McDermott Sticks to CBI Brushing Aside Subsea 7, Stock Jumps

McDermott International, Inc. MDR recently announced that it will combine its operations with that of Chicago Bridge & Iron Company N.V. CBI, which is expected to close in May 2018. The news came following a dramatic chain of events wherein McDermott was approached by Norway-based offshore oil services provider Subsea 7 S.A. SUBCY with an unsolicited, non-binding buyout proposal that was subject to the termination of the agreed-upon Chicago Bridge & Iron deal.

Subsea 7 was interested in acquiring McDermott as it would have made the merged company the leader in subsea equipment industry, with significant expansion in market share.

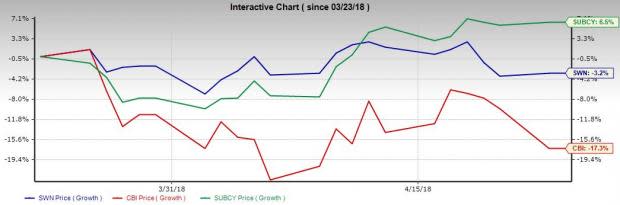

Stock Price Movement

The events benefited McDermott's shares, which gained 15.7% yesterday. As Subsea 7's $7 per outstanding share bid potentially threatened the deal between McDermott and Chicago Bridge & Iron, the latter's shares declined 8.3% yesterday.

Present Scenario

McDermott's board believed that the bid from Subsea 7 was undervalued. McDermott recently provided encouraging first-quarter 2018 operational update, while reaffirming its strong guidance for the whole year. Moreover, with a strong balance sheet, the company is well positioned to benefit from the deal with Chicago Bridge & Iron in the long term. Thus, McDermott ruled in favor of the $6 billion Chicago Bridge & Iron deal struck in December.

The combined company is expected to keep the name, McDermott. The present CEO of the acquirer, David Dickson, will retain the leading position in the combined company. The merged entity is expected to enjoy an integrated technology and engineering expertise, along with a cost-effective delivery structure. Moreover, offshore-focused McDermott is expected to largely benefit from the $1.86 billion all-stock deal — having $60 million termination fee — with onshore-based Chicago Bridge & Iron, as it will diversify the combined company's portfolio.

Brands

"Lummus" will be used as the brand name for Chicago Bridge & Iron's business section, which supplies its clients with associated engineering services, catalysts and engineered products, as well as proprietary process technology licenses. Along with the “Digital Twin” software platform, Lummus will be covered under McDermott Technology. The tank business of Chicago Bridge & Iron, which has provided services in more than 100 countries and built in excess of 46,000 storages, will keep its present branding.

Zacks Rank and Stock to Consider

McDermott has a Zacks Rank #3 (Hold). If you are interested in the energy sector, you can opt for a better-ranked stock like CNOOC Limited CEO, having a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hong Kong-based CNOOC is an integrated energy company. Its revenues for 2018 are anticipated to improve 49% year over year, while its bottom line is expected to increase 82.8%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNOOC Limited (CEO) : Free Stock Analysis Report

Chicago Bridge & Iron Company N.V. (CBI) : Free Stock Analysis Report

McDermott International, Inc. (MDR) : Free Stock Analysis Report

Subsea 7 SA (SUBCY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance