? I recommend researching its fundamentals here.

Technology One Limited (ASX:TNE)

Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia, New Zealand, and internationally. Founded in 1987, and currently headed by CEO Edward Chung, the company currently employs 994 people and has a market cap of AUD A$1.39B, putting it in the small-cap group.

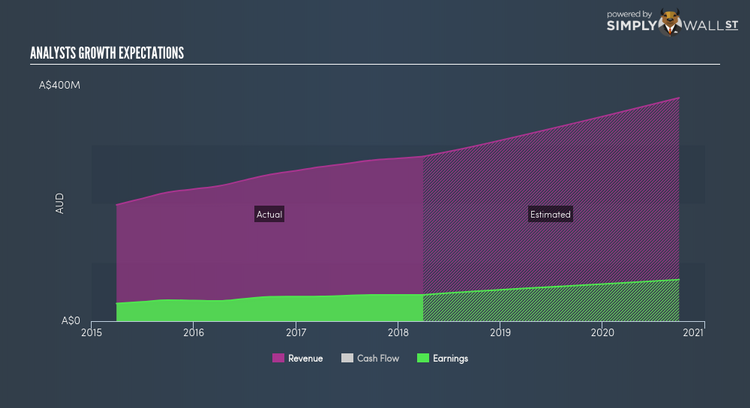

TNE’s forecasted bottom line growth is an optimistic double-digit 17.84%, driven by the underlying double-digit sales growth of 28.03% over the next few years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 32.45%. TNE’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Want to know more about TNE? Check out its fundamental factors here.

Nearmap Ltd (ASX:NEA)

Nearmap Ltd provides online aerial photomapping services in Australia and the United States. Nearmap was started in 2000 and with the market cap of AUD A$368.63M, it falls under the small-cap stocks category.

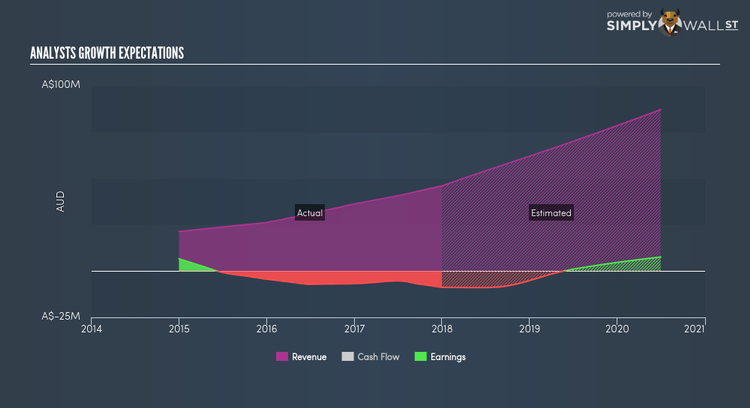

NEA is expected to deliver a triple-digit high earnings growth over the next couple of years, bolstered by an equally impressive revenue growth of 71.07%. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 2.28%. NEA ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. A potential addition to your portfolio? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance