New Media vs. Old Media: Winners & Losers

Mainstream Media “Shake-Ups” Gain Momentum

Traditionally, the media tracks and reports the news instead of making the news. However, yesterday, news broke that Vice Media (once valued in the billions) was filing for bankruptcy. Before the Vice announcement, on the same day in April, national news also broke that anchors Don Lemon of CNN and Tucker Carson of Fox News would no longer work in their respective posts on their networks. Before migrating to a morning show, Lemon had been the anchor of the prime-time show “Don Lemon Tonight” for years. Meanwhile, Carlson hosted “Tucker Carlson Tonight” – the most viewed cable news show on television for most of its existence. Both anchors were “staples” for their respective networks. Politically, Lemon catered to the left and Carlson to the right.

The “shake-up” occurring in the mainstream media is nothing new. For various reasons, Fox News, part of publicly traded Fox (FOXA), has parted ways with popular prime-time anchors such as Bill O’Reilly and Megyn Kelly. In recent years, CNN, part of Warner Bros Discovery (WBD), has done the same – parting ways with Chris Cuomo and other high-profile anchors.

What is causing the departures?

Unlike alternative media mediums such as Rumble (RUM), networks such as Fox and CNN are beholden to political, reputational, and sponsorship pressures.

Is the Legacy Media Dying?

From a valuation perspective, the space has merit. For example, Fox has a P/E ratio of 10x earnings, which compares favorably to the S&P valuation of 19x.

Image Source: Zacks Investment Research

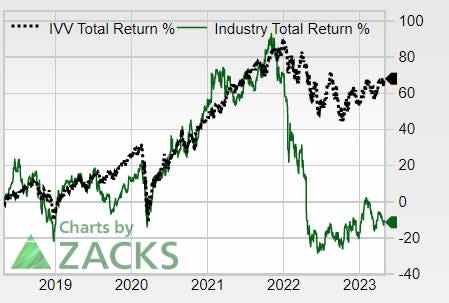

Considering the entire industry’s fundamentals, making any conclusions in one direction or another is tough. On an earnings-per-share basis, Warner Bro’s has chalked up losses for three straight quarters. Fox is highly profitable and saw year-over-year EPS growth of 269% last quarter. However, the Broadcast Radio and Television group has been an avoid over the past five years, underperforming the S&P 500 dramatically and ranking in the bottom 35% of industries tracked by Zacks.

Image Source: Zacks Investment Research

Due to the underperformance of the industry and the uncertain impact of the recent departures, investors should avoid FOXA and WBD at this juncture.

The New York Times (NYT) is the most attractive legacy media player. The Publishing – Newspapers group is the number one ranked group tracked by Zacks. Furthermore, the company is profitable and saw EPS grow 37% last quarter. Finally, the stock is showing strength. Year-to-date, NYT is higher by 21.4% - more than three times the return of the S&P 500 over the same time.

Image Source: Zacks Investment Research

New Media’s Rise

Thus far, the most apparent winner of the recent media mayhem is Spotify (SPOT). Spotify is home to the world’s most popular podcast, “The Joe Rogan Experience.” SPOT is higher by 73% year-to-date, trouncing the performance of the old media stocks. Outlets like Spotify can offer more niche and personalized experiences, such as long-form content on the Rogan podcast.

Image Source: Zacks Investment Research

The sports – media industry is another side of the business likely to see big winners and losers. YouTube parent Alphabet (GOOGL), recently paid $2 billion to gain the rights to “Sunday NFL Ticket”. AT&T’s (T) DirecTV previously held the rights to Sunday Ticket. The bold bet by Google is profound in that football fans will no longer be beholden to having satellite or long-term contracts.

Conclusion

Shake-ups in traditional media outlets are hitting a fever pitch. Though the underlying stocks have low valuations, future earnings may slow as the advent of non-traditional media fragments the market. Avoid old sluggish media companies like Fox and WBD and focus on new, disruptive entrants such as Spotify and Google.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AT&T Inc. (T) : Free Stock Analysis Report

The New York Times Company (NYT) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Spotify Technology (SPOT) : Free Stock Analysis Report

Rumble Inc. (RUM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance