Merck (MRK) to Report Q3 Earnings: What's in the Cards?

We expect Merck MRK to beat expectations when it reports third-quarter 2021 results on Oct 28, before market open. In the last reported quarter, the company delivered a negative earnings surprise of 1.50%.

The large drugmaker’s performance has been rather weak, with the company missing earnings expectations in three of the trailing four quarters while missing in one. The company delivered a four-quarter earnings surprise of 0.57%, on average.

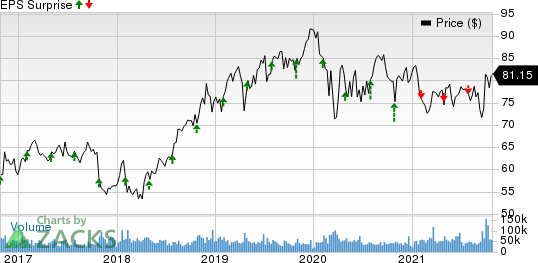

Merck & Co., Inc. Price and EPS Surprise

Merck & Co., Inc. price-eps-surprise | Merck & Co., Inc. Quote

Merck’s stock has declined 0.8% this year so far against an increase of 11.6% for the industry.

Image Source: Zacks Investment Research

Factors to Consider

Sales of some drugs of Merck recovered from the impact of the pandemic in the second quarter. We expect the positive trend to have continued in the third quarter. However, some negative effects of the pandemic on its business are expected to have persisted. The impact of rising infection rates due to the Delta variant remains to be seen. Strong commercial execution and higher demand are also expected to have boosted sales of most drugs.

The strong demand for cancer drugs is likely to have boosted sales growth in the third quarter.

In oncology drugs, Keytruda sales are likely to have been driven by continued strong momentum in lung cancer indications and continued uptake in newer indications. The Zacks Consensus Estimate for Keytruda’s sales is $4.43 billion. Higher alliance revenues from Lynparza, driven by continued uptake across the multiple approved indications in the United States, the EU and China, may have boosted oncology sales. Please note that Merck markets Lynparza in partnership with AstraZeneca AZN. Alliance revenues from Lenvima may have also boosted oncology sales.

In the hospital specialty portfolio, higher demand reflecting ongoing recovery from the pandemic may have benefited sales of Bridion Injection. The Zacks Consensus Estimate for Bridion is $364million.

Merck’s vaccines portfolio recovered sharply in the second quarter due to the return to a more normal level of wellness visits. The positive trend is expected to have continued in the third quarter. The Zacks Consensus Estimate for third-quarter total vaccine sales is $2.82 billion.

Some of the company’s important vaccines include the HPV vaccine, Gardasil/Gardasil 9, Proquad, M-M-R II and Varivax vaccines. Gardasil, sales are expected to have significantly benefited from increases in productivity across its supply chain and a near-normal back-to-school season. The Zacks Consensus Estimate for Gardasil is $1.6 billion.

The top line is expected to have been affected by the loss of U.S. market exclusivity for drugs like Remicade, Noxafil and Zetia, continued pricing pressure for the diabetes franchise (Januvia/Janumet) in the United States, and lower demand in Europe.

In July/August, the FDA approved Merck’s novel HIF-2α inhibitor Welireg (belzutifan) to treat some von Hippel-Lindau (VHL) disease-associated tumors and its 15-valent pneumococcal conjugate vaccine, Vaxneuvance. We expect management to discuss the initial sales numbers of these drugs on the third-quarter conference call.

The Animal Health franchise should continue to see strong sales growth driven by higher demand.

Key Recent Updates

Merck and partner Ridgeback Biotherapeutics filed an application seeking Emergency Use Authorization (“EUA”) for its investigational oral antiviral medicine, molnupiravir, for the treatment of mild-to-moderate COVID-19 in adults who are at risk of progressing to severe COVID-19 and/or hospitalization. The application was based on positive data from the interim analysis of the phase III MOVe-OUT study.

Last month, Merck announced a definitive agreement to acquire Acceleron Pharma XLRN for $180 per share in cash or an approximate total equity value of $11.5 billion. The deal, if successful, will add Acceleron’s promising phase III pipeline candidate, sotatercept, which is being evaluated for the treatment of pulmonary arterial hypertension, to Merck’s portfolio.

Earnings Whispers

Our proven model predicts an earnings beat for Merck in the to-be-reported quarter. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for a likely positive surprise. This is the case here..

Earnings ESP: Merck’s Earnings ESP is +2.64% as the Most Accurate Estimate of $1.56 is higher than the Zacks Consensus Estimate of $1.52. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Merck has a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Another Stock to Consider

Here is another large drug stock that has the right combination of elements to beat on earnings this time around:

Pfizer PFE has an Earnings ESP of +2.25% and a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Acceleron Pharma Inc. (XLRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance