MGM Resorts (MGM) Q2 Earnings Miss Estimates, Revenues Top

MGM Resorts International MGM reported mixed second-quarter 2022 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. The top and the bottom line increased on a year-over-year basis. The company's results in the quarter benefited from robust regional operations, courtesy of strong leisure demand and better convention business. Following the results, shares of the company increased 2.5% in the after-hours trading session on Aug 3.

Bill Hornbuckle, CEO and president of MGM Resorts International, stated, " We look to the future with optimism, as our convention and event calendar for the next year remain notably strong and BetMGM continues to be a market leader with a roadmap for growth. We remain focused on achieving our vision to be the world's premier gaming entertainment company."

Earnings & Revenue Discussion

MGM Resorts reported adjusted earnings per share (EPS) of 3 cents, missing the Zacks Consensus Estimate of 24 cents. In the prior-year quarter, the company had reported an adjusted loss of 13 cents per share.

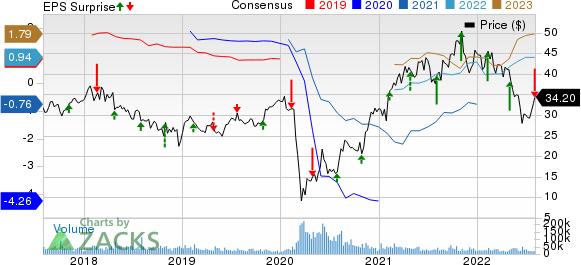

MGM Resorts International Price, Consensus and EPS Surprise

MGM Resorts International price-consensus-eps-surprise-chart | MGM Resorts International Quote

Total revenues were $3,264.9 million, which surpassed the Zacks Consensus Estimate of $3,034 million. The top line soared 44% from $2,268 million reported in the year-ago period. The upside was primarily driven by the rise in Casino, BetMGM, and other sports betting and iGaming revenues.

MGM China

MGM China's net revenues fell 54% year over year to $143 million. The figure is down 79.7% compared to 2019 levels. VIP Table Games turnover declined 74% year over year to $684 million. MGM China casino revenues decreased 55% year over year to $121 million.

MGM China's adjusted property EBITDAR (Earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs) amounted to ($52.1) million against the adjusted property EBITDAR of $8.6 million reported in the prior-year quarter.

Domestic Operations

Net revenues at Las Vegas Strip Resorts during the second quarter were $ 2,137.2 million, up 112.7% year over year. The company benefitted from increased business volume and travel activity on a year-over-year basis. Also, the addition of The Cosmopolitan and Aria added to the upside.

Adjusted property EBITDAR improved a whopping 108% year over year to $825.3 million. Casino revenues in the quarter under review were $499 million, up 41% year over year.

During the quarter under review, net revenues from the company's regional operations totaled $959.7 million, up 12.1% from the prior-year quarter. The upside was primarily driven by strong leisure demand and a return from its convention customers.

Adjusted property EBITDAR was $339.9 million, up 6.8% year over year. Adjusted property EBITDAR margin contracted 180 basis points year over year to 35.4%.

Casino revenues in the quarter under review rose 4% from the year-ago level of $734 million.

Balance Sheet & Share Repurchase

MGM Resorts ended the second quarter with cash and cash equivalents of $5,784.2 million compared with $2,719.1 million reported in the previous quarter. The company's long-term debt at the end of the quarter stood at $7,107.2 million, down from $10,507.1 million as of Mar 31, 2022.

During the second quarter, the company repurchased nearly $32 million shares at an average price of $34.42 per share for $1.1 billion.

Zacks Rank & Other Key Picks

MGM Resorts carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the Consumer Discretionary sector are G-III Apparel Group, Ltd. GIII, Marriott International, Inc. MAR and Choice Hotels International, Inc. CHH.

G-III Apparel sports a Zacks Rank #1. GIII has a trailing four-quarter earnings surprise of 97.5%, on average. The stock has declined 26.5% in the past year.

The Zacks Consensus Estimate for GIII’s current financial year sales and EPS indicates growth of 13.8% and 8.2%, respectively, from the year-ago period’s reported levels.

Marriott carries a Zacks Rank #2. MAR has a trailing four-quarter earnings surprise of 1.4%, on average. The stock has increased 36.2% in the past year.

The Zacks Consensus Estimate for MAR’s current financial year sales and EPS indicates growth of 44.6% and 93.7%, respectively, from the year-ago period’s reported levels.

Choice Hotels carries a Zacks Rank #2. CHH has a trailing four-quarter earnings surprise of 20.4%, on average. The stock has increased 4% in the past year.

The Zacks Consensus Estimate for CHH’s current financial year sales and EPS indicates growth of 13.6% and 17.7%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance