Melrose spies more opportunities in GKN takeover as engineer's board steps down

Melrose’s directors have identified further ways to wring more out of their takeover of GKN after finally gaining the keys to the business.

The mid-cap turnaround firm revealed its £8.1bn offer had become unconditional today as it had secured acceptances from 85pc of GKN shareholders.

Current chief executive Anne Stevens, finance boss Jos Sclater, chairman Mike Turner and the rest of GKN's board stepped down today, with directors from Melrose taking on interim board roles.

They will stay in those roles until GKN’s shares are cancelled and the business delists as it merges with Melrose, a move expected in mid-May.

Melrose first made its approach in January saying that it could improve margins at automotive and aerospace engineer GKN, which it had claimed was under-performing.

Having had full access to GKN’s accounts, Christopher Miller, Melrose chairman, said his company’s hopes had been confirmed.

“Our in-depth review has confirmed our expectations about the size and scale of the opportunity to create lasting value for shareholders and all stakeholders as we drive the businesses to their full potential,” he said.

"Today sees the formation of a new manufacturing powerhouse, headquartered in the UK and with diverse operations around the world."

The takeover will go ahead despite opposition from trade unions and some politicians, who had accused Melrose of planning to "asset-strip" GKN. It is still subject to approval from Defence Secretary Gavin Williamson, with concerns being raised about GKN’s work on sensitive defence projects.

However recent reports citing unidentified Government officials claimed that Mr Williamson did not see any issues.

Melrose has made a series of “binding commitments” to the UK and other governments about national security in relation to the takeover, as well as saying it would take a long-term investment approach and keep the company's headquarters in the UK.

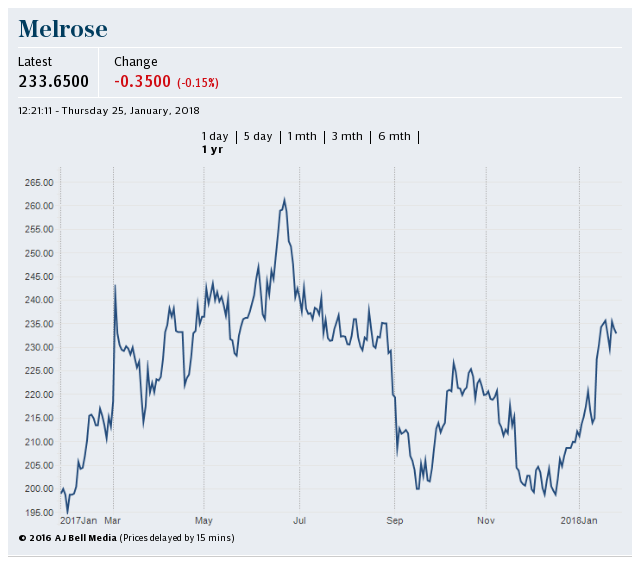

Mr Miller added: “We look forward to working closely with those governments as a responsible supplier and corporate citizen.” Shares in Melrose edged up 1.2pc on the news.

Yahoo Finance

Yahoo Finance