Medtronic's (MDT) Q2 Earnings Beat, Revenues Lag Estimates

Medtronic plc MDT reported second-quarter fiscal 2022 adjusted earnings per share (EPS) of $1.32, which beat the Zacks Consensus Estimate by 3.1%. Adjusted earnings surged 29.4% from the year-ago adjusted figure. Currency-adjusted EPS came in at $1.28 for the quarter.

Without certain one-time adjustments — including certain amortization and restructuring expenses and acquisition-related gains among others — GAAP EPS was 97 cents, reflecting a 169.4% surge from the year-ago reported figure.

Total Revenues

Worldwide revenues in the reported quarter grossed $7.85 billion, up 2% on an organic basis (excluding the impacts of currency) and 2.6% on a reported basis. The top line, however, lagged the Zacks Consensus Estimate by 1%.

In the quarter under review, U.S. sales (51% of total revenues) fell 1% year over year on a reported basis to $3.99 billion. Non-U.S. developed market revenues totaled $2.48 billion (32% of total revenues), depicting a 1% improvement on a reported basis (up 2% on an organic basis).

Emerging market revenues (17% of total revenues) amounted to $1.37 billion, up 20% on a reported basis (up 16% organically).

Segment Details

The company currently generates revenues from four major segments, namely Cardiovascular Portfolio, Medical Surgical Portfolio, Neuroscience Portfolio, and Diabetes.

In the fiscal second quarter, Cardiovascular revenues rose 3% at CER to $2.83 billion, reflecting mid-single-digit organic growth in Coronary & Peripheral Vascular (CPV) and low-single-digit organic growth in Cardiac Rhythm & Heart Failure (CRHF) and Structural Heart & Aortic (SHA). CRHF sales totaled $1.47 billion, up 2.8% year over year at CER. Revenues from SHA were up 2% at CER to $750 million. CPV revenues were up 6.3% at CER to $606 million.

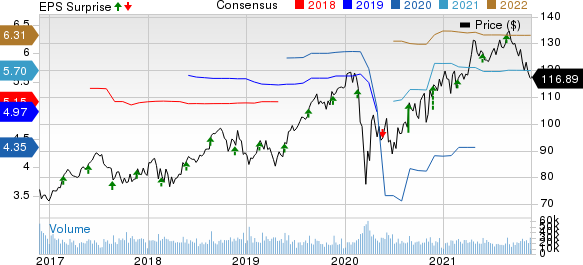

Medtronic PLC Price, Consensus and EPS Surprise

Medtronic PLC price-consensus-eps-surprise-chart | Medtronic PLC Quote

In Medical Surgical, worldwide sales totaled $2.29 billion, unchanged year over year at CER. The quarter registered high-single-digit organic growth in Surgical Innovations (SI), partially offset by low double-digit organic declines in Respiratory, Gastrointestinal & Renal (RGR). Excluding the impact of ventilator sales declines, Medical Surgical revenues increased 6% organically.

In Neuroscience, worldwide revenues of $2.14 billion were up 3% year over year at CER, driven by high-single-digit growth in Specialty Therapies and mid-single-digit growth in Neuromodulation, partially offset by low-single-digit decline in Cranial & Spinal Technologies (CST), all on an organic basis.

Revenues at the Diabetes group rose 1% at CER to $585 million. Durable insulin pumps grew in the low-twenties, including high-teens growth in the United States and low-twenties growth in international markets on the continued launches of the MiniMed 770G and MiniMed 780G systems, respectively. However, this was offset by high-single digit sales decline in consumables.

Margins

Gross margin in the reported quarter expanded 355 basis points (bps) to 68.2% on an 8.3% rise in gross profit to $5.35 billion. Adjusted operating margin expanded 396 bps year over year to 26.2%. Selling, general and administrative expenses rose 0.6% to $2.62 billion. Research and development expenses increased 5.8% to $676 million.

Guidance

Medtronic has updated its fiscal 2022 financial guidance.

Considering the greater-than-expected market impact of the pandemic and healthcare system staffing challenges in the fiscal second quarter, which is expected to continue into the second half of fiscal 2022, Medtronic now expects fiscal 2022 organic revenue growth of 7-8% compared with the prior expectation of approximately 9%. Considering the current foreign exchange rate, fiscal 2022 revenues are now expected to be positively impacted by $0 to $50 million compared with the earlier expectation of a positive impact of $100 to $200 million.

The Zacks Consensus Estimate for the company’s fiscal 2022 worldwide revenues is pegged at $32.93 billion.

The full-year adjusted EPS guidance, however, has been reiterated in the range of $5.65 to $5.75 including an estimated 5 to 10 cents positive impact from foreign exchange. The Zacks Consensus Estimate for the year’s adjusted earnings is $1.28.

Our Take

Medtronic’s second-quarter fiscal 2022 earnings beat the Zacks Consensus Estimate while revenues missed the mark. The sluggish top-line results reflected the unfavorable market impact of COVID-19 and health system labor shortages on medical device procedure volumes, primarily in the United States.

In the quarter, Respiratory Interventions decreased in the mid-thirties, with sales of ventilators declining in the mid-fifties as demand returns to pre-pandemic levels. The company had to decline its revenue guidance for the full year on a projection of severe pandemic impact to continue through the rest of the year.

On a positive note, the company registered organic growth in the Cardiovascular, Neuroscience and Diabetes segments. Within Cardiovascular, CRHF, CPV and SHA each registered organic growth. The quarter’s gross and operating margins showed improvements on a year-over-year basis.

Zacks Rank and Key Picks

The company currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader medical space that have announced quarterly results are Thermo Fisher Scientific Inc. TMO, Medpace Holdings, Inc. MEDP and AmerisourceBergen ABC.

Thermo Fisher reported third-quarter 2021 adjusted EPS of $5.76, which surpassed the Zacks Consensus Estimate by 23.3%. Thermo Fisher’s revenues of $9.33 billion outpaced the Zacks Consensus Estimate by 12%. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Thermo Fisher has an estimated long-term growth rate of 14%. The company surpassed estimates in the trailing four quarters, the average surprise being 9.02%.

Medpace, currently carrying a Zacks Rank #2 (Buy), reported third-quarter 2021 adjusted EPS of $1.29, surpassing the Zacks Consensus Estimate by 20.6%. Revenues of $295.57 million beat the Zacks Consensus Estimate by 1.2%.

Medpace has an estimated long-term growth rate of 16.4%. The company surpassed estimates in the trailing four quarters, the average surprise being 11.9%.

AmerisourceBergen, carrying a Zacks Rank #2, reported fourth-quarter fiscal 2021 adjusted EPS of $2.39, which beat the Zacks Consensus Estimate by 1.27%. Revenues of $58.91 billion outpaced the consensus mark by 3.9%.

AmerisourceBergen has an estimated long-term growth rate of 11.3%. The company surpassed estimates in the trailing four quarters, the average surprise being 5.48%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medtronic PLC (MDT) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance