Meta Makes Bond-Market Debut With $10 Billion Jumbo Deal

(Bloomberg) -- Meta Platforms Inc., one of the few S&P 500 companies without debt, sold $10 billion in its first ever corporate bond deal as its cash flow and stock price fall.

Most Read from Bloomberg

Russia Is Scouring the Globe for Weapons to Use Against Ukraine

Trump Under Intense Legal Scrutiny After FBI Searches Mar-a-Lago

Trump Search Was Unprecedented, But Records Case Will Be Tough

The social media giant’s bond deal sold in four parts, according to a person with knowledge of the matter. The longest portion of the offering, a 40-year security, yields 1.65 percentage points above Treasuries, said the person, who asked not to be identified as the details are private, after initial discussions of 1.75 to 1.8 percentage points. Orders reached more than $30 billion at the peak early in the afternoon in New York, according to a person familiar with the demand.

The company’s stance on borrowing may have shifted with the state of its business. Meta just posted its first year-over-year quarterly revenue decline, citing uncertainty in the digital advertising market, which has driven its growth for years.

The parent of Facebook and Instagram is concerned that young people are abandoning its platform for ByteDance Ltd.’s TikTok. And it has big, expensive ambitions to build a whole new version of the internet in the Metaverse, an immersive virtual reality world where Chief Executive Officer Mark Zuckerberg imagines we will communicate, work and shop in the future.

Share Buybacks

Proceeds from the bond sale can be used for purposes including capital expenditures, stock repurchases, and acquisitions or investments. The company may be more likely to use the money to significantly bolster its share buybacks, and hire and retain talented employees, rather than boost spending on Metaverse investments, according to Bloomberg Intelligence analysts Mandeep Singh and Ashley Kim.

Meta has been using cash to repurchase stock, including $5.1 billion in the second quarter of this year, and had $24.3 billion available for buybacks as of June 30, according to its earnings release last week. Its stock price has more than halved from its high in September to $168.80 as of market close on Wednesday, making the repurchases cheaper. And even with issuing a mega deal, leverage would remain below 1x, based on 2022 consensus Ebitda, BI analyst Robert Schiffman wrote in a note.

Its stockpile of cash has dropped $23.6 billion from a year earlier, according to data compiled by Bloomberg. That’s among the biggest cash losses for non-financial S&P 500 corporations during the period.

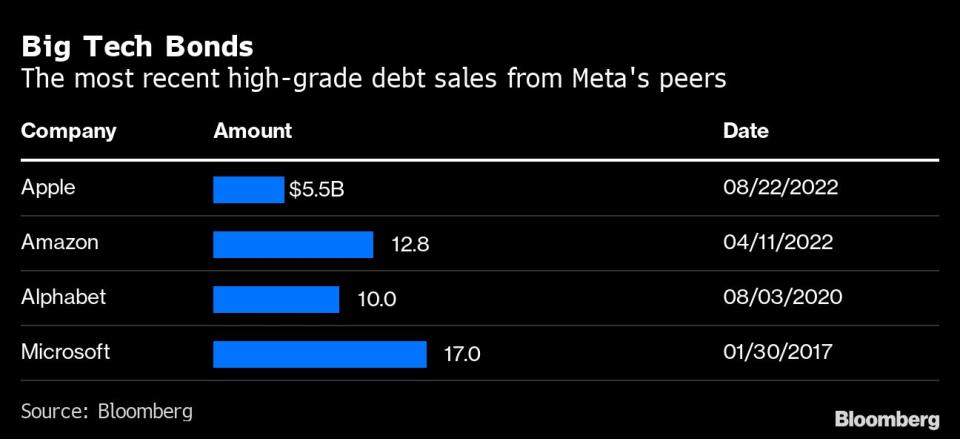

Many of Meta’s large peers in the technology industry have borrowed heavily at low rates despite large cash piles. Including Meta, there are just 18 companies in the S&P 500 without outstanding short or long-term debt, excluding lease liabilities, as of the most recent quarter, according to data compiled by Bloomberg.

Over the past month, other tech companies including Apple Inc. and Intel Corp. have ridden the rally in credit markets to sell debt. The companies are taking advantage of yields that have been drifting lower after surging all year, offering a moment of relative stability in the market.

S&P Global Ratings has assigned Meta a AA- investment-grade rating, while Moody’s Investors Service gave the tech giant an A1 rating, the equivalent of one step lower.

“The A1 issuer rating is based on Meta’s strong credit profile which reflects the leading global position of its platform brands in social networking, supported by its extensive user base,” Moody’s said in a report.

Morgan Stanley, JPMorgan Chase & Co., Bank of America Corp. and Barclays Plc managed the bond sale on Thursday. Meta and the banks did a series of fixed-income investor calls Wednesday to market the deal.

(Updates with final pricing.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Yahoo Finance

Yahoo Finance