Mellanox (MLNX) Earnings & Revenues Beat Estimates in Q3

Mellanox Technologies, Ltd. MLNX reported third-quarter 2019 non-GAAP earnings of $1.69 per share, beating the Zacks Consensus Estimate of $1.58 per share. Further, the bottom line improved from the year-ago quarter figure of $1.33.

Revenues of $335.3 million improved 20.1% from the year-ago quarter and also outpaced the Zacks Consensus Estimate of $315 million. Robust demand of Ethernet adapters, switches and LinkX cables drove the top line. Robust demand for InfiniBand product was an added positive.

Further, the company reinforced its dominant position in the 25 gigabit per second (Gbps) and above merchant adapter market in the reported quarter.

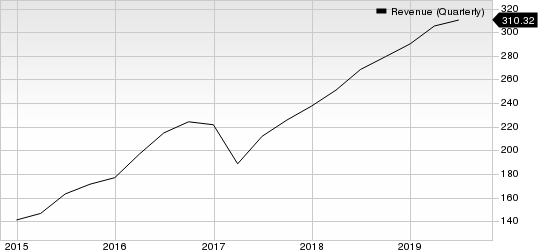

Mellanox Technologies, Ltd. Revenue (Quarterly)

Mellanox Technologies, Ltd. revenue-quarterly | Mellanox Technologies, Ltd. Quote

Quarter in Details

It is to be noted that on Mar 11, 2019, Mellanox entered into a definitive agreement with NVIDIA (NVDA), by which the acquirer will buy shares of Mellanox for $125 per share in cash, indicating a total enterprise value of around $6.9 billion.

Notably, the Israel-based Mellanox is one of the major suppliers of 25, 40, 50 and 100GB Ethernet adapters, switches and cables. The company enjoys robust demand for its InfiniBand solutions. Mellanox’s customers include datacenter owners and companies that build datacenters. Alibaba, Dell and Hewlett Packard Enterprise are some of its notable clients. These factors made the company a lucrative acquisition target.

This apart, Mellanox’s Ethernet business is doing well. Markedly, the need to access and process data at a faster speed due to data growth is fueling demand for high-speed Ethernet adapters.

Recently, Mellanox introduced its latest LinkX Cables & Transceivers at CIOE, Shenzhen, China and ECOC, Dublin, Ireland 2019. These are aimed at enhancing the performance of its Spectrum-2 family of Ethernet switches, which offer data transfer speeds of 200/400 Gbps.

Mellanox recently unveiled ConnectX-6 Dx SmartNICs and BlueField-2 I/O Processing Unit (IPU) interconnect solutions at VMworld 2019, San Francisco, CA.

Growing clout of Ethernet adapters and InfiniBand solutions in high growth datacenter and HPC market remains a tailwind.

Operating Results

Non-GAAP gross margin in the third quarter was 68.1%, down 150 bps on a year-over-year basis.

Non-GAAP operating expenses in the quarter were up 9.9% year over year and came in at $133.2 million. Non-GAAP operating income totaled $95.1 million compared with $73.2 million reported in the year-ago quarter. Non-GAAP operating margin was 28.4% compared with 26.2% in the year-ago quarter.

Balance Sheet & Cash Flow

Mellanox exited the third quarter with cash & investments worth $742.5 million compared with $610.6 million in the previous quarter.

In the third quarter, the company generated cash of $130 million from operations compared with $58.6 million in the previous quarter.

Guidance

Mellanox refrained from providing fourth-quarter guidance due to the pending acquisition by NVIDIA.

Zacks Rank and Key Picks

Mellanox carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Vonage Holdings Corp. VG, Hewlett Packard Enterprise Company HPE and Taiwan Semiconductor Manufacturing Company Ltd. TSM. Each of the stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Vonage, Hewlett Packard Enterprise and Taiwan Semiconductor is currently pegged at 5%, 7.4% and 10.4%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Vonage Holdings Corp. (VG) : Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance