Metallus Inc (MTUS) Reports Steady Financial Performance in Q1 2024 Amidst Market Challenges

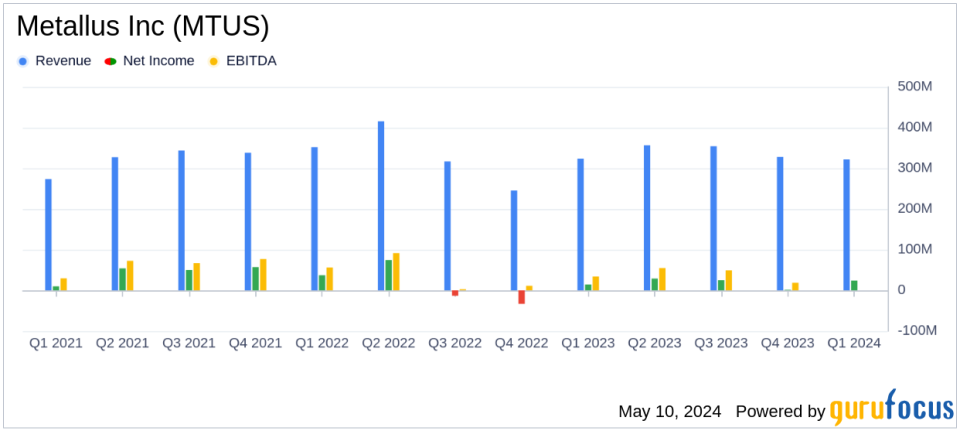

Net Sales: $321.6 million, slightly down from $323.5 million in the same quarter last year.

Net Income: Reported at $24.0 million, a significant increase from $14.4 million year-over-year.

Earnings Per Share (EPS): $0.52 per diluted share, up from $0.30 in the prior-year quarter.

Operating Cash Flow: Generated $33.4 million, compared to $9.8 million in the first quarter of 2023.

Capital Expenditures: Invested $17.4 million, reflecting ongoing commitment to infrastructure and growth.

Share Repurchase: $4.4 million spent to buy back common shares, underscoring confidence in financial stability.

Additional Share Repurchase Program: Board authorized a new $100 million program, signaling strong future prospects and shareholder value focus.

On May 9, 2024, Metallus Inc (NYSE:MTUS), a prominent player in the specialty metals industry, disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company, known for its high-performance alloy steel and components, reported net sales of $321.6 million and a net income of $24.0 million, reflecting a robust performance despite a challenging market environment.

Company Overview

Metallus Inc is an America-based manufacturer specializing in alloy steel, carbon, and micro-alloy steel. Their products are critical in various sectors including automotive, aerospace, and energy, predominantly serving the U.S. market. With a commitment to innovation and quality, Metallus also offers value-added services like machining and thermal treatment, alongside managing comprehensive recycling programs.

Financial Performance Insights

The reported net income of $24.0 million, or $0.52 per diluted share, marks a significant improvement from the $1.3 million, or $0.03 per diluted share, recorded in the fourth quarter of 2023. This performance demonstrates a strong recovery and operational efficiency, with adjusted EBITDA also rising to $43.4 million from $35.7 million in the previous quarter.

Year-over-year comparison shows a stable revenue stream but a notable increase in net income from $14.4 million in Q1 2023 to $24.0 million in Q1 2024, underscoring effective cost management and operational improvements. The company has successfully maintained a cash and cash equivalents balance of $278.1 million as of March 31, 2024, ensuring solid liquidity to sustain future growth.

Strategic Developments and Market Position

Metallus Inc's strategic focus on diversifying its product offerings and enhancing operational efficiencies has been pivotal. The company's participation in over 20 defense-related programs and initiatives to explore new metals like titanium illustrates its proactive approach to capturing emerging market opportunities.

Despite a slight decline in shipments, particularly from the automotive and energy sectors, Metallus has managed to offset these challenges through favorable price/mix adjustments and strategic market engagements. Notably, the company's manufacturing costs have seen a sequential decrease by $10.0 million due to higher production volumes and reduced maintenance costs.

Shareholder Value and Future Outlook

The Board's authorization of an additional $100 million for share repurchases reflects confidence in the companys financial health and its commitment to delivering shareholder value. Looking ahead to Q2 2024, Metallus anticipates a slight dip in adjusted EBITDA, with stable shipments and a focus on optimizing product mix and pricing strategies.

As Metallus continues to navigate market fluctuations and invest in strategic growth areas, its ability to maintain financial stability and adapt to industry demands will be crucial. For detailed financial figures and future projections, stakeholders are encouraged to review the full earnings report and tune into the upcoming webcast scheduled for May 10, 2024.

For further information, please contact Jennifer Beeman at ir@metallus.com or visit www.metallus.com.

Explore the complete 8-K earnings release (here) from Metallus Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance