Medpace Holdings Inc (MEDP) Surpasses Analyst Revenue and Earnings Projections in Q1 2024

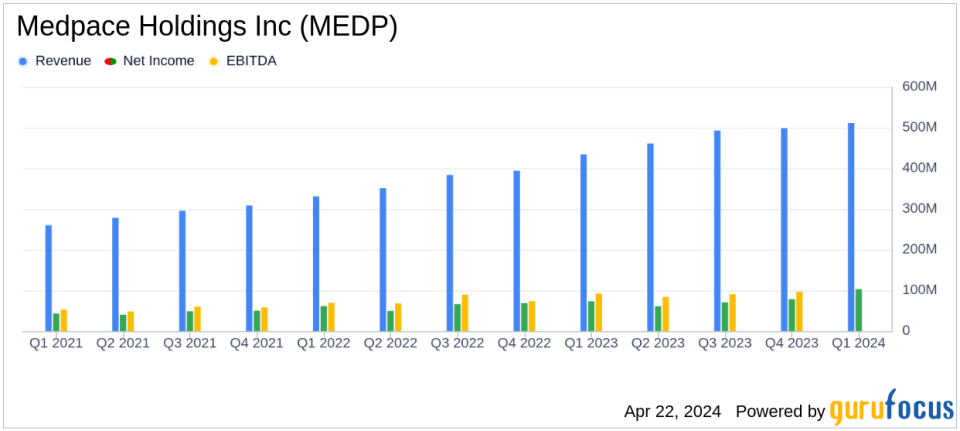

Revenue: Reported at $511.0 million for Q1 2024, up 17.7% year-over-year, slightly below the estimate of $512.59 million.

Net Income: Achieved $102.6 million in Q1 2024, significantly exceeding the estimated $78.67 million, with a net income margin improvement to 20.1% from 16.8% year-over-year.

Earnings Per Share (EPS): Recorded at $3.20 per diluted share, surpassing the estimated $2.47.

EBITDA: Increased by 24.6% to $115.7 million in Q1 2024, with an EBITDA margin of 22.6%, reflecting operational efficiency improvements.

Net Book-to-Bill Ratio: Stood at 1.20x due to net new business awards of $615.6 million, indicating robust future revenue potential.

Cash Flow: Generated $152.7 million from operating activities, supporting strong liquidity and financial health.

2024 Financial Guidance: Projects revenue between $2.150 billion and $2.200 billion and GAAP net income between $347.0 million and $369.0 million, with EPS ranging from $10.79 to $11.47.

On April 22, 2024, Medpace Holdings Inc (NASDAQ:MEDP) released its 8-K filing, revealing a robust financial performance for the first quarter of 2024. The company reported a revenue of $511.0 million, a significant 17.7% increase from the previous year, surpassing the analyst estimate of $512.59 million. Additionally, Medpace achieved a GAAP net income of $102.6 million, or $3.20 per diluted share, comfortably exceeding the estimated earnings per share of $2.47.

Medpace, a global full-service clinical contract research organization (CRO), has continued to demonstrate its capability in delivering comprehensive drug development and clinical trial services to biotechnology, pharmaceutical, and medical device firms. With over three decades of experience and a workforce of approximately 5,800 employees across 42 countries, the company's extensive expertise and strategic operations have contributed significantly to its financial outcomes.

Financial and Operational Highlights

The first quarter saw Medpace's revenue reach $511.0 million, driven by a backlog conversion rate of 18.2%. The net new business awards totaled $615.6 million, reflecting a net book-to-bill ratio of 1.20x. These figures indicate a robust pipeline and efficient conversion of backlog into revenue, which is crucial for sustained growth in the competitive CRO industry.

Medpace's operational efficiency is further underscored by its EBITDA of $115.7 million, marking a 24.6% increase from the previous year and resulting in an EBITDA margin of 22.6%. This improvement in profitability metrics highlights the company's effective management and operational execution.

Analysis of Financial Statements

Medpace's balance sheet remains strong with cash and cash equivalents standing at $407.0 million as of March 31, 2024. The company's liquidity position is robust, supported by $152.7 million generated from operating activities during the quarter. This financial stability is crucial as it provides the company with the flexibility to navigate market fluctuations and invest in growth opportunities.

The income statement reflects a disciplined cost management approach with total direct costs amounting to $355.9 million compared to $303.9 million in the first quarter of 2023. Despite the increase in costs, the company's net income margin improved to 20.1% from 16.8% in the previous year, demonstrating enhanced profitability.

2024 Financial Outlook and Strategic Directions

Looking ahead, Medpace forecasts its 2024 revenue to be in the range of $2.150 billion to $2.200 billion, indicating a growth of 14.0% to 16.7% over the previous year. The projected GAAP net income for 2024 is expected to range between $347.0 million and $369.0 million. These projections reflect the company's confidence in its operational strategies and market position.

Medpace's continued focus on expanding its global footprint and enhancing its service offerings is likely to drive future growth. The company's strategic initiatives, coupled with a strong financial position, position it well to capitalize on the increasing demand for outsourced clinical research services.

Conclusion

Medpace's first quarter results for 2024 not only surpassed analyst expectations but also demonstrated the company's robust operational and financial health. With a strong start to the year, Medpace is well-positioned to continue its trajectory of growth, leveraging its global presence and deep industry expertise to meet the evolving needs of the healthcare sector.

Investors and stakeholders can look forward to Medpace's sustained performance, underpinned by strategic initiatives and a strong market position. The company's upcoming conference call on April 23, 2024, will likely provide further insights into its strategies and outlook, potentially reinforcing confidence in its future prospects.

Explore the complete 8-K earnings release (here) from Medpace Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance