McGrath RentCorp (MGRC) Exceeds Analyst Expectations with Strong Q1 2024 Performance

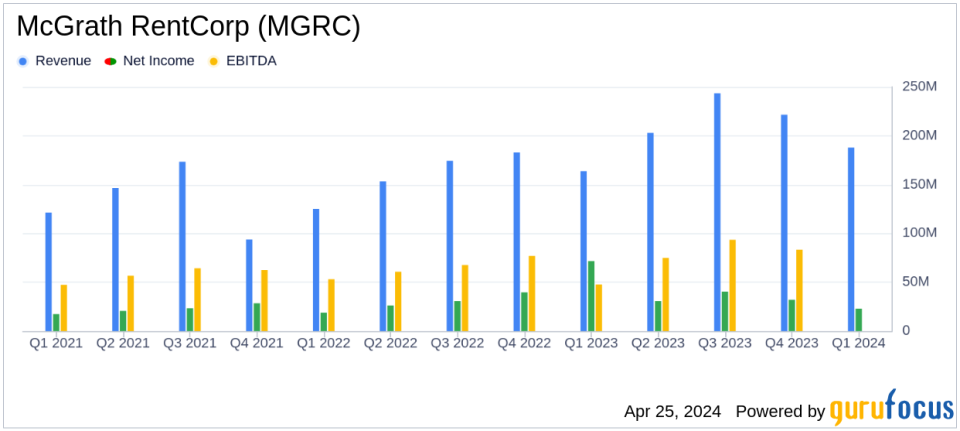

Revenue: Reported $187.8 million, a 15% increase year-over-year, surpassing the estimated $172.08 million.

Net Income: Achieved $22.8 million from continuing operations, exceeding the estimate of $17.92 million.

Earnings Per Share (EPS): Delivered $0.93 per diluted share, significantly above the estimated $0.73.

Dividend: Declared a quarterly dividend of $0.475 per share, reflecting a 1.8% yield based on the closing price as of April 24, 2024.

Adjusted EBITDA: Increased by 17% to $72.1 million, indicating strong operational efficiency.

Modular Rental Revenues: Saw a notable increase of 19% in the Mobile Modular division, driven by full quarter contributions from recent acquisitions.

TRS-RenTelco Division: Faced challenges with a 13% decrease in rental revenues due to lower demand in semiconductor-related markets.

On April 25, 2024, McGrath RentCorp (NASDAQ:MGRC), a prominent North American business-to-business rental company, announced its financial results for the first quarter ended March 31, 2024. The company reported a robust increase in total revenues and net income, significantly surpassing analyst expectations. McGrath RentCorp released its earnings details in its 8-K filing.

For Q1 2024, McGrath RentCorp posted total revenues of $187.8 million, a 15% increase from $163.7 million in the first quarter of 2023. This performance exceeded the estimated revenue of $172.08 million by analysts. The company's net income from continuing operations reached $22.8 million, or $0.93 per diluted share, more than doubling the previous year's figure of $11.5 million, or $0.47 per diluted share. This result also comfortably beat the analyst's net income estimate of $17.92 million and earnings per share estimate of $0.73.

Company Overview and Segment Performance

McGrath RentCorp operates through several segments, including Mobile Modular (modular building and portable storage), TRS-RenTelco (electronic test equipment), and Adler Tanks (containment solutions for storage of hazardous and non-hazardous liquids and solids). The company's revenue primarily comes from equipment rentals, complemented by equipment sales.

The Mobile Modular segment was particularly strong, with rental revenues up 19% to $76.5 million. This growth was supported by a full quarter of contributions from Vesta Modular in 2024 compared to two months in the previous year. The segment's Adjusted EBITDA rose by 34% to $43.3 million. However, the TRS-RenTelco segment faced challenges, with a 13% decline in rental revenues due to reduced demand in semiconductor-related projects.

Financial Statements and Key Metrics

The company's balance sheet remains solid with total assets of $2.26 billion as of March 31, 2024. McGrath RentCorp continues to maintain a strong liquidity position, evidenced by an increase in cash from $877,000 at the end of 2023 to $1.91 million.

Key financial metrics such as Adjusted EBITDA saw a significant increase, up 17% to $72.1 million. This improvement reflects the company's effective cost management and operational efficiency. The dividend rate for the first quarter was $0.475 per share, indicating a stable return to shareholders.

Management Commentary

Joe Hanna, President and CEO of McGrath, expressed satisfaction with the quarterly performance, highlighting the growth in modular rental revenues and the strategic integration of Vesta Modular. He acknowledged the challenges in the TRS-RenTelco segment but noted progress in aligning the fleet size with current demand conditions.

"We were pleased with our first quarter results. The 9% increase in companywide rental revenues was driven by strong modular and portable storage performance. Our modular business was a highlight for the quarter, with broad-based rental strength across commercial and education customer bases," stated Hanna.

Conclusion and Forward Look

McGrath RentCorp's Q1 2024 performance sets a positive tone for the year, with significant revenue and net income growth. The company's ability to exceed analyst expectations reflects its robust operational execution and strategic initiatives. Investors and stakeholders may look forward to continued growth, especially with the ongoing integration of acquisitions and potential market expansions.

For more detailed financial information and future updates, investors are encouraged to refer to the full earnings report and McGrath RentCorp's upcoming conference call scheduled for April 25, 2024.

Explore the complete 8-K earnings release (here) from McGrath RentCorp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance