Meritor (MTOR) Set to Gain From Acquisitions & Investments

On Oct 16, we issued an updated research report on Meritor Inc. MTOR.

On Aug 3, Meritor reported adjusted earnings per share of 64 cents for third-quarter fiscal 2017 (ended Jun 30, 2017), comfortably beating the Zacks Consensus Estimate of 44 cents. Quarterly revenues rose 9% year over year to $920 million. Thus, the top line too significantly surpassed the Zacks Consensus Estimate of $841 million.

On Nov 15, the company will release fourth-quarter and fiscal 2017 results.

Meritor, Inc. Price and Consensus

Meritor, Inc. Price and Consensus | Meritor, Inc. Quote

For the fiscal-end, Meritor expects revenues to be roughly $3.25 billion, an increase from the projection of $3.1 billion. The adjusted EBIDTA margin is likely to be around 10.2%, while the anticipated adjusted earnings from continuing operations is $1.7 per share, a rise from the previous expectation of $1.4.

The company achieved its objectives under the M2016 plan, having improved operational excellence and reduced debt, among other financial gains. The plan also helped Meritor gain new customers across Europe, North & South America and India. This success has in turn encouraged the company to set new objectives with its M2019 plan. Per the plan, the company will continue with expansion motives through new business acquisitions and investments to develop products and technologies.

Further, the company intends to offer innovative products to customers, aiming to launch 20 products over the next three years.

The company’s stock has seen the Zacks Consensus Estimate for quarterly and annual earnings being revised 2.2% and 0.59% upward respectively, over the last seven days.

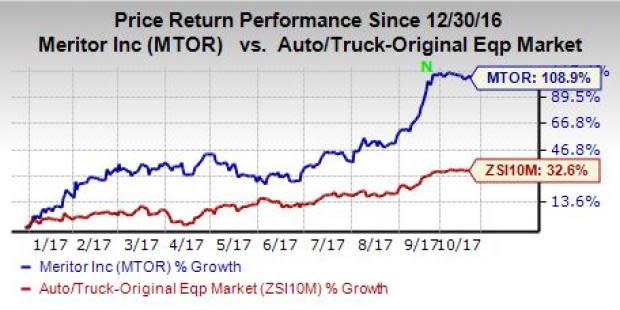

Price Performance

Shares of Meritor have soared 108.9% year to date, substantially outperforming the 32.6% rally of the industry it belongs to.

Zacks Rank & Other Stocks to Comsider

Meritor currently carries a Zacks Rank #1 (Strong Buy).

A few other top-ranked auto stocks are Lear Corporation LEA, The Goodyear Tire & Rubber Company GT and Magna International Inc. MGA, all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lear has an expected long-term earnings growth rate of 7.1%.

Goodyear has an expected long-term earnings growth rate of 12.4%.

Magna has an expected long-term earnings growth rate of 9.5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magna International, Inc. (MGA) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Meritor, Inc. (MTOR) : Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance