Negative rates won't work, warns Mervyn King

Cutting interest rates into unprecedented negative territory will not protect the economy as it is battered by tightening Covid restrictions, Mervyn King has warned.

Rate setters are unlikely to turn to the controversial policy to support growth, the former Bank of England Governor said, because a further cut to borrowing costs will not get consumers spending during a period of tighter restrictions.

He said: “I don’t believe that will have a significant impact and I don’t believe that it’s relevant to the current circumstances.

“If people are not spending money on travel or entertainment or hospitality or various other things because of the lockdown and the restrictions, the idea that people are going to say to themselves, ‘Darling, let’s go out for a wonderful holiday or a meal tomorrow because interest rates are just 50 basis points lower than they were last week’ [won't happen].”

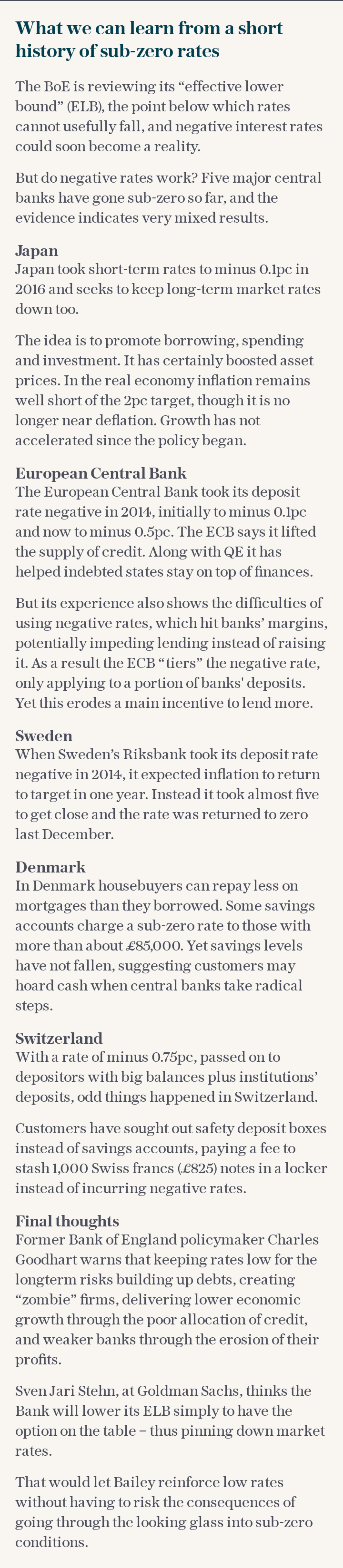

The European Central Bank is among several worldwide which have already slashed interest rates into negative territory, meaning it charges banks for holding onto their excess reserves. An experimental tool, negative rates aim to reduce borrowing costs and encourage banks to lend by penalising them for holding on to too much money.

The Bank opened the door to going negative after the Covid-19 hit. Speculation is growing that it could act as the economy lurches into a bleak winter of increasingly damaging rules.

Threadneedle Street has already cut rates to a record low of 0.1pc and last week asked banks to consider their readiness for negative rates.

Some economists and banking bosses have warned they become counterproductive if they erode lenders' profitability too much, making it even harder for them to keep credit flowing to the economy.

Andrew Bailey, the current Governor, said yesterday that negative rates work best in a “nascent” economic upturn as he warned the risks to the UK are “very heavily skewed towards the downside”.

He said: “As we get near to zero and even contemplate going below zero, the effectiveness of policy in its transmission becomes much more conditional."

Speaking on a Tortoise Media podcast, Lord King said the Government should instead take advantage of ultra-low interest rates and borrow heavily to support businesses and keep workers in jobs.

He said: "The Government will be wise to lock in as much debt as possible to very long-term borrowing at extremely low interest rates."

Yahoo Finance

Yahoo Finance