Medical problems wipe £500m off Smiths Group's value

Engineering mini-conglomerate Smiths Group had almost £500m wiped off its market value after warning of problems in its medical division.

In a pre-close trading update, the FTSE 100 business said while it had returned to growth on a group level, the medical business was experiencing troubles.

Some of its medical products have been suspended from use because of new EU regulations, an issue which was compounded by the termination of two US contracts.

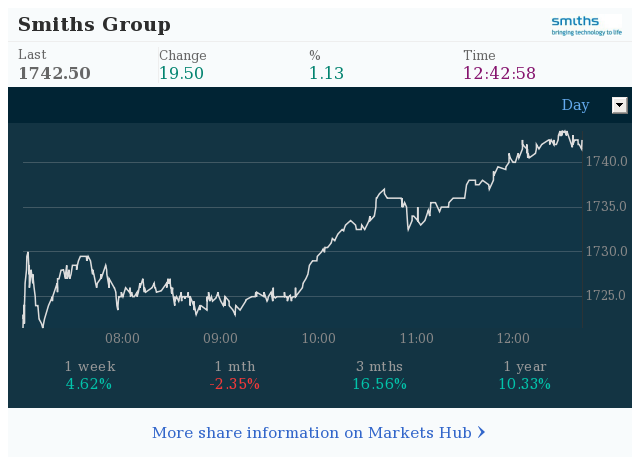

Investors took flight at the news, with the shares plunging as much as 9.4pc in early dealing. They closed down 7pc at £16.27, valuing the business at £6.4bn.

Smiths said in the 11 months to the end of June sales were up 3pc on an underlying basis, and that with the exception of the medical unit, the business will perform in line with expectations.

The company has five main businesses: John Crane, supplying components for the energy industry; detection, making airport and port security scanners; Interconnect, which produces electronic components; Flex-Tek, which makes hoses used in industry and vehicles, and medical.

Medical is the largest part of the Smiths, with sales of £951m last year, almost a third of total group revenues. The company said the unit is set to report a 2pc drop in full-year sales.

The troubled medical business is the subject of a potential sale to rival ICU Medical. When news of the possible combination emerged in May it helped drive up Smiths’ shares to an all-time high of above £18.

Artjom Hatsaturjants, analyst at Accendo Markets, called the new an “effective profit warning despite a broadly positive update”.

“The market reaction highlights the vagaries of the stock market and how even a single underperforming division can sour investor outlook for the otherwise healthy business,” he added.

“While Smiths Group is trying to reassure investors by pointing to the fact that this is a one-off disruption, regulations is something entirely out of the company’s hands.

“With the post-Brexit landscape still unclear for UK businesses, the company’s certainty that it can avoid similar disruptions in the future should be taken with a pinch of salt.”

Yahoo Finance

Yahoo Finance