MetLife (MET) Launches Savings Calculator to Educate Pet Parents

MetLife, Inc. MET recently rolled out its new savings calculator in a bid to educate pet parents about the benefits of pet health insurance in their pockets. MET’s pet insurance allows pet parents to save money from sudden accidents, illnesses and preventive care. MET’s insurance plans can help pet parents get reimbursed for up to 90% of their bills.

This move bodes well as MET will attract new customers and benefit from improved premiums in the future. This will also solidify MetLife’s position as a market leader in U.S. group benefits by enabling the company to offer pet insurance to potential customers.

Per a survey from MetLife Pet and OnePoll, pet parents’ most expensive costs were related to health needs. 45% of people mentioned their pet going through a major health problem last year, and 82% of pet parents mentioned not being financially prepared for it. The survey also highlighted that only 58% of pet parents own pet medical insurance, leaving a huge gap for MET to cater to by offering pet insurance solutions.

MetLife’s pet insurance is a relief for pet parents in this regard. MET offers family plans for pets and is very flexible in terms of coverage, previous records requirements etc. MET is exceptional due to these features and competitive rates. MET aims to reduce the out-of-pocket costs for pet parents covering accidents, preventive care and illnesses. MET will not just support pet parents financially but also by being available through a live 24/7 vet chat, counselling support, and provide lost pet coverage.

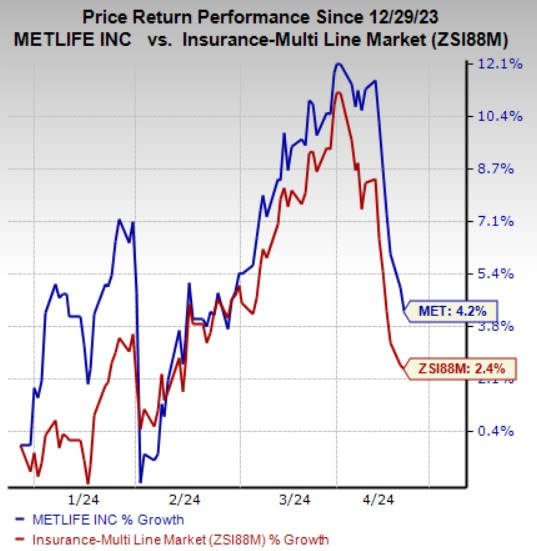

Shares of MetLife have gained 4.2% year to date compared with the industry’s 2.4% growth. MET currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks in the broader Finance space are Ryan Specialty Holdings, Inc. RYAN, Root, Inc. ROOT and Brown & Brown, Inc. BRO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ryan Specialty’s 2024 full-year earnings indicates a 28.3% year-over-year increase. It beat earnings estimates in two of the past four quarters and met twice, with an average surprise of 5.1%. Also, the consensus mark for RYAN’s 2024 full-year revenues suggests 19.5% year-over-year growth.

The consensus mark for Root’s 2024 full-year earnings indicates a 23.1% year-over-year improvement. The earnings estimate has witnessed three upward estimate revisions in the past month against no movement in the opposite direction. Furthermore, the consensus estimate for ROOT’s 2024 full-year revenues suggests 101.8% year-over-year growth.

The Zacks Consensus Estimate for Brown & Brown’s 2024 full-year earnings is pegged at $3.55 per share, which indicates 26.3% year-over-year growth. The estimate jumped 14 cents over the past month. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Ryan Specialty Holdings Inc. (RYAN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance