Meta Platforms is the Ultimate Outlier Stock

Meta Platforms is One of the Most Accumulated Stocks

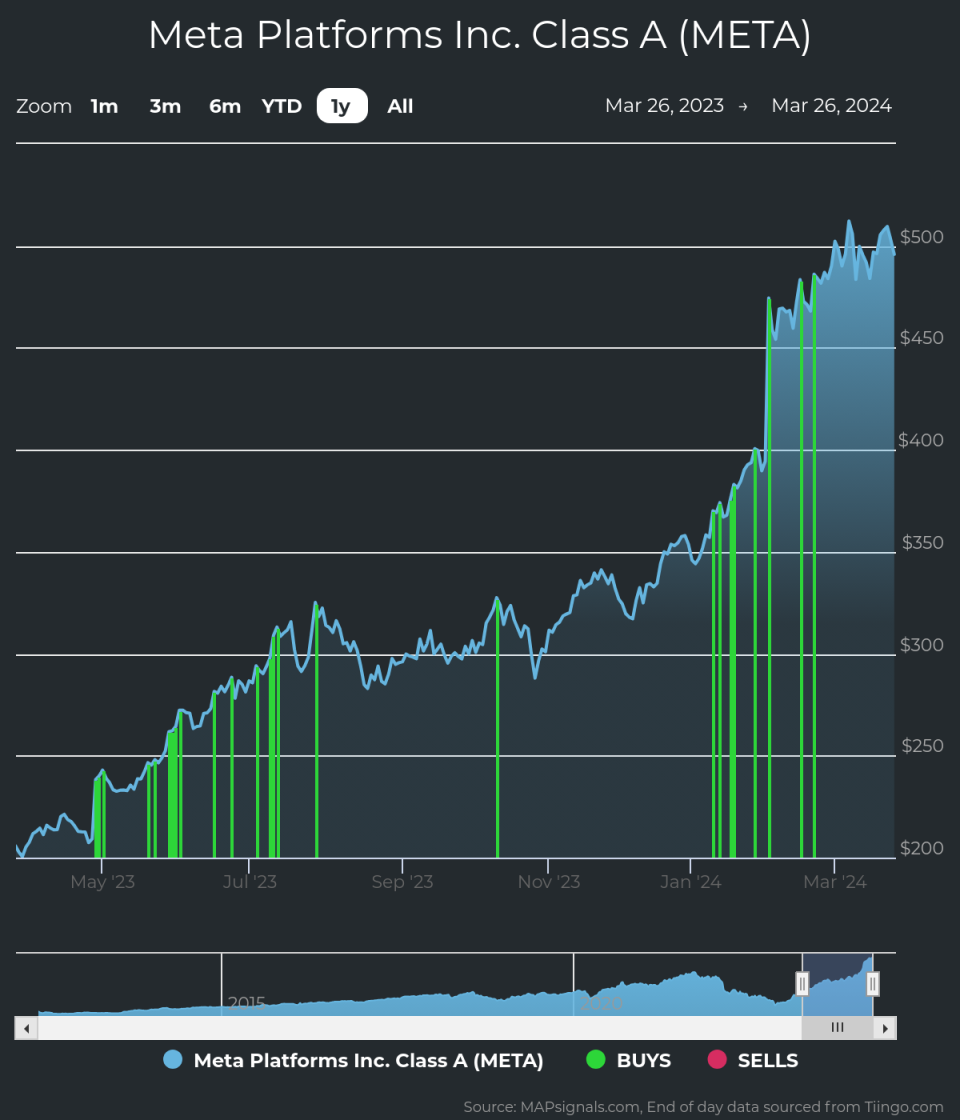

Institutional volumes reveal plenty. In the last year, META has enjoyed heavy Big Money buying, which we believe to be institutional accumulation.

Each of the green bars signal unusually large volumes in META shares, pushing the stock higher:

Plenty of technology names are under accumulation right now. But when you dive into the fundamentals, there’s a special tailwind going on with Meta Platforms.

Meta Platforms Fundamental Analysis

Institutional support coupled with a healthy fundamental backdrop makes this company worth investigating. As you can see, META has had positive sales & EPS growth in recent years:

3-year sales growth rate (+17.3%)

3-year EPS growth rate (+24.8%)

Source: FactSet

EPS is estimated to ramp higher this year by +15.7%.

Now it makes sense why the stock has been powering to new heights. META is gaining due to it being an earnings powerhouse.

Marrying great fundamentals with our proprietary software has found some big winning stocks over the long-term.

META has recently been a top-rated stock at MAPsignals. That means the stock has unusual buy pressure and growing fundamentals. We have a ranking process that showcases stocks like this on a weekly basis.

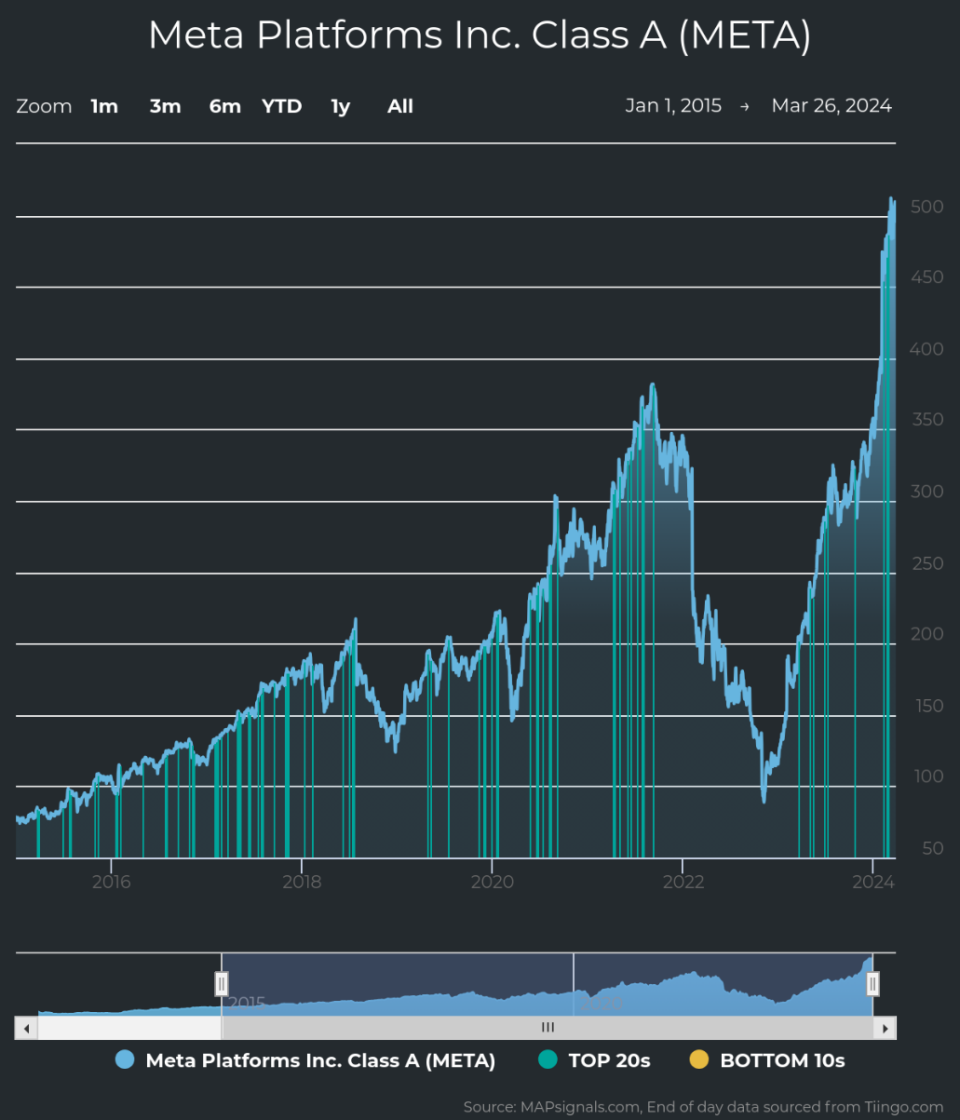

It’s made the rare Top 20 report numerous times. The blue bars below shows when META was a top pick…cutting through the noise.

Tracking unusual volumes reveals the power of money flows.

This is a trait that most outlier stocks exhibit…the superstars. Money flows often reveal tomorrow’s leaders…today.

Meta Platforms Price Prediction

The META rally isn’t new at all. Big Money buying in the shares is signaling to take notice. Given the historical gains in share price and strong fundamentals, this stock could be worth a spot in a diversified portfolio.

Disclosure: the author holds no position in META at the time of publication.

If you are a Registered Investment Advisor (RIA) or are a serious investor, take your investing to the next level, learn more about the MAPsignals process here.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance