Media and retail — What you need to know for the week ahead

A busy week for earnings was punctuated by the July jobs report topping expectations, but this coming week in markets should be a bit calmer.

The economic calendar this week is quite light, with the highlights coming on Tuesday being the NFIB’s latest reading on small business optimism and the latest update on job openings in the U.S. Small business confidence — along with consumer confidence — has been one of the strongest economic indicators since the election.

Job openings will also be closely watched as the April report released earlier this year showed a record number of jobs open in the U.S.

Earnings highlights in the coming week will include a number of retail names, with Michael Kors (KORS), Ralph Lauren (RL), Macy’s (M), Kohl’s (KSS), and Nordstrom (JWN).

The media sector will also be in focus with results from Disney (DIS), 21st Century Fox (FOXA), and CBS (CBS).

Also reporting next week will be Nvidia (NVDA), Yahoo Finance’s company of the year in 2016 and a stock that has gained more than 55% since the beginning of the year.

Last week, we saw the Dow rally above 22,000 for the first time, much to the delight of President Donald Trump, and eventually settle at 22,092.81.

The S&P 500 closed just shy of a record high on Friday, while the tech-heavy Nasdaq is currently about 70 points from its record hit back in late July.

Economic calendar

Monday: Consumer credit, June (+$15.5 billion expected; +$18.4 billion previously)

Tuesday: NFIB small business optimism, July (103.5 expected; 103.6 previously); Job openings and labor turnover survey, June (5.66 million jobs expected; 5.67 million jobs previously)

Wednesday: Nonfarm productivity, Q2 (+0.8% expected; 0% previously)

Thursday: Initial jobless claims (240,000 expected; 240,000 previously); Producer price index, July (+0.1% expected; +0.1% previously)

Friday: Consumer price index, July (+0.2% month-on-month expected; +0% previously); “Core” consumer price index, July (+1.7% year-on-year expected; +1.7% previously)

U.S. savings rate in focus

The U.S. household savings rate is near a 10-year low.

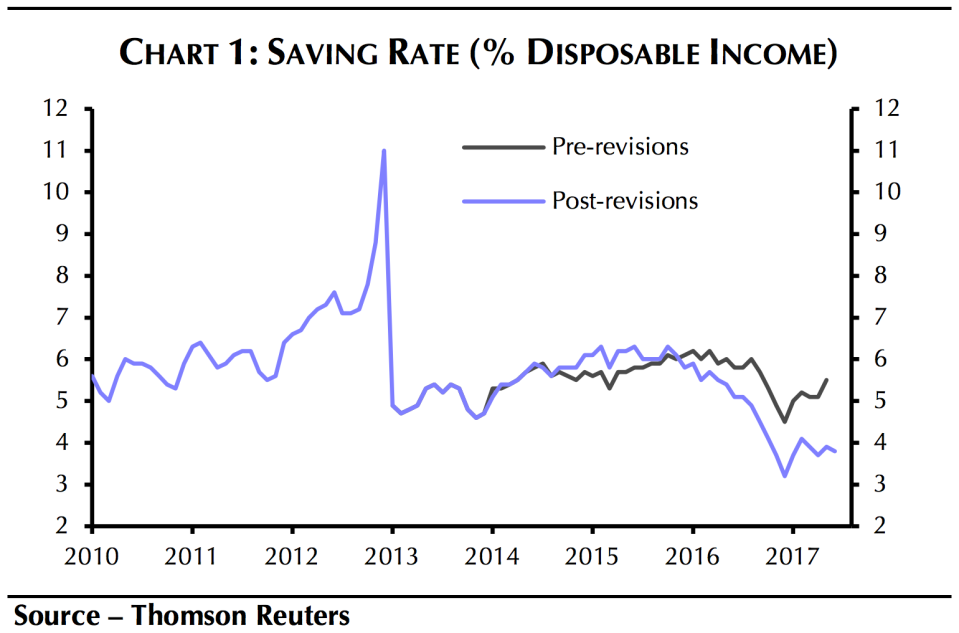

Revisions from the Commerce Department’s national income and product accounts (NIPA) series released this week showed that the U.S. savings rate fell further than previously reported late last year. As of June, the personal savings rate in the U.S. was 3.8% and in December, the now-revised savings rate fell to 3.2%, the lowest since December 2007.

This was due to a $58 billion reduction in personal incomes and a $62 billion increase in personal outlays, bringing down this rate which is the difference between the two. The following chart from Capital Economics outlines the difference following this week’s revisions.

So while a declining personal savings rate indicates a more confident consumer class, this does raise questions about the future of consumer spending and, in turn, economic growth.

In a note to clients out Friday, JPMorgan economist Michael Feroli looked at this revised decline in savings and outlined what is, and is not, troubling about these revisions.

For starters, the savings rate bears watching if only for no other reason than the fact that it cannot fall indefinitely.

Feroli notes that, “In the absence of an ever-declining saving rate, real income growth will have to remain strong for consumers to continue carrying the economy. With the labor market now near full employment, the growth in hours worked is set to slow. To maintain income growth, a pickup in either labor force participation or labor productivity is needed.”

As we saw in the latest jobs report, labor force participation has stabilized some and participation is notably growing among prime-age workers, or those between the ages of 25-54. The aging of the workforce, however, has kept a lid on overall participation, and slow productivity growth has perhaps been the hallmark of the recovery.

Average hourly earnings were also up 2.5% over the prior year in July, better than expected but still somewhat disappointing given the drop in the unemployment rate we’ve seen over the last couple years.

And so either savings must fall to keep consumption rising in the absence of higher incomes, incomes must rise to keep consumption rising with savings stable, or consumption (and likely overall economic growth) will fall.

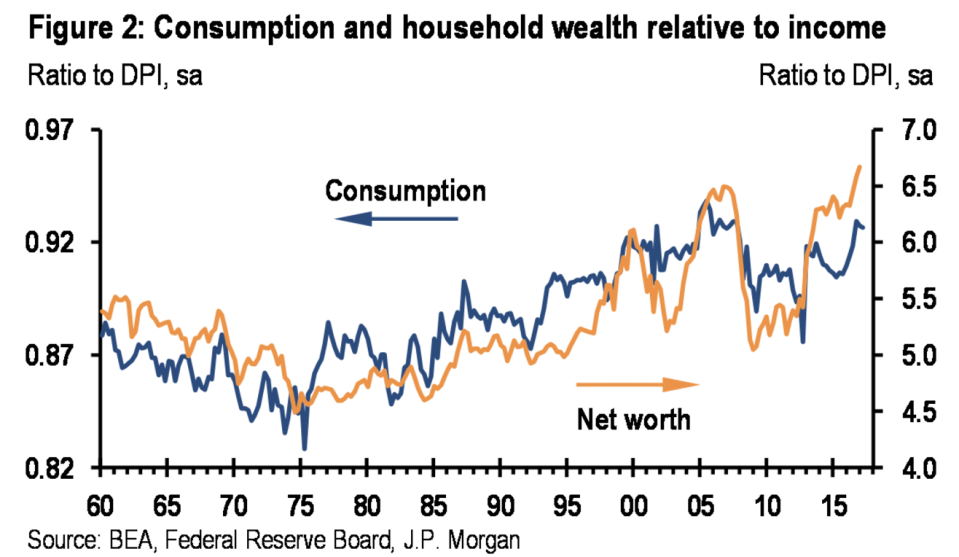

These revisions also indicate that the disappointing wealth effect we’d seen this cycle is lagging previous cycles, not entirely broken as a modifier of consumer behavior, and yet still disappointing. The wealth effect is the increase in consumer spending we see as asset prices — read: the stock market — rises.

So whether it’s because 46% of Americans do not have direct exposure to the stock market or because consumers are still scarred from the last recession, we’ve clearly seen an overall muted enthusiasm about this economic expansion from the household sector. The latest NIPA revisions, however, show that household responses to better economic conditions is not entirely broken.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance