MGM Resorts' (MGM) BetMGM Unveils Betting App in Maryland

MGM Resorts International MGM and Entain Plc’s joint venture BetMGM recently announced the launch of its mobile app in Maryland. The app will enable customers to access several online betting options.

BetMGM CEO Adam Greenblatt said, “The convenience of our best-in-class mobile app connects directly to the engaging atmosphere we've created in our retail sportsbooks at MGM National Harbor and Nationals Park.”

BetMGM’s expansion efforts continue to drive growth. Net revenues from BetMGM in the first half of 2022 came in at $608 million, up 70% from 2021 levels. Meanwhile, BetMGM continues to gain market share. In second-quarter 2022, BetMGM rolled out its offerings in Ontario. As of May 2022, BetMGM achieved a market share of 21% in the U.S. sports betting and the iGaming space.

BetMGM has a long-term growth target of 20- 25% in U.S. sports betting and iGaming. Currently, the company is on track to achieve its target. Given the positive momentum in the markets coupled with its exceptional online and offline offerings, the company expects revenues to be more than $1.3 billion in 2022.

BetMGM expects to achieve positive EBITDA in 2023. To drive growth, the company continues to invest in additional markets.

The company announced partnerships with Gila River Hotels & Casinos and the Arizona Cardinals to expand its retail and online sports betting. Further, the company started a collaboration with Orix to build a world-class integrated resort in Japan.

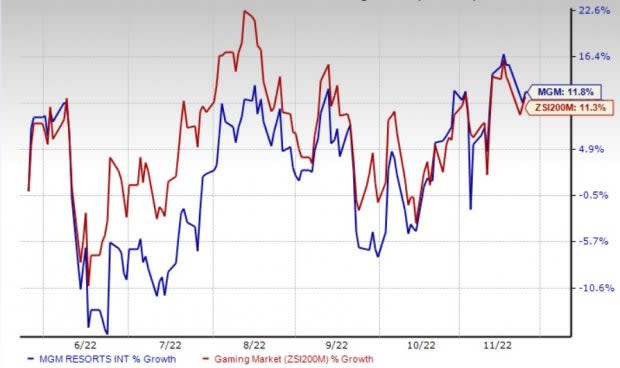

Image Source: Zacks Investment Research

Price Performance

Shares of MGM Resorts have gained 11.8% in the past six months, compared with the industry’s increase of 11.3%. The company is benefiting from pent-up consumer demand, high domestic casino spends and robust demand for sports betting. It is also benefiting from increased visitation in the Las Vegas market. Sports betting and iGaming continue to be major growth drivers for the company.

Zacks Rank & Key Picks

The company currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Consumer Discretionary sector are Hyatt Hotels Corporation H, Crocs, Inc. CROX and Boyd Gaming Corporation BYD.

Hyatt currently carries a Zacks Rank #2 (Buy). H has a trailing four-quarter earnings surprise of 652.3% on average. The stock has improved 16.1% in the past year.

The Zacks Consensus Estimate for H’s current financial year’s sales and EPS indicates a surge of 92.6% and 121.8%, respectively, from the year-ago period’s reported levels.

Crocs currently carries a Zacks Rank #2. CROX has a long-term earnings growth rate of 15%. Shares of Crocs have declined 43.7% in the past year.

The Zacks Consensus Estimate for CROX’s 2022 sales and EPS indicates a rise of 51.5% and 23.7%, respectively, from the year-ago period’s levels.

Boyd Gaming carries a Zacks Rank #2 at present. BYD has a long-term earnings growth rate of 12.8%. The stock has declined 3.4% in the past year.

The Zacks Consensus Estimate for BYD’s 2022 sales and EPS indicates growth of 4.4% and 11.9%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance