Micro Focus Remains in the Penalty Box

- By

International software company Micro Focus International PLC (LSE:MCRO) (NYSE:MFGP) announced lukewarm results on July 1 for the six months ended April 30.

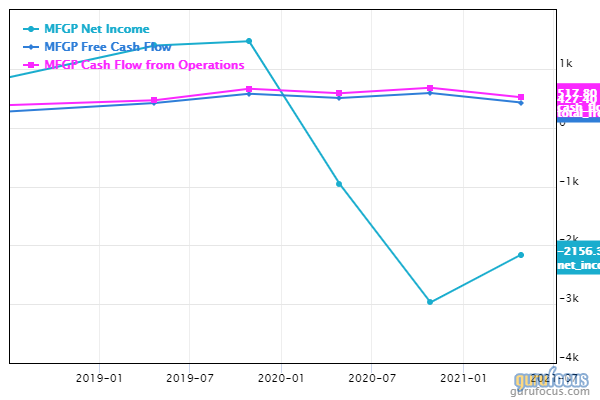

The company recorded revenue of $1.4 billion for the period, representing a decline of 4.6%. The operating loss from continuing operations (after exceptional items and amortization of purchased intangibles) was $154.8 million (the operating loss for the same period las year was $906.7 million, including a goodwill impairment charge of $922.2 million). Cash generated from operating activities was $468.1 million (it recorded $560.4 million last year), which after exceptional items resulted in adjusted cash conversion of 124.5% (compared to 131.5% in the prior-year quarter).

Micro Focus also entered a strategic partnership with Amazon Web Services in moving mainframe application into AWS, and satisfactory progress across the product portfolios, including key partnerships announced with Microsoft Azure, Snowflake, Dell EMC and others.

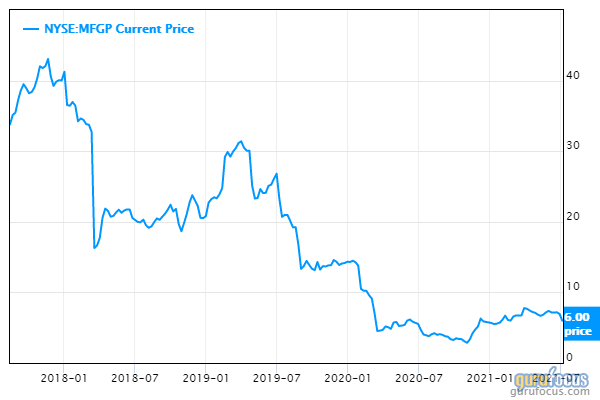

The stock fell about 20% following the announcement, which was an overreaction given the company's strong cash generation and improving results. The company, which at one time was a high-flier, has lost a lot of credibility with investors and remains in the penalty box.

Regardless, investors are missing out on Micro Focus' significant cash generation as they are still too focused on declining revenue and accounting losses as the company executes its turnaround.

Micro Focus is a U.K.-based developer of enterprise software. The company specializes in acquiring infrastructure software from larger companies who want to focus on other strategic priorities. Though it has a long history of successfully acquiring and integrating software companies, it bit off more than it could chew when, in 2017, it acquired the software business of Hewlett Packard Enterprise Co. (HPE). It paid $2.5 billion in cash (financed with debt) to Hewlett Packard and then proceeded to merge with its software business as well as listing on the New York Stock Exchange.

The transformative deal, together with debt and equity, was valued at over $8 billion. After the transaction, Hewlett Packard shareholders owned 50.1% of the combined company. However, the integration of the two businesses did not go smoothly, so both the company's revenue and the stock tanked. Since the deal, the company has taken heavy losses (in the order of around $3.5 billion), which have been mostly asset impairment charges as intangibles was written down. However, the cash generation ability of the company has not been affected very much. The company currently has a free cash yield of over 20%, driven by its low share price.

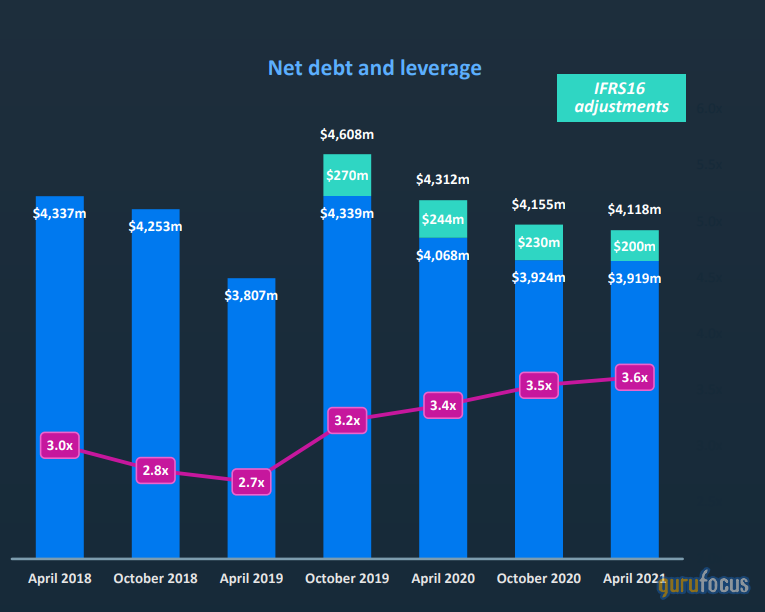

The company, which took on a large amount of debt to fund the acquisition, is now in the process of bringing down leverage. Since October 2019, Micro Foucs has reduced net debt by $490 million. Current leverage of 3.6 times is in line with expectations of the planned investment program as part of the turnaround efforts. Reduction of leverage over the medium term remains a key target for the company, but will increase in the short term due to impact of one-off cash flow items. The term loans are not due for repayment until June 2024 and the company has available liquidity of over $1 billion.

I believe the company can bring its debt down substantially in the next five years due its highly sticky and cash-generative business. The revenue decline is slowing and Micro Focus believes it can stabilize it in the next two year or so. The company also recently reinstated its dividend, signalling increased confidence in the business.

Conclusion

Micro Focus continues to trade at extremely depressed valuation. It takes time to execute a turnaround, but the new management team is making good progress. I can see the stock eventually doubling or tripling from here. I continue to build my position as patience is the key.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance