Metro Bank loses £130m after disastrous year

Metro Bank (MTRO.L) swung to a huge loss last year as it battled a loan miscalculation fiasco that upended the business.

Metro Bank said on Wednesday it made a loss of £130.8m ($170m) last year, compared with a profit of £40.6m in 2018.

The bank blamed a £88m write-down of assets, including millions of costs linked to loan issues last year.

However, Metro Bank fell to an £11.7m loss on an underlying basis when one-off costs are stripped out. That compared to an underlying profit of £50m in 2018.

Revenue shrank by 1% to £400m in 2019 and customer deposits declined by 8% to £14.4bn. Demand for its retail savings account fell by 19% and deposits from commercial customers, not including small businesses, halved. Total assets fell by 1% to £21.4bn.

Shares in Metro Bank slumped 6% on Wednesday morning.

‘A very challenging year’

New chief executive Dan Frumkin said the results reflected “a very challenging year for Metro Bank” but said it was now “on a more positive trajectory”.

Metro Bank admitted in January 2019 it had misclassified some loans, which were riskier than first thought. It forced the bank to set aside extra cash to cover potential losses and ask investors for £375m to bolster funds.

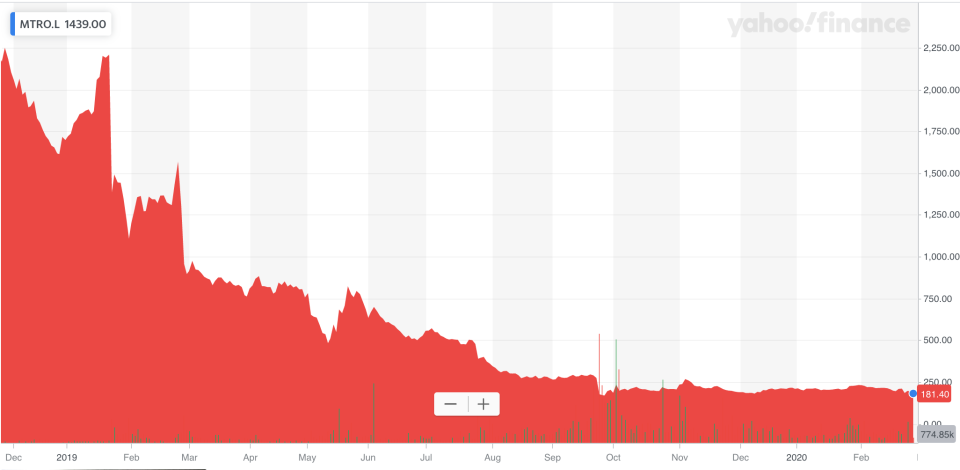

The scandal pushed the bank to a quarterly loss, prompted some customers to withdraw their money, and led to the exit of both Metro’s founder and chief executive. Shares in the bank have also fallen over 90% since the loan issue was announced.

The Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) are both investigating Metro Bank over the loan issues. Regulators are also investigating self-reported sanctions issues at the bank.

One-off costs of £27m last year were linked to these investigations. Frumkin joked on a call with journalists: “Lawyers are expensive.”

Frumkin said he expected the investigations to run throughout 2020 and couldn’t give a guidance on the size of potential fines. He pointed to a recent £44m fine for Citi Bank over regulatory failings, but suggested any fine for Metro would be smaller.

“They’re 15, 20 times the size that we are,” Frumkin said. “The reality is we had a single misstatement over a single period and we’re tiny.”

One-off costs of £68m were linked to IT projects that have been abandoned. Frumkin said the write-offs were “lots of little bitty-bits” rather than one single project, but highlighted an unsecured lending platform as one example.

‘Execution has been poor’

Metro Bank last week appointed turnaround specialist Frumkin as its new chief executive and the British-American on Wednesday announced a new strategy alongside annual results.

Frumkin said Metro Bank would look to cut costs and slow growth as the lender tries to “grow into our clothes”. It will also double down on efforts to win over small business customers and pull-back from less profitable areas such as mortgages.

Frumkin ruled out redundancies and store closures, and said Metro Bank was still “completely committed to our customer service model, seven-day banking, [and] extended hours.”

“Our core strategy is not the problem,” Frumkin told journalists. “Instead, the bank’s execution has been poor.”

A key cost cutting measure will be to try and relocate Metro Bank’s headquarters away from central London. Metro’s office at Twenty Old Bailey costs £65-per-square-foot and is currently largely staffed by back office and support workers.

The bank is also “putting our foot on the ball” when it comes to new store openings, Frumkin said. The lender now plans to open just 24 stores over the next three years, compared with earlier plans to open 71 new branches over the period.

Some stores will also be smaller. Frumkin said there would be “mama bear store, papa bear store, and baby bear stores,” but said all branches would still have Metro’s unique safety deposit box feature.

As a result of the scaled back ambition, Metro Bank said on Wednesday it would also hand back £50m to a government-backed scheme meant to foster competition and innovation in UK banking.

‘Living within our means’

Frumkin, a turnaround specialist who worked on Northern Rock after it was nationalised, said the new strategy was about “living within our means.”

The turnaround will cost £250m to £300m over the next three years, but Frumkin said it was “within our gift to deliver” and ruled out asking shareholders for more cash to fund the plan. Metro Bank has already booked £11m in transformation costs.

As part of the turnaround, Metro Bank is targeting return of tangible equity of 8.5% by 2024.

Frumkin, who was brought in last September as chief transformation officer at the bank, admitted the rescue job would be “difficult” and predicted more turnover of top management staff at the bank.

“Not everyone will be up for that journey with us,” he said. “To be honest, some of the people I will chose not to take with me.”

Frumkin said he believed Metro could survive as an independent bank and confirmed the company was not currently being marketed for sale. He declined to comment on whether it had received any unsolicited takeover approaches.

Frumkin thanked Metro Bank customers who have stuck by the lender during the last year and said: “There’s nothing to actually be concerned about. Metro has a bright future going forward. They’ll be noise today but it doesn’t matter. We’re hear for the long term and we really appreciate their custom.”

Yahoo Finance

Yahoo Finance