Can Michael Kors (KORS) Deliver an Earnings Beat in Q4?

Michael Kors Holdings Limited KORS is scheduled to report fourth-quarter fiscal 2018 results on May 30, before the market opens. In the last quarter, the company delivered a positive earnings surprise of 37.2%. Let’s see how things are shaping up prior to this announcement.

Which Way Are Top & Bottom-Line Estimates Headed?

The Zacks Consensus Estimate for the quarter under review stands at 60 cents, reflecting a year-over-year decline of 17.8%. The consensus estimate is above the company’s guided range of 50-55 cents per share. We note that the Zacks Consensus Estimate has increased by a penny in the last 30 days.

Michael Kors has a remarkable history, at least in terms of the bottom line. The company’s third-quarter fiscal 2018 results marked the 11th consecutive quarter of earnings beat. In the trailing four quarters, the company outperformed the Zacks Consensus Estimate by an average of 32.7%.

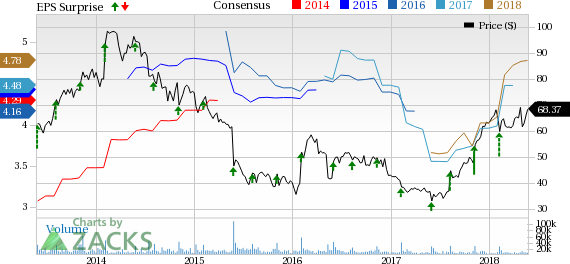

Michael Kors Holdings Limited Price, Consensus and EPS Surprise

Michael Kors Holdings Limited Price, Consensus and EPS Surprise | Michael Kors Holdings Limited Quote

Well the obvious question that comes to mind is whether Michael Kors will be able to sustain its positive earnings surprise streak in the fiscal fourth quarter. Though the past trend indicates a positive surprise, it will not be wise to jump to a conclusion without analyzing the factors at play.

Deciding Factors

Michael Kors has been constantly deploying resources to expand product offerings, open stores and build shop-in-shops. Management intends to upgrade e-commerce platform and expects the channel to be a significant contributor in the long run. We note that despite the possibility of heavy investments weighing on margins in the short term, the company continues to take up strategic endeavors.

Michael Kors’ Runway 2020 strategic plan, which focuses on product innovation, brand engagement and customer experience, is likely to drive the top line. The company had earlier launched Bancroft in the Michael Kors collection line as part of its strategy of product innovation.

However, stiff competition, declining comps, aggressive promotional environment and waning mall traffic are making things tough. We noted that comparable sales dropped 3.2% in third-quarter fiscal 2018, following declines of 1.8% and 5.9% in the second and first quarter, respectively. For fiscal 2018, the company continues to anticipate comparable sales decline in the mid-single digit range.

What the Zacks Model Unveils

Our proven model shows that Michael Kors is likely to beat estimates this quarter as the stock has the right combination of two key ingredients — a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen.

Michael Kors has an Earnings ESP of +9.64% and carries a Zacks Rank #2. This makes us reasonably confident of an earnings beat.

Other Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dollar General Corporation DG has an Earnings ESP of +1.97% and a Zacks Rank #2.

Costco Wholesale Corporation COST has an Earnings ESP of +1.39% and a Zacks Rank #3.

Kroger KR has an Earnings ESP of +3.94% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Michael Kors Holdings Limited (KORS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance