GKN rejects Melrose's £8.5bn hostile bid

A war of words has broken out between GKN and Melrose as the 259-year-old engineer attempts to fend off the largest hostile bid for a British blue-chip in almost a decade.

Mid-cap turnaround business Melrose formally launched a £7.4bn cash-and-paper offer for GKN, valuing its shares at 430.1p, and pledged to boost profits at the historic engineer.

The offer was swiftly rebuffed by the target’s management as “fundamentally undervaluing” the business, warning it would dilute investors' exposure to a “meaningful upside” GKN executives say they can deliver.

Melrose’s offer is the biggest hostile bid for a FTSE 100 company since US group Kraft’s acrimonious but ultimately successful £12bn purchase of chocolate-maker Cadbury in 2009.

The new offer – at a 29pc premium – aims to tempt GKN’s shareholders with an immediate 81p-a-share cash payout and 57pc ownership of the combined business.

Worth more than £8bn when debt is included, the deal is up from a 405p informal approach Melrose made less than a week ago, which the target company revealed to the markets on Friday, having knocked it back as failing to reflect GKN’s true value.

Alongside announcing the unsolicited approach, GKN confirmed interim chief executive Anne Stevens in the role, issued an upbeat trading update, and outlined plans to boost profits while splitting itself along the lines of its aerospace and automotive divisions.

Both sides are now running charm offensives, touring the City to convince investors of the merits of their respective plans.

Dismissing the formal bid as “virtually unchanged” from the previous proposal, Ms Stevens told shareholders to “retain all the benefits of the clear upside potential in GKN, rather than handing 43pc of it to Melrose and its management”.

Melrose claims it offers the chance to “re-energise” GKN, which the suitor says is failing to deliver on profits, having issued two recent profit warnings following a botched management succession. CEO-designate Kevin Cummings was ditched in November after problems were discovered in a division he previously ran, which led to heavy writedowns, with Ms Stevens appointed in the interim.

Simon Peckham, Melrose chief executive, added: “GKN’s management is admitting with the turnaround plan they’re not performing. We’re giving investors the chance to decide who will be better running it – us or the current management.”

Melrose also questioned how long GKN could continue with its current “patrician” management and structure, suggesting that despite its long history, the company had suffered “more than a decade of neglect”.

The suitor also laid into the permanent appointment of Ms Stevens as a knee-jerk reaction, noting she had been on the board since 2016, a period which saw GKN’s troubles intensify.

But sources close GKN hit back, warning that Melrose – which is attempting it largest ever acquisition – could be biting off more than it can chew.

Pointing to Ms Stevens’ previous jobs with Ford and Lockheed Martin, the source added: “Anne is the best person for the job – her appointment wasn’t by accident. Automotive and aerospace are a lot more complex than the widget-makers Melrose has bought before.”

GKN’s major customers include giants such as Airbus and Boeing in aerospace and most of the major car manufacturers, and the source questioned how Melrose will deal with these notoriously tough negotiators.

“They have no experience of dealing at this level, know nothing about the pricing pressure those customer can bring to bear,” the source said.

Melrose’s quoted 29pc premium was also rubbished by GKN, with internal documents putting it at about half this level when factors including using cash on the target’s balance sheet to fund the investor payout are factored in.

The speed at which Melrose has gone hostile has surprised many. Bidders often stalk their target with the aim of shareholders forcing talks. It also highlights how little value Melrose sees in trying to find an agreement with GKN’s board and prefers to let the market decide.

The process has been complicated by trustees of GKN’s pension fund weighing in. They want assurances the £1.1bn funding hold in the scheme will be plugged in a deal, a level which would allow it to stand alone.

Melrose said it had improved pension schemes of companies it had previously bought.

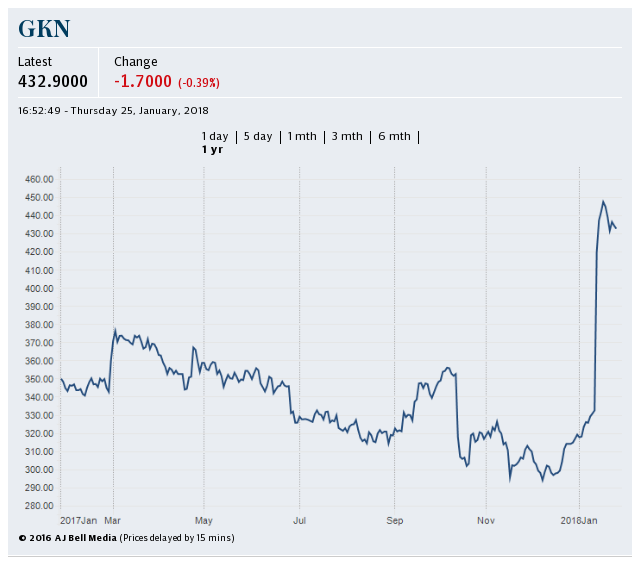

Shares in GKN, which surged by almost a quarter when the approach emerged, are now up almost 35pc, and closed on Wednesday at 447.6p, while Melrose shares slipped 0.9pc to 232.2p, indicating markets expect a higher offer.

Yahoo Finance

Yahoo Finance