Medical Device Stocks' Q4 Earnings on Feb 16: WST, SWAV & More

The fourth-quarter earnings season is almost coming to its end for the Medical sector, with several major industry players having already reported results. Sales of these companies continued their recovering trend from the third quarter on the back of recovering demand, following the continued adverse impact of COVID-19 in 2021 and the first half of 2022. Per the latest Earnings Preview, 62.5% of the companies in the Medical sector, comprising 94.2% of the sector’s market capitalization, reported earnings till Feb 8. Of these, 80% beat earnings estimates, while 74.3% surpassed revenue estimates. So far, earnings have decreased 2% year over year on 5.8% higher revenues.

This scorecard highlights the Medical sector’s continued resilience amid an uncertain macroeconomic environment. With the normalization of economies, the demand for diagnostics and surgical procedures is increasing, with more and more people visiting physicians and healthcare centers. However, the inflationary pressure, labor shortage, supply-chain disruption and interest-rate hikes continue to hurt industry players' performance in the quarter ending December 2022. Despite these macroeconomic headwinds, the earnings of several companies have increased year over year on the back of strong sales growth. Moreover, the companies have put in place cost-saving initiatives and price hikes for products and services. These initiatives are also helping Medical sector companies to improve margins.

Overall, fourth-quarter earnings of the Medical sector are expected to decline 6.8%, while sales are expected to increase 4.8%. This compares with the third-quarter reported earnings decline of 3.3% and revenue growth of 5.1%.

Medical Device Quarterly Synopsys

Integral to the broader Medical sector, Medical Device companies’ collective business growth is likely to have recorded an improvement compared with the last year, with a significant reduction in COVID-led fatality across the United States and other developed countries. Added to this, notable Medical Device players have been undertaking consistent efforts to mitigate staffing shortages that have disrupted business growth since the pandemic’s beginning. These factors are likely to have been advantageous for the base businesses of Medical Device stocks.

Yet, Medical Device companies continue to be burdened by the global shortage of semiconductors chips that produce life-saving medical equipment like pacemakers, blood-pressure monitors, insulin pumps and defibrillators. This ongoing challenge is expected to have significantly hampered the performance of several businesses in the Medical Device industry in Q4. Moreover, the rising cost of materials has also been hurting margins

Overall, the rebound in the base business, through the months of the fourth quarter, is expected to have been impressive. Medical Device companies like West Pharmaceutical Services WST, ShockWave Medical SWAV, AMN Healthcare Services AMN, Integer Holdings ITGR and Pacific Biosciences of California PACB or PacBio are likely to have shown improvement in revenues, while margins are likely to have been hurt.

Let’s take a look at the Medical Device players scheduled to announce results on Feb 16.

West Pharmaceutical Services: West Pharmaceutical’s Proprietary Products business is likely to have exhibited sustained strength and contributed to the company’s top-line growth in the fourth quarter. Apart from this, the company is likely to have witnessed margin expansion in the aforementioned segment in the to-be-reported quarter, owing to a favorable mix of products sold (stemming from the demand in HVP), production efficiencies and higher sales price. However, exposure to foreign currency exchange rate fluctuations is likely to have adversely impacted the company’s fourth-quarter performance. (Read more: What's in Store for West Pharmaceutical in Q4 Earnings?)

Per our proven model, a stock with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates.

WST is likely to beat earnings estimates in the upcoming release as it has an Earnings ESP of +1.08% and a Zacks Rank #3. The combination changed following our preview article published on Feb 13. The company had a Zacks Rank of 3 but an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

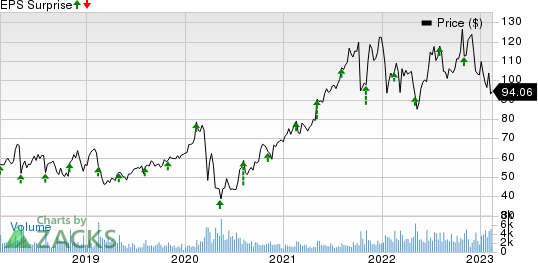

West Pharmaceutical Services, Inc. Price and EPS Surprise

West Pharmaceutical Services, Inc. price-eps-surprise | West Pharmaceutical Services, Inc. Quote

ShockWave Medical: ShockWave Medical is likely to have benefited from sustained strong product adoption. The volume for the M5 product family was up nearly 70% in the first nine months in the United States compared with the same period last year, a trend likely to have continued in the soon-to-be-reported quarter. Moreover, the price increase for the M5+ product family in the U.S. market is likely to have further contributed to top-line growth. Additional sales from new products launched in the second half of 2022 are likely to have aided the top line.

Last month, ShockWave Medical announced preliminary revenues for the fourth quarter of 2022. Per the preliminary report, fourth-quarter 2022 revenues are estimated to be between $143 million and $144 million, reflecting an increase of 70-71% year over year. The company’s U.S. Coronary revenues are expected to be approximately $81 million to $82 million.

SWAV is likely to beat earnings estimates in the upcoming release as it has an Earnings ESP of +1.94% and a Zacks Rank #3.

ShockWave Medical, Inc. Price and EPS Surprise

ShockWave Medical, Inc. price-eps-surprise | ShockWave Medical, Inc. Quote

AMN Healthcare Services: Over the past few months, AMN Healthcare has been registering solid demand for healthcare staffing on the back of continued labor shortages. Although demand continued to remain well above pre-pandemic levels, as confirmed by management on the third-quarter 2022 earnings call in November 2022, the demand for healthcare staffing has been gradually declining. The continued demand for the company’s comprehensive solutions to address the recruitment and staffing challenges is likely to have driven its overall top line in the to-be-reported quarter.

Management confirmed on the last earnings call that the demand for locum tenens and physician permanent placement continues to remain strong and well above pre-pandemic levels. However, some healthcare organizations have been streamlining leadership and non-clinical roles to reduce costs, which has affected short-term demand for interim and permanent leadership. However, AMN Healthcare's continued strength in digital health capabilities with its AMN Passport and AMN Cares bodes well. Management expects a sequential and year-over-year fall in overall revenues in the fourth quarter. (Read more: AMN Healthcare to Post Q4 Earnings: What's in the Cards?)

AMN has an Earnings ESP of 0.00% and a Zacks Rank of 2.

AMN Healthcare Services Inc Price and EPS Surprise

AMN Healthcare Services Inc price-eps-surprise | AMN Healthcare Services Inc Quote

Integer Holdings: Robust segmental performances are likely to have driven the company’s top line in the fourth quarter of 2022. Solid demand in the electrophysiology and structural heart markets as well as sales from the Oscor and Aran buyouts in the third quarter is likely to have continued in the soon-to-be-reported quarter. However, complex catheter supplier delays may have hurt growth. Strong sales at the Electrochem product line are likely to have aided Non-Medical segment sales, partially offset by battery-supplier constraints.

Last month, Integer Holdings reported preliminary fourth-quarter results, demonstrating strong revenue growth. Per the preliminary report, fourth-quarter 2022 revenues are estimated to be within $370 million-$372 million, reflecting an increase of 18-19% year over year on a reported basis. On an organic basis (reported sales growth adjusted for the impact of foreign currency and the contribution of acquisitions), fourth-quarter revenues are estimated to reflect an uptick of 12-13% year over year. Adjusted earnings per share are estimated to be within $1.08-$1.11, implying an uptick of 9-12%.

ITGR has an Earnings ESP of +4.31% and a Zacks Rank #4 (Sell).

Integer Holdings Corporation Price and EPS Surprise

Integer Holdings Corporation price-eps-surprise | Integer Holdings Corporation Quote

PacBio: Recovery in China in the post-lockdown period is likely to have aided sales of the Asia-Pacific region during the fourth quarter. However, lower Sequel IIe placements are likely to have resulted in a year-over-year decline in the Americas segment, partially benefitted from Revio uptake. Adverse impacts from the forex headwind are likely to have hurt sales in the EMEA region.

Last month, PacBio reported preliminary revenues for the fourth quarter. Per the preliminary report, fourth-quarter 2022 worldwide revenues are estimated to be $27.3 million, reflecting a decrease of 24% year over year on a reported basis. Preliminary service and other revenues for the fourth quarter of 2022 are expected to be approximately $4.6 million, down 4.2% year over year. Preliminary instrument revenues for the fourth quarter of 2022 are expected to be approximately $6.1 million, reflecting a 62.3% fall year over year. The company’s consumable revenues are expected to be approximately $16.6 million in the fourth quarter, up 10.7% from the prior-year period.

PACB has an Earnings ESP of 0.00% and a Zacks Rank #3.

Pacific Biosciences of California, Inc. Price and EPS Surprise

Pacific Biosciences of California, Inc. price-eps-surprise | Pacific Biosciences of California, Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance