Is Melhus Sparebank (OB:MELG) A Smart Pick For Income Investors?

Dividend paying stocks like Melhus Sparebank (OB:MELG) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

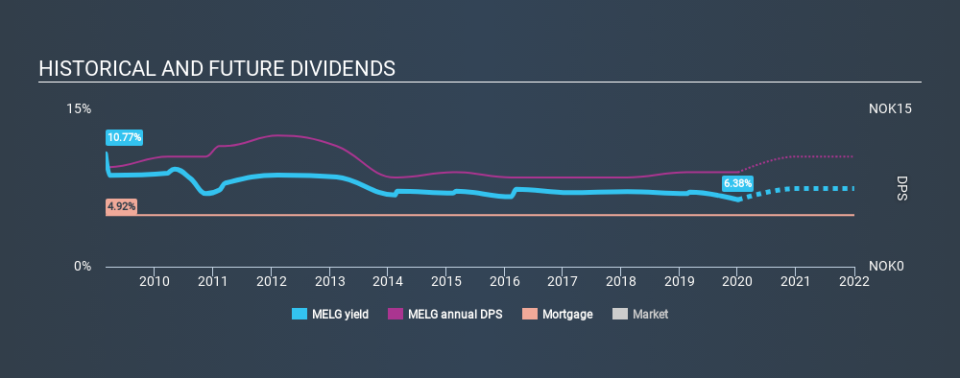

With Melhus Sparebank yielding 6.4% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. It would not be a surprise to discover that many investors buy it for the dividends. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Melhus Sparebank!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Melhus Sparebank paid out 71% of its profit as dividends. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We update our data on Melhus Sparebank every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of Melhus Sparebank's dividend payments. The dividend has been cut by more than 20% on at least one occasion historically. During the past ten-year period, the first annual payment was kr9.50 in 2010, compared to kr9.00 last year. Dividend payments have shrunk at a rate of less than 1% per annum over this time frame.

We struggle to make a case for buying Melhus Sparebank for its dividend, given that payments have shrunk over the past ten years.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Melhus Sparebank has grown its earnings per share at 7.1% per annum over the past five years. The rate at which earnings have grown is quite decent, and by paying out more than half of its earnings as dividends, the company is striking a reasonable balance between reinvestment and returns to shareholders.

We'd also point out that Melhus Sparebank issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Melhus Sparebank's payout ratio is within normal bounds. Unfortunately, earnings growth has also been mediocre, and the company has cut its dividend at least once in the past. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Melhus Sparebank out there.

Are management backing themselves to deliver performance? Check their shareholdings in Melhus Sparebank in our latest insider ownership analysis.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance