MD.C. Holdings Inc. (NYSE:MDC): Commentary On Fundamentals

Building up an investment case requires looking at a stock holistically. Today I’ve chosen to put the spotlight on MD.C. Holdings Inc. (NYSE:MDC) due to its excellent fundamentals in more than one area. MDC is a financially-robust company with a a great history of performance, trading at a great value. Below, I’ve touched on some key aspects you should know on a high level. For those interested in digger a bit deeper into my commentary, read the full report on M.D.C. Holdings here.

Good value with proven track record and pays a dividend

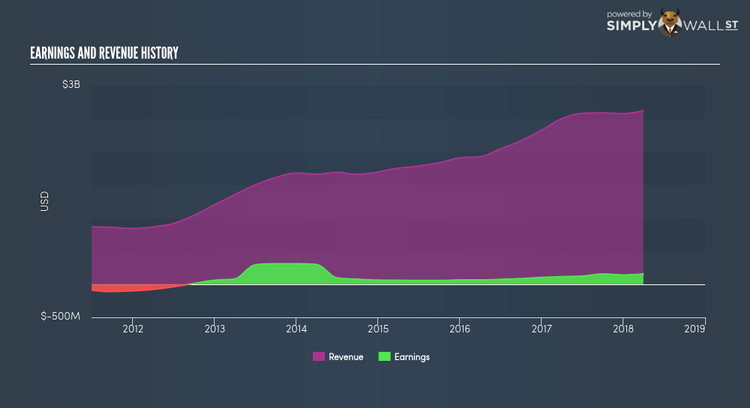

In the previous year, MDC has ramped up its bottom line by 36.41%, with its latest earnings level surpassing its average level over the last five years. In addition to beating its historical values, MDC also outperformed its industry, which delivered a growth of 10.84%. This is an notable feat for the company. MDC’s strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This suggests prudent control over cash and cost by management, which is a crucial insight into the health of the company. MDC’s earnings amply cover its interest expense. Paying interest on time and in full can help the company get favourable debt terms in the future, leading to lower cost of debt and helps MDC expand.

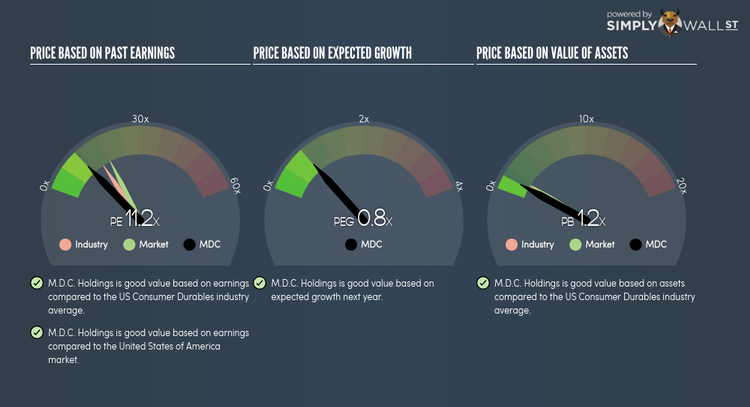

MDC is currently trading at a price-to-equity ratio of 11.16x relative to the industry ratio of 15.47x and market ratio of 18.45x, which means it is relatively cheaper than its peers.

Next Steps:

For M.D.C. Holdings, I’ve put together three pertinent aspects you should further research:

Future Outlook: What are well-informed industry analysts predicting for MDC’s future growth? Take a look at our free research report of analyst consensus for MDC’s outlook.

Dividend Income vs Capital Gains: Does MDC return gains to shareholders through reinvesting in itself and growing earnings, or redistribute a decent portion of earnings as dividends? Our historical dividend yield visualization quickly tells you what your can expect from MDC as an investment.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of MDC? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance