Meritage Homes (MTH) Q2 Earnings and Revenues Top Estimates

Meritage Homes Corporation MTH reported solid results for second-quarter 2022 despite challenges associated with higher mortgage rates. Quarterly earnings surpassed the Zacks Consensus Estimate and increased on a year-over-year basis. Revenues also rose from the year-ago quarter’s levels on the back of a strong housing market, thanks to a low supply of new and resale housing inventory and favorable demographics.

Pertaining to the quarterly results, Phillippe Lord, the CEO of MTH, said, “Despite some slowing demand, our second quarter 2022 average absorption pace was 4.4 per month, which was down from 5.5 per month in the second quarter of 2021 yet higher than our expected normalized average pace of 3-4 sales orders per month.”

However, the company refrained from providing full-year guidance due to lack of visibility into the market.

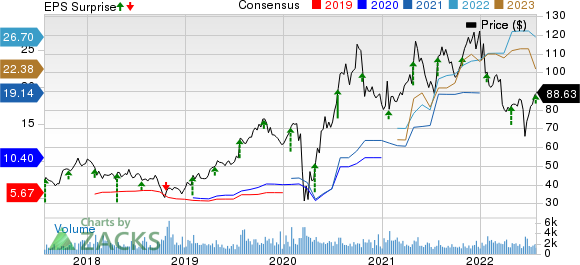

Meritage Homes Corporation Price, Consensus and EPS Surprise

Meritage Homes Corporation price-consensus-eps-surprise-chart | Meritage Homes Corporation Quote

Earnings & Revenue Discussion

Meritage Homes reported earnings of $6.77 per share, which topped the Zacks Consensus Estimate of $5.81 by 16.5% and increased 55% year over year. The uptrend was due to solid pricing power, expanded gross margin and improved overhead leverage in the quarter.

Total revenues (including Homebuilding and Financial Services revenues) amounted to $1.417 billion, up 10.5% from the year-ago quarter’s levels, backed by solid home closing revenues given higher pricing.

Segment Discussion

Homebuilding: Total closing revenues totaled $1,412.4 million, up 11% from the prior-year quarter’s level of $1,277.6 million. The metric topped the consensus mark of $1,377 million by 2.5%. Of the total closing revenues, home closing revenues totaled $1,408.9 million, up 11% year over year. The upside can be attributed to a 13% increase in average sales price or ASP. Volumes dropped 2% year over year. During the quarter, the company reported homes closed of 3,221 units, down 2% year over year.

Total home orders increased 6.4% from the prior year to 3,767 homes, backed by a 33% increase in active community count, partially offset by a 20% decrease in average absorptions per store to 4.4 per month from 5.5 per month a year ago.

Entry-level buyers represented 86% of sales order compared with 81% in the year-ago quarter.

The value of net orders increased 27% year over year to $1.81 billion. Quarter-end backlog totaled 7,241 units, up 31% year over year. The value of the backlog also increased 48% year over year to $3.44 billion.

Home closing gross margin increased 430 basis points (bps) to 31.6%. Selling, general and administrative expenses — as a percentage of home closing revenues — improved 100 bps from the prior-year quarter’s levels to 8.3%. The uptrend was mainly driven by continued leverage of fixed costs on higher home closing revenues, lower broker commissions and benefits of technology on sales and marketing efforts.

Land closing revenues amounted to $3.43 million, down 73% from the year-ago quarter.

Financial Services: The segment’s revenues dropped 9% from the prior-year quarter’s level to $5.14 million.

Balance Sheet

At the second quarter-end, cash and cash equivalents totaled $272.1 million compared with $618.3 million on Dec 31, 2021. At June-end, 71,000 lots were owned or controlled by the company compared with 63,000 lots at the end of second-quarter 2021.

Total debt to capital at quarter-end was 25.3% compared with 27.6% at 2021-end. Net debt to capital was 20.6% versus 15.1% on Dec 31, 2021.

Zacks Rank & Peer Releases

Meritage Homes currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NVR, Inc.’s NVR second-quarter 2022 earnings missed the Zacks Consensus Estimate but revenues surpassed the same.

The company reported earnings of $123.65 per share, increased 50% from the prior-year figure of $82.45 per share. Total revenues (Homebuilding & Mortgage Banking fees combined) amounted to $2.66 billion for the reported quarter, reflecting growth of 16% on a year-over-year basis. Higher average price of settlements in the quarter and lower lumber prices led to the year-over-year improvement.

PulteGroup Inc. PHM reported mixed results for second-quarter 2022, with earnings surpassing the Zacks Consensus Estimate but revenues missing the same.

Earnings for PHM grew 58.7%, from $1.72 per share a year ago. Revenues increased 16.9% from the year-ago figure of $3.36 billion.

D.R. Horton, Inc.’s DHI third-quarter fiscal 2022 earnings beat the Zacks Consensus Estimate but revenues missed the same.

DHI also lowered its revenue guidance for the full year, given expected completion dates of homes under construction and current market conditions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance