Meta vs. Google: The Better Advertising Platform for Investors

First published on Simply Wall St News

Summary:

Meta is quantitatively dominating the social media space, but YouTube is moving fast to leverage existing infrastructure with their "Shorts".

As technology becomes more accessible, the landscape may fragment and large companies may not have such a large share.

Meta and Google are primarily advertisers that build attractive software where ads can be served along media.

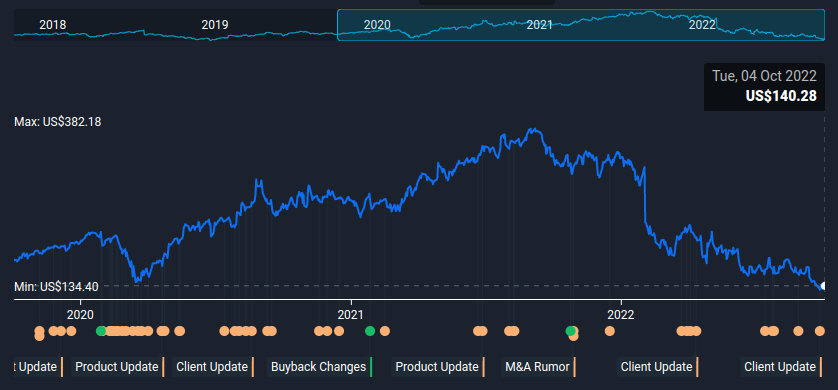

Meta Platforms, Inc. ( NASDAQ:META ) is pushing multi-year lows, as the stock hovers around the $140 level. While in the short run, a company can be volatile, it is ultimately the quality of the business that determines a company's valuation. In our analysis, we will re-cap Meta's core business and attempt to evaluate how it fares against key competitors.

The chart below shows how the company is reaching March 2020 price levels, and investors can view the key event drivers in our report:

Check out our latest analysis for Meta Platforms

Recapping the Business Model

Companies sometimes promote themselves in a trendy way to the public in order to draw attention to more socially acceptable aspects of the business. But from time to time it is good to remind ourselves what a company actually sells. Meta, formerly Facebook, has presented itself as a social media company and now a metaverse company. However, Meta at its core, is an advertiser. While the distribution channels are novel, the company primarily makes revenue from ads.

A good analogy for Meta is a traditional billboard company that owns the real estate.

In a way, people are creating media assets (the real estate), but since they are creating them on Meta's property, the company gets to put up the billboards. The business works by incentivizing people to freely create media assets, which the company then uses to lease to ad-space buyers.

How Did The Company's Projects Evolve

The first and still largest piece of internet "real estate" was Facebook. After it discovered a new market for photography focused media, Meta bought Instagram, then added Snapchat-like features and the "Stories" were born. It even tried to take-on video, but that didn't work too well because the company has no revenue sharing scheme and (good) video takes resources to produce. Now, Meta seems to be pushing on the "metaverse" front, but their income generating focus is probably set on the reels feature. Reels is a short video producing format that has a similar concept to the popularized video sharing trend from TikTok.

We can summarize that Meta is currently building the infrastructure for two new "real estate" assets - reels, which is already in production, and the metaverse - which is a longer term project.

Investors need to be aware that the company has managed to have such high margins (net 28%) because these assets were the cheapest to produce. Once the growth avenues for these assets top out, the company will have to provide additional incentive for creators (not necessarily income) in order to stimulate revenue growth.

Comparing the Business Models Between Key Peers

Meta's business can be compared to peer advertisers and companies with a high user market share. Peer advertisers have different channels of distribution, while the user market share is important because it makes advertising viable.

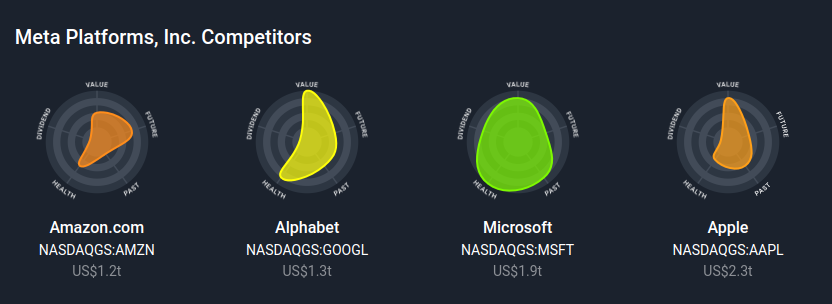

While there are many businesses competing with Meta, we will quickly go over the key peers, but focus our analysis on Google:

You can find the reports for each peer from the list below:

Alphabet a.k.a. Google ( NASDAQ:GOOGL )

Microsoft ( NASDAQ:MSFT )

Apple ( NASDAQ:AAPL )

Amazon ( NASDAQ:AMZN )

Microsoft's main competitive platform is LinkedIn, where it serves ads and sells subscription services. The company has positioned LinkedIn as the world's go-to PR and HR platform, with new edtech and freelance aspects in production. By serving these needs, LinkedIn is taking a large portion of the daily attention of users, especially those whose life currently revolves around a career and are arguably higher-income users, which is why advertising on LinkedIn can be more expensive.

Apple has been a thorn in Meta's business since it gave iOS users the option to opt-into tracking - which, understandably, people are reluctant to do. The company is fighting Meta's family of apps and onboarding more users in its own ecosystem with apps such as Apple Messages.

We should also mention Amazon , as the company represents the largest e-commerce store. Meta made an attempt to get into e-comm on a grassroots level with their marketplace app. While many investors were looking forward to the company pursuing this vertical, it seems that this project has taken a back seat in development.

YouTube: The Other Social Media Platform

Just like we mentioned with Meta, Google is also mainly an advertiser. The company has 4 key assets it leverages for selling advertising space: Google Ads, YouTube, Maps, and Gmail. The company has a similar philosophy with Meta regarding "leasing out" ad space. However, a key difference with Google is that it allows some form of revenue sharing with partners. This is obvious in the case of Google Ads as they present the ads with permission from partner websites, but is not a "natural choice" when it comes to YouTube. We could see, how the revenue sharing possibility has stimulated the creation of more costly content vs other social media, giving YouTube a distinctive advantage in attracting media creators.

YouTube has even become a separately reported segment for Google, which grew 4.8% YoY in Q2 this year to $7.34b. It seems that YouTube dropped from the 2021 Q4 high of $8.6b, but looking at the quarterly revenue, it does look that the platform experiences some winter seasonality.

While YouTube may seem like a one-directional app, it has some key social media aspects to it via the comment section and subscriptions. Even though people are not connected by proximity, they find connections by interests, which gives rise to productive or, at the very least, entertaining conversations.

If we compare the use of Facebook vs. YouTube, we find that the latter comes in second behind Meta's family of apps, but is still a large player in the social media landscape. Here is the breakdown of their Monthly Active Users (MAUs):

Facebook 2.910b

YouTube 2.562b

WhatsApp* 2b

Instagram 1.478b

WeChat 1.263b

TikTok 1b

*No updates in the last 12 months.

Looking at android app downloads, we find that Facebook has 5b+, Instagram has 1b+, WhatsApp has 5b+, while YouTube has 10b+ downloads, indicating that the app has a dominant position by virtue of being a default app for android phones.

On the other hand, Apple Store download stats are harder to find, but we can see that:

YouTube has 27.6m ratings, average score of 4.7

Instagram has 23.8m ratings, score 4.7

WhatsApp has 10.7m ratings, score 4.7

Facebook has 1.3m ratings, score 2.2

Messenger has also 1.3m ratings, score 4.1

This shows us that both companies are in intense competition for the media space and YouTube has the second position as a single app, while Meta has more overall users in its family of apps.

Looking to the future, a key development to monitor for investors would be the success of the mentioned Instagram Reels feature vs YouTube's "Shorts". One may assume that YouTube is in a better position to push this product, as it already has attracted a core audience on its platform, but this is too early to tell.

There is one more aspect that can benefit Google. The problem with Google is, that in order to create content, people need tech skills and time to create their websites or web apps. This is where Facebook had an advantage, as the platform offered people a simple way to create content within its ecosystem. However, as technology advances and lowers the bars to entry, more people may be able to create their own web assets and engage in revenue sharing with Google. This is partly made available by no-code web development tools, but is also a reflection of a generational shift as more technically literate people join the workforce who have shifting interests from pure entertainment to making an income.

The Fundamentals Matter

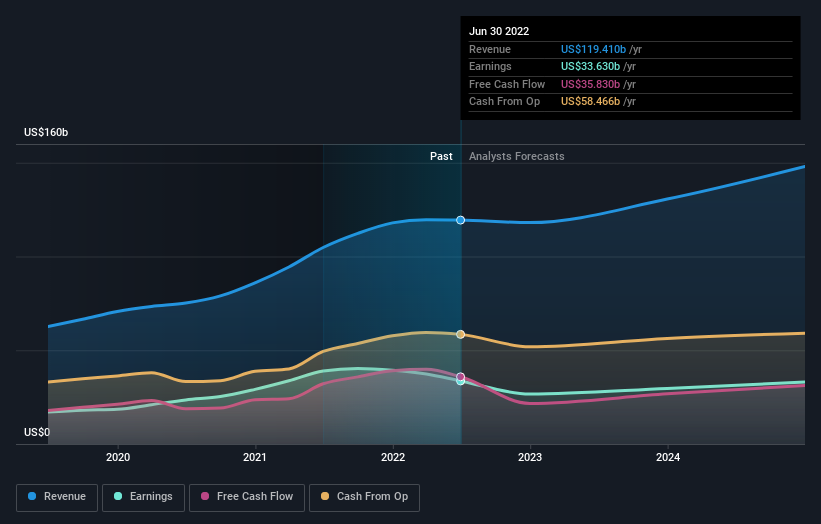

Connecting all of this to the fundamentals means that we need to see what it means for the future income of the company, and consequently for investors. The chart below shows that analysts have stagnating expectations for Meta in the coming year . The mega cap is not to be underestimated, since even with its current operating assets, it generates quarterly r evenues of $29b, EPS of $2.46, and analysts are holding the price target at $221.

For FY 2022 Meta Platforms' 51 analysts are forecasting revenues to be $118.1b, approximately in line with the last 12 months. EPS are forecast to drop by 22% to $9.81 in the same period.

Analysts has different projections for Meta just a year ago, and when analysts can't estimate the qualitative future with a good degree of certainty, investors may choose to value a company based on short term performance, which is partly why we are seeing higher volatility in Meta's stock.

Conclusion

One of the key competitors to Meta is Google, with its advertising products and YouTube. While Facebook's social media platform was ahead of Google in terms of users for many years, we may now be seeing both companies shifting to a closer race than.

Looking at the business development, it seems that Google may increase its media dominance as it rolls out new features for YouTube and web technology becomes even more accessible to people.

Investors can look at the fundamentals and examine the quality of both businesses more closely in order to form a better picture of the future for both companies. Before you take the next step, you should know about the 1 warning sign for Meta Platforms that we have uncovered.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance