Metro Bank hires building society ‘bad boy’ as chairman

Metro Bank has hired building society "bad boy" Robert Sharpe, one of the sector's key figures during the financial crisis, as its chairman to replace founder Vernon Hill .

Mr Sharpe, famous for his lucrative pay-off at Portman Building Society and a scandalous affair with a colleague half his age, was credited with transforming Britain's seventh-largest society West Bromwich after the 2008 crash.

He is chairman of Bank of Ireland UK and will join Metro in November. Sir Michael Snyder will remain interim chairman until then.

Before the crisis Mr Sharpe turned Bournemouth-based mutual Portman from the 13th largest society into the third biggest through multiple acquisitions, before it merged with Nationwide in 2007.

He also earned notoriety for going to a rival lender when he wanted a mortgage for his £2.4m luxury mansion in Cobham, Surrey while running West Bromwich.

Takeovers are likely be back on the agenda at Metro, which is in the middle of takeover talks with peer-to-peer lender Ratesetter as it battles to revive its fortunes.

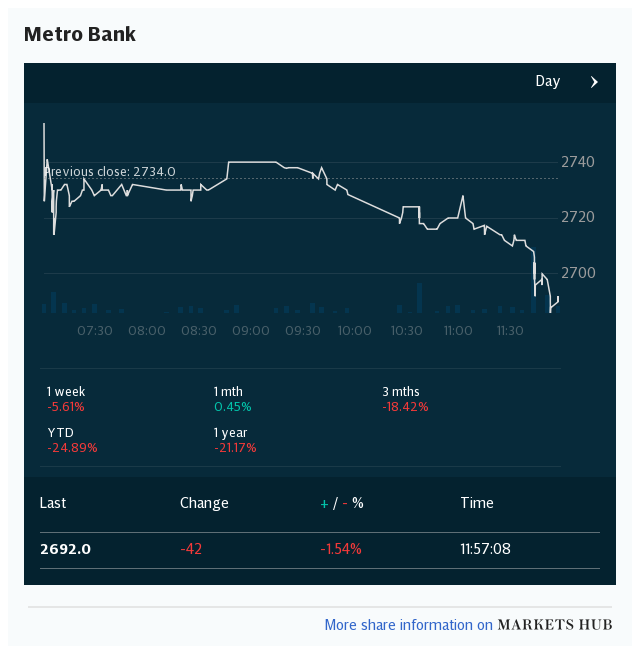

Its share price remains depressed, however, at just 115p compared with more than 500p this time last year.

Mr Sharpe said: "As we navigate the new economic environment caused by Covid-19, community banking has never been more important as people, businesses and communities adapt to this new normal. It is this community banking model that sets Metro Bank apart and will enable us to continue to grow."

He will be tasked with rebuilding Metro's reputation after a loans scandal last year sent its shares crashing and shone a light on corporate governance concerns. Regulatory probes into the loans error are still ongoing.

Mr Hill, who has compared opening a bank account in London to "having your teeth drilled" and initially made a fortune running Burger King franchises, stood down as chairman and left the board last year following an accounting gaffe.

Metro also replaced its chief executive and cut ties with an interior design firm run by Mr Hill's wife.

Last year sources told The Telegraph that the bank was under pressure from the Bank of England to replace Mr Hill with an experienced retail banker. Mr Sharpe will be paid an annual fee of £350,000 to chair Metro.

Yahoo Finance

Yahoo Finance