MGIC Investment Corp (MTG) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

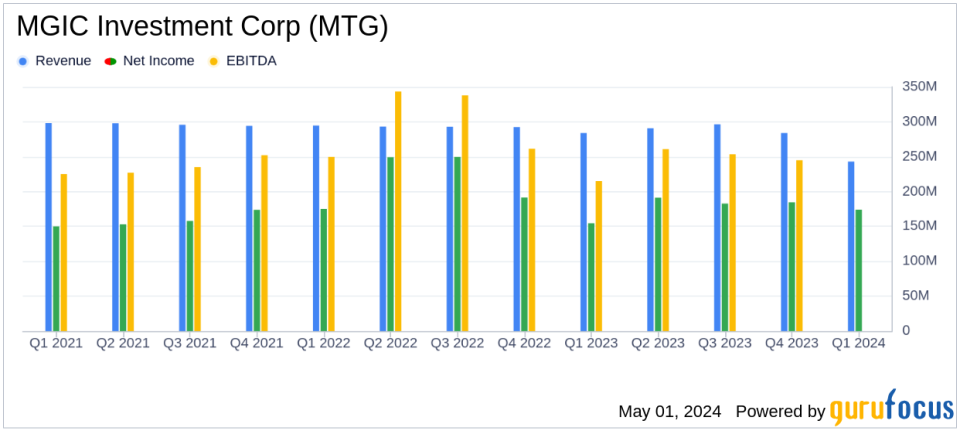

Net Income: Reported $174.1 million for Q1 2024, surpassing the estimated $166.93 million.

Earnings Per Share (EPS): Achieved $0.64 per diluted share, exceeding the estimated $0.60.

Revenue: Total revenue reached $294.36 million, slightly below the forecast of $300.51 million.

Return on Equity: Delivered a strong return on equity of 13.7% for the quarter.

Book Value Per Share: Increased to $18.97, up from $16.57 year-over-year, reflecting a 14.5% growth.

Shareholder Returns: Paid dividends of $0.115 per common share and repurchased 4.7 million shares using $93.3 million of cash.

Insurance in Force: Grew to $290.9 billion, compared to $292.4 billion in the previous year.

On May 1, 2024, MGIC Investment Corp (NYSE:MTG) released its 8-K filing, revealing a robust financial performance for the first quarter of 2024. The company reported a net income of $174.1 million, or $0.64 per diluted share, outperforming analyst estimates of $0.60 per share. This represents a notable increase from the previous year's $154.5 million, or $0.53 per diluted share.

MGIC, a key player in the private mortgage insurance sector, continues to benefit from favorable market conditions and strategic initiatives. The company's revenue for the quarter stood at $294.36 million, surpassing the estimated $300.51 million and reflecting a growth from $283.96 million in the same quarter last year. This growth is primarily driven by higher net premiums earned and a significant increase in net investment income, which rose from $49.22 million to $59.74 million year-over-year.

Company Overview

MGIC Investment Corp provides private mortgage insurance and other mortgage credit risk management solutions. The company operates across all 50 states and Puerto Rico, with significant exposure in major states including California and Florida. Insurance premiums, which form the bulk of MGIC's revenue, are complemented by investment income from the companys well-managed portfolio.

Operational Highlights and Financial Metrics

During Q1 2024, MGIC wrote $9.1 billion in new insurance, a slight decrease from Q4 2023's $10.9 billion but an improvement over $8.2 billion from Q1 2023. The company's insurance in force rose to $290.9 billion, showcasing steady growth and market confidence. Notably, MGIC's loss ratio improved significantly to 1.9% from 2.7% in the prior year, indicating better risk management and underwriting practices.

The company's solid financial position is further underscored by its capital and liquidity metrics. MGIC reported $5.9 billion in PMIERs available assets and a robust holding company liquidity of $793 million as of March 31, 2024. These figures reflect MGICs strong balance sheet and its ability to meet future claims and other financial obligations.

Strategic Shareholder Returns

MGIC's commitment to enhancing shareholder value is evident from its active return of capital. The company paid dividends of $0.115 per common share and repurchased 4.7 million shares for $93.3 million during the quarter. Furthermore, the board approved a new share repurchase program authorizing up to $750 million in buybacks through December 31, 2026.

Managements Perspective

CEO Tim Mattke expressed confidence in the company's strategic direction, citing robust quarterly performance and strong market positioning. He highlighted the favorable credit trends and the resilience of the housing market as key drivers of MGIC's success.

Future Outlook and Industry Position

MGIC's performance in the first quarter sets a positive tone for 2024. With a strong capital position, effective risk management, and proactive shareholder return strategies, MGIC is well-positioned to capitalize on market opportunities and navigate potential challenges. The company's focus on maintaining underwriting discipline and leveraging market dynamics will be crucial in sustaining its growth trajectory and market leadership in the competitive mortgage insurance landscape.

For detailed financial information and future updates, stakeholders and interested investors are encouraged to refer to MGIC's filings and upcoming reports on their official website.

Explore the complete 8-K earnings release (here) from MGIC Investment Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance