Merck (MRK) Beats on Q1 Earnings and Sales, Ups 2023 View

Merck MRK reported first-quarter 2023 adjusted earnings of $1.40 per share, which beat the Zacks Consensus Estimate of $1.34. Earnings declined 35% year over year (30% excluding the impact of currency) due to charges related to acquisitions and collaboration deals. Earnings slightly missed our estimate of $1.41 per share.

Including acquisition and divestiture-related costs, restructuring costs, income and losses from investments in equity securities, and certain other items, earnings per share were $1.11, down 30% (ex Fx) year over year.

Revenues declined 9% year over year (5% on a constant currency basis) to $14.49 billion. Sales beat the Zacks Consensus Estimate of $13.84 billion and our estimate of $13.74 billion.

Quarter in Detail

The Pharmaceutical segment generated revenues of $12.72 billion, down 10% (6% excluding Fx impact) year over year as higher sales of oncology drugs and vaccines were offset by lower sales of Merck’s COVID-19 drug, Lagevrio (molnupiravir) and diabetes medicines. Excluding Lagevrio, Pharmaceutical sales grew 14%.

Keytruda, the largest product in Merck’s portfolio, generated sales of $5.8 billion in the quarter, up 20% (24% excluding Fx impact) year over year. Keytruda sales gained from continued strong momentum in metastatic indications, including in some types of NSCLC renal cell carcinoma, head and neck squamous cell carcinoma, TNBC and MSI-H cancers, and rapid uptake across recent earlier-stage launches. Keytruda sales beat the Zacks Consensus Estimate of $5.67 billion as well as our estimate is $5.72 billion.

Alliance revenues from Lynparza and Lenvima also boosted oncology sales in the quarter. Merck has a deal with British pharma giant AstraZeneca AZN to co-develop and commercialize PARP inhibitor, Lynparza, and a similar one with Japan’s Eisai for its tyrosine kinase inhibitor, Lenvima.

Alliance revenues from AstraZeneca-partnered Lynparza increased 8% (excluding Fx impact) year over year to $275 million in the quarter, driven by increased demand. Lenvima alliance revenues were $232 million, up 5% from the year-ago period.

In the hospital specialty portfolio, neuromuscular blockade medicine, Bridion injection generated sales of $487 million in the quarter, up 27% year over year, driven by increased demand and market share.

In vaccines, sales of HPV vaccines — Gardasil and Gardasil 9 — rose 43% year over year to $1.97 billion, driven by strong demand in ex-U.S. markets, particularly China. Gardasil sales beat the Zacks Consensus Estimate of $1.81 billion as well as our estimate of $1.88 billion.

Proquad, M-M-R II and Varivax vaccines recorded combined sales of $528 million, up 14% year over year. Sales of the rotavirus vaccine, Rotateq rose 42% to $297 million. Pneumovax 23 (pneumococcal vaccine polyvalent) vaccine sales declined 40% to $96 million due to declining demand in the U.S. market as it shifts toward newer vaccines. Sales of Merck’s new pneumococcal 15-valent conjugate vaccine, Vaxneuvance, were $106 million compared with $138 million in the previous quarter.

Januvia/Janumet (diabetes) franchise sales were down 25% year over year to $880 million. The drug sales were hurt by lower demand and pricing in the United States and generic competition in certain international markets. The drugs lost market exclusivity in China in July and the European Union in September last year.

The company’s COVID-19 drug, Lagevrio (molnupiravir) generated sales of $392 million during the first quarter, down 87% year over year. Lower sales in Japan and Australia and no sales in the United States and the United Kingdom hurt Lagevrio sales. However, Lagevrio sales were better than the Zacks Consensus Estimate of $291 million as well as our estimate of $294 million.

Merck’s Animal Health segment generated revenues of $1.49 billion, up 1% year over year (5% excluding Fx impact). Animal Health segment sales were better than the Zacks Consensus Estimate of $1.47 billion.

Margin Discussion

Adjusted gross margin was 76.9%, up 620 basis points year over year, driven by the favorable impact of product mix and lower sales of Lagevrio, which is a low-margin product.

Selling, general and administrative (SG&A) expenses were $2.5 billion in the reported quarter, up 9% year over year due to higher administrative costs and higher promotional spending. Research and development (R&D) spending was $4.3 billion, reflecting an increase of 67% year over year due to increased charges related to the acquisition of Imago and a collaboration and licensing agreement with Kelun-Biotech.

2023 Guidance Upped

Merck slightly upped its earnings and sales outlook for 2023.

Merck expects revenues to be in the range of $57.7-$58.9 billion in 2023 compared with $57.2 - $58.7 billion previously. The Zacks Consensus Estimate is pegged at $58.5 billion.

Lagevrio is expected to generate $1.0 billion in sales in 2023, a significant decline from $5.7 billion in 2022.

Adjusted earnings per share are expected to be between $6.88 and $7.00 versus the prior expectation of $6.80 to $6.95. The Zacks Consensus Estimate is pegged at $6.88 per share.

The adjusted gross margin is expected to be approximately 77% (maintained).

Adjusted operating costs are expected to be in the range of $23.3 to $24.1 billion versus the prior expectation of $23.1 to $24.1 billion. The adjusted tax rate is expected to be approximately 17% to 18% (maintained).

The EPS guidance does not take into account charges related to Merck’s proposed acquisition of Prometheus Biosciences RXDX. In mid-April, Merck announced a definitive agreement to acquire Prometheus Biosciences for $200 per share in cash for a total equity value of approximately $10.8 billion.

The deal will add Prometheus’ lead product candidate, PRA023, a humanized monoclonal antibody (mAb). PRA023 is currently being developed in mid-stage studies for the treatment of immune-mediated diseases, including ulcerative colitis, Crohn’s disease and other autoimmune conditions. The Prometheus Biosciences acquisition is expected to close in the third quarter of 2023. The acquisition is expected to result in a one-time charge of approximately $10.3 billion or approximately $4.00 per share, which will reduce adjusted earnings.

Our Take

Merck’s first-quarter results were better than expected as it beat estimates for earnings as well as sales.

Strong sales of key products cancer drug, Keytruda and Gardasil vaccine drove the top line in the quarter. Merck also raised its full-year sales profit outlook, citing strong global underlying demand for its key products. Shares of Merck were up 1.4% in pre-market trading.

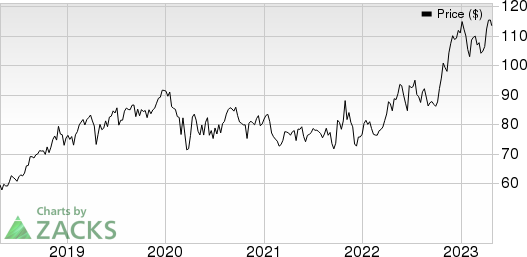

The stock has rallied 34.4% in the past year compared with the industry’s increase of 12.1%.

Image Source: Zacks Investment Research

Merck’s drugs like Keytruda and Gardasil vaccine have been driving sales. Animal health and vaccine products are also core growth drivers. Merck is investing in M&A activity to strengthen its pipeline. Recent deals included the acquisition of Imago and key agreements with Moderna, Orna, Orion and Kelun-Biotech. Merck has also made meaningful progress in its pipeline in the past year.

Zacks Rank & Stock to Consider

Merck currently carries a Zacks Rank #3 (Hold).

Merck & Co., Inc. Price, Consensus and EPS Surprise

Merck & Co., Inc. price-consensus-eps-surprise-chart | Merck & Co., Inc. Quote

A better-ranked large drug stock is Novo Nordisk NVO, which has a Zacks Rank of 1 (Strong Buy).

Estimates for Novo Nordisk’s 2023 earnings per share have increased from $4.49 to $4.70 over the past 30 days. Estimates for 2024 have jumped from $5.29 per share to $5.51 in the same timeframe. Novo Nordisk’s stock has surged 47.9% in the past year.

Novo Nordisk beat earnings expectations in three of the trailing four quarters. The company delivered a four-quarter earnings surprise of 3.00%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Prometheus Biosciences, Inc. (RXDX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance