Meta Platforms, Inc. (NASDAQ:FB) at a Historic P/E Low and Possibly Undervalued

This article was originally published on Simply Wall St News

Meta Platforms, Inc. (NASDAQ:FB) is one of the rare stocks that was possibly undervalued even before the drop in growth stocks and the legal turmoil. At around US$300 per share, this stock has yet again piqued our interest, and we will review the fundamentals and cash earning capacity for Meta (Facebook).

Fundamentals

Looking at the income statement, we see that Meta still has a very high and rising profit margin of 35.9%. However, diving a bit deeper into the free cash flows, reveals that the FCF margin is a bit lower - at 31.8%.

We keep stressing the free cash flows instead of statutory profits, because this is what is actually attributable to investors, and is at the core of what makes up the intrinsic value of any business.

Moving forward to the future with the free cash flows, it seems that analysts are projecting that Meta will make a present value of $398.9b in cash flows (discounted at 6.7%). Along with this, we estimate a present value of the terminal value (what the company is worth beyond the forecast period) of US$708.4b. All of this, gives us an intrinsic value of US$1.1t or US$398 per share - this means that Meta is trading below some 26% of our estimate of the value of the business.

Click HERE to view how we analyze the intrinsic value of Meta.

Cash is king, and in our analysis thus far, we outlined the importance of future cash flows. Depending on how impactful the current legal situation turns out to be for Meta, investors might be looking at a mega cap stock that still has room to grow and is possibly miss-priced by the market.

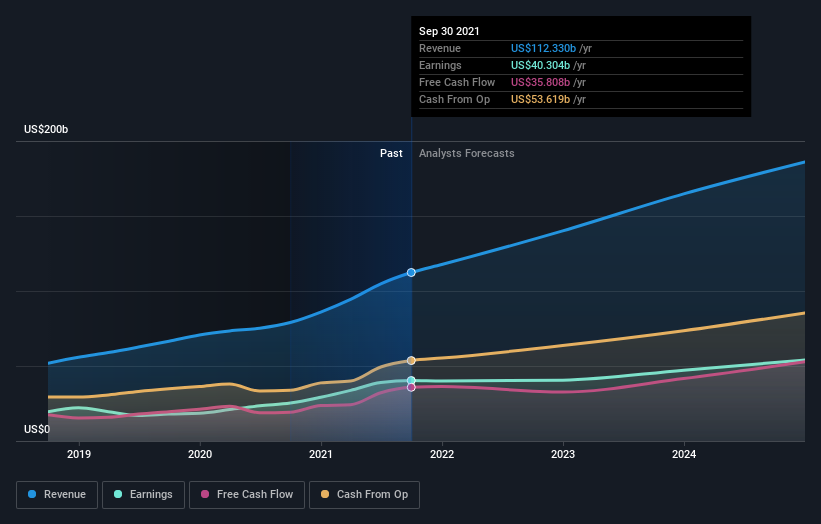

We also gathered the historical income figures and paired them with the average expectations from analysts. The chart below shows that Meta is still expected to grow and optimize profitability.

View our latest analysis for Meta Platforms

Analyst Forecasts

The current consensus from Meta Platforms' 50 analysts is for revenues of US$140.1b in 2022, which would reflect a substantial 25% increase in its sales over the past 12 months. Per share earnings are forecast to be US$14.21, approximately in line with the last 12 months. Investors may want to mark the 2nd February in their calendars, as that is when FB will report on its Q4 earnings, and a price swing might happen.

The consensus price target still holds firm and is largely unchanged at US$402.

Fixating on a single price target can be unwise, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Meta Platforms, with the most bullish analyst valuing it at US$466 and the most bearish at US$250 per share.

Relative Value

From 2018, up until recently, Meta had a price to earnings ratio between 24x and 26x. Currently, we are witnessing P/E of 20.3, which is the lowest P/E for FB since the company became profitable.

Just for comparison, the industry is trading at a 25.8x P/E, while the market is slightly down and trading at 16.3x P/E.

It seems that FB investors are currently less enthusiastic for the stock. However, we are not sure if that is fundamentally driven, or is the result of the current market mood and the fear of legal uncertainties around Meta. If we go strictly by the fundamentals, investors may want to dig a bit deeper into Meta, and consider adding it to their watch list, especially before the next earnings release.

Conclusion

Meta seems to be trading below its intrinsic value by about 26%, and is also trading at historic lows relative to its P/E ratio. Investors are staying away from the stock, but there might be a fundamental argument to be made for the cash flow production capacity of the business.

Facebook is not without risks, including the legal controversies surrounding the stock, as well as external factors, such as possible rate hikes that might increase the discount rate of future cash flows for the company - For more info on the impact of interest rates visit our educational video. Additionally, we've identified 1 warning sign for Meta Platforms that you should be aware of.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Yahoo Finance

Yahoo Finance