Mettler-Toledo (MTD) Q3 Earnings & Sales Beat, Increase Y/Y

Mettler-Toledo International, Inc. MTD reported third-quarter 2022 adjusted earnings of $10.18 per share, which beat the Zacks Consensus Estimate by 3.6%. The bottom line also improved 17% on a year-over-year basis.

Net sales of $985.8 million were up 4% on a reported basis and 10% on a currency-neutral basis from the year-ago quarter’s respective readings. The figure surpassed the Zacks Consensus Estimate of $974.9 million.

Solid momentum across the Laboratory and Industrial segments in the reported quarter drove the top line. Also, improving food retail business remained a positive. The strong performance delivered across the Americas and Asia/Rest of the World contributed well.

Headwinds related to the pandemic, supply-chain disruptions, inflationary pressure, uncertainties due to the Russia-Ukraine war and foreign exchange headwinds remain a concern for MTD in the days ahead.

Mettler-Toledo has lost 27.7% on a year-to-date basis compared with the industry’s decline of 27.9%

Nevertheless, portfolio strength, cost-cutting efforts, margin and productivity initiatives, and robust sales and marketing strategies are expected to remain tailwinds.

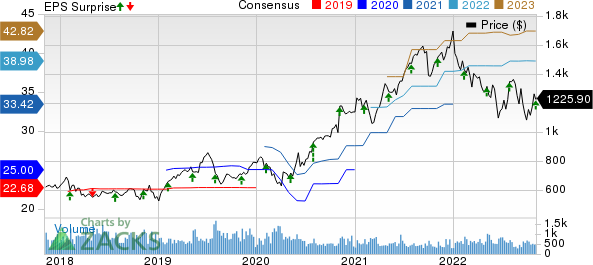

MettlerToledo International, Inc. Price, Consensus and EPS Surprise

MettlerToledo International, Inc. price-consensus-eps-surprise-chart | MettlerToledo International, Inc. Quote

Top Line in Detail

By Segments: MTD reports revenues under three segments, namely Laboratory Instruments, Industrial Instruments and Food Retail, which accounted for 56%, 39% and 5% of net sales in the third quarter, respectively. The Laboratory, Industrial and Food Retail segments witnessed year-over-year improvements of 10%, 10% and 7%, respectively, in the quarter under review.

By Geography: Total sales from the Americas, Europe and Asia/Rest of the World contributed 41%, 23% and 35% to net sales in the third quarter, respectively. Sales in the Americas, Europe and Asia/Rest of the World went up 11%, 1% and 15%, respectively, on a year-over-year basis.

Operating Results

The gross margin was 59.3%, expanding 90 basis points (bps) year over year.

Research & development (R&D) expenses were $44.1 million, up 4.4% from the year-ago quarter’s tally. Selling, general & administrative (SG&A) expenses decreased 3.1% year over year to $233.4 million.

As a percentage of sales, R&D expenses expanded 10 bps year over year to 4.5%. SG&A expenses contracted 160 bps year over year to 23.7%.

The adjusted operating margin was 31.2%, which expanded 250 bps from the prior-year quarter’s level.

Balance Sheet & Cash Flow

As of Sep 30, 2022, Mettler-Toledo’s cash and cash equivalent balance was $122.1 million, up from $109.4 million as of Jun 30, 2022.

Long-term debt was $1.825 billion at the end of the third quarter compared with $1.821 billion at the end of the second quarter.

Mettler-Toledo generated $245.4 million cash from operating activities in the reported quarter, up from $219.2 million in the previous quarter. Free cash flow was $224.7 million in the reported quarter.

Guidance

For fourth-quarter 2022, Mettler-Toledo projects sales growth of 7% in local currency from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for sales is pegged at $1.08 billion.

Adjusted fourth-quarter earnings are anticipated to be $11.55-$11.65 per share, implying a 10-11% rise from the year-ago quarter’s reported number, which includes a foreign-currency headwind of 10%. The Zacks Consensus Estimate for earnings is pegged at $11.97 per share.

For 2022, Mettler-Toledo expects sales growth in local currency at 10% from the year-earlier tally. The Zacks Consensus Estimate for the same is pegged at $3.93 billion.

Mettler-Toledo revised the guidance for adjusted 2022 earnings by hiking the lower end. It is now expected within $38.95-$39.05 per share, suggesting growth of 15% from the year-ago reported number. The Zacks Consensus Estimate for the same is pegged at $38.98. Previously, management had anticipated adjusted EPS within $38.85-$39.05.

Zacks Rank & Stocks to Consider

Currently, Mettler-Toledo has a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like US Foods USFD, The Trade Desk TTD and Tencent Music Entertainment Group TME, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

US Foods is set to report third-quarter 2022 results on Nov 10. The Zacks Consensus Estimate for USFD’s earnings is pegged at 59 cents per share, suggesting an increase of 22.9% from the prior-year period’s reported figure. USFD has lost 17.4% in the year-to-date period. Its long-term earnings growth rate is currently projected at 20%.

The Trade Desk is scheduled to release third-quarter 2022 results on Nov 9. The Zacks Consensus Estimate for TTD’s earnings is pegged at 24 cents per share, suggesting an increase of 33.3% from the prior-year quarter’s reported figure. TTD has lost 46.3% in the year-to-date period. TTD’s long-term earnings growth rate is currently projected at 24%.

Tencent Music is scheduled to release third-quarter 2022 results on Nov 15. The Zacks Consensus Estimate for TME’s earnings is pegged at 11 cents per share, suggesting an increase of 22.2% from the prior-year quarter’s reported figure. TME has lost 44.7% in the year-to-date period. TME’s long-term earnings growth rate is currently projected at 17.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MettlerToledo International, Inc. (MTD) : Free Stock Analysis Report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

The Trade Desk (TTD) : Free Stock Analysis Report

Tencent Music Entertainment Group Sponsored ADR (TME) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance