Microchip (MCHP) Enhances Aviation Footprint With Latest Solution

Microchip Technology MCHP is strengthening its presence in the aviation industry with its latest integrated actuation power solution aimed at addressing the sector’s rising demand for efficiency, sustainability and decarbonization.

With a focus on the emerging trend of More Electric Aircraft (MEA), Microchip’s latest solution combines companion gate driver boards with their adaptable Hybrid Power Drive (HPD) modules, which are available in both silicon carbide and silicon technology, spanning a power range of 5kVA to 20kVA.

The new integrated actuation power solution maintains a consistent footprint regardless of power output, ensuring seamless integration across various aviation systems, including flight controls, brakes and landing gear.

Tested thoroughly to meet airborne equipment standards stated in DO-160, the actuation power solution boasts multiple protection features, including shoot-through detection and short circuit protection, ensuring optimal safety and performance.

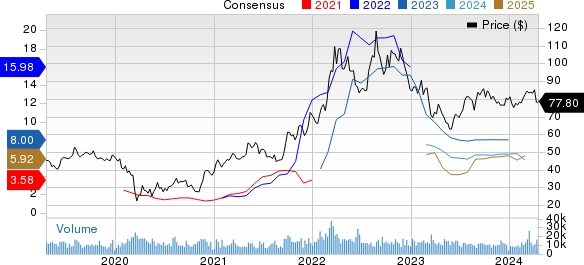

Microchip Technology Incorporated Price and Consensus

Microchip Technology Incorporated price-consensus-chart | Microchip Technology Incorporated Quote

By providing a lightweight and temperature-resistant solution, Microchip aims to drive the aviation industry toward electrification, offering customers a pathway to accelerate development, reduce costs, and achieve faster time-to-market for MEA and all-electric aircraft.

Microchip’s Strong Portfolio Aids Prospect

The latest move bodes well with MCHP’s commitment to strengthen its overall portfolio in a bid to boost its customer momentum across various end-markets.

Acquisitions have also been a key catalyst in strengthening MCHP’s overall portfolio. It recently acquired Neuronix AI Labs to enhance its FPGA capabilities for power-efficient AI-enabled edge solutions with neural network sparsity optimization technology, facilitating power-efficient AI deployments without requiring deep FPGA design expertise.

This month, MCHP also completed the acquisition of VSI Co. Ltd., strengthening its position in providing high-speed, asymmetric camera, sensor, and display connectivity for in-vehicle networking, aligning with Automotive SerDes Alliance (ASA) open standard to meet the growing demand for next-generation vehicles.

MCHP's consistent strength in its microcontroller business is noteworthy. It has recently announced the launch of the AVR DU family of microcontrollers, offering enhanced USB connectivity, power delivery, security features and cost-saving benefits for embedded designs.

Despite MCHP’s robust portfolio, persistent inflationary pressures and high interest rates have resulted in a weak macro environment.

Microchip also paused internal capacity expansion, which is likely to reduce capital expenditure spending in fiscal 2024 and 2025 due to sluggish demand and a challenging macroeconomic environment.

MCHP expects net sales to be $1.225-$1.425 billion for the fourth quarter of fiscal 2024. Non-GAAP earnings are anticipated between 46 cents per share and 68 cents. The Zacks Consensus Estimate for revenues is pegged at $1.33 billion, indicating a 40.57% year-over-year decline.

The consensus mark for earnings is pegged at 57 cents per share, suggesting a 65.24% year-over-year decline.

Zacks Rank & Other Stocks to Consider

Microchip currently has a Zacks Rank #5 (Strong Sell).

MCHP’s shares have dropped 5.7% year to date against the Zacks Computer & Technology sector's rise of 9.1%.

Some other top-ranked stocks in the broader technology sector are NetApp NTAP, Synopsys SNPS and NVIDIA NVDA, each sporting Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NetApp shares have returned 14.5% in the year-to-date period. NTAP’s long-term earnings growth rate is currently projected at 8.79%.

Synopsys shares have returned 2.5% in the year-to-date period. SNPS's long-term earnings growth rate is currently projected at 17.51%.

NVIDIA shares have gained 69.7% in the year-to-date period. NVDA's long-term earnings growth rate is currently projected at 30.93%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance