Mercadolibre (MELI) Incurs Loss in Q1, Beats on Revenues

MercadoLibre, Inc. MELI reported a first-quarter 2021 loss of 68 cents per share, which lagged the Zacks Consensus Estimate for earnings of 27 cents per share. Notably, the company reported a loss of 44 cents per share in the year-ago quarter.

Its revenues surged 111.4% on a year-over-year basis (158.4% on an FX-neutral basis) to $1.38 billion. Further, the top line surpassed the Zacks Consensus Estimate of $1.19 billion.

Revenues were driven by accelerating commerce and fintech revenues, which grew 139.2% and 72.4% year over year to $910.6 million and $467.8 million, respectively.

Further, the e-commerce boom continued to act as a major tailwind.

Further, increasing total payments volume (TPV), courtesy of a robust Mercado Pago and the mobile-point-of-sale (MPOS) business,contributed well. Moreover, a solid momentum across Mobile Wallet benefited the results.

Moreover, the company’s rising gross merchandise volume (GMV), led by an accelerating mobile GMV, contributed 72.9% to the total GMV. Also, mobile GMV soared 215.7% year over year.

Also, strong shipment growth via MercadoEnvios in the reported quarter was another positive. The growing penetration of managed networks was also a tailwind.

Additionally, strengthening momentum acrossMercado Fondo and Mercado Credito benefited the company.

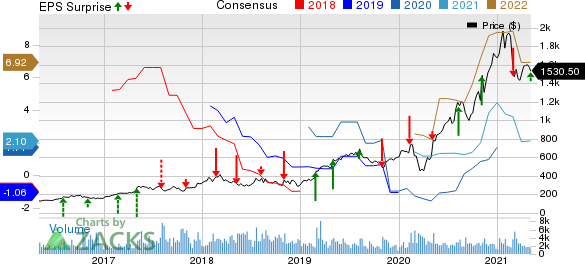

MercadoLibre, Inc. Price, Consensus and EPS Surprise

MercadoLibre, Inc. price-consensus-eps-surprise-chart | MercadoLibre, Inc. Quote

Quarter in Detail

Brazil: Net revenues in the firstquarter were $768.7 million (55.8% of total revenues), up 93% year over year.

Argentina:The market generated revenues of $297.2 million (21.6% of the top line), which soared 124% year over year.

Mexico: Net revenues in the reported quarter were $230.5 million (16.7% of revenues), up 143% year over year.

Other countries:The markets generated revenues of $81.9 million (5.9% of total revenues), climbing 203.5% on a year-over-year basis.

Key Metrics

GMV of $6.1 billion jumped 77.4% year over year and 114.3% on a reported basis and a FX-neutral basis, respectively.

The number of successful items sold was 222 million, up 110% year over year. Moreover, the number of successful items shipped surged 130.7% year over year to 208.1 million. This can be attributed to the sturdy performance of MercadoEnvios.

TPV was up 81.8% on a year-over-year basis to $14.7 billion, driven by a strong performance of MercadoPago. Further, off-platform payment volume (online-to-offline) was $8.5 billion, up 82.5% from the year-ago quarter.

Additionally, the MPOS business witnessed year-over-year TPV growth of 90.2%. Further, the rapid adoption of MercadoLibre’s Mobile Wallet generated $2.9billion in transactions, up 192% year over year.

TPV on marketplace was $5.8 billion, up 82.3% year over year. Further, total payment transactions skyrocketed 116.7% year over year to 630.1 million.

Unique active userstotaled69.8 million, up 61.6% year over year.

Operating Details

For the first quarter, the gross margin was 42.9%, contracting 510 basis points year over year.

Operating expenses were $500.5 million, which increased 46% year over year. However, as a percentage of revenues, the figure contracted to 36.3% from 52.5% in the year-ago quarter.

The company reported $90.8 million of income from operations in the first quarter against the year-ago quarter’s loss of $29.7 million.

Balance Sheet

As of Mar 31, 2021, cash and cash equivalents were $862.7 million, down from $1.9 billion as of Dec 31, 2020.

Short-term investments were $980.1 million in the first quarter, down from $1.2 billion in the previous quarter.

Accounts receivable amounted to $64.8 million, up from $49.7 million in the fourth quarter of 2020. Further, the inventory level at the end of the first quarter was $131.5 million, up from $118.1 million at the end of the prior quarter.

Zacks Rank & Stocks to Consider

MercadoLibre currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader sector worth consideration are Agilent Technologies A, Pure Storage PSTG and NVIDIA NVDA. All the stocks carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate of Pure Storage, NVIDIA and Agilent, is pegged at 52.21%, 15.05% and 9%, respectively.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance