Microsoft's (MSFT) Azure Purview to Enhance Data Governance

Microsoft Corporation MSFT recently unveiled a new offering — Azure Purview — that is aimed at improving data governance for enterprises. The data management solution is currently available in preview.

Azure preview has three main functionalities — data discovery, classification and mapping, data cataloguing as well as data governance.

With Azure Purview, customers can get valuable business insights by automating data discovery and cataloguing from multiple locations including multi-cloud, on-premises as well as software as a service (SaaS) site.

The latest data management offering also enables users to search for data through web-based experience while visual graphs aid customers to verify if the data belongs to a trusted source, added Microsoft.

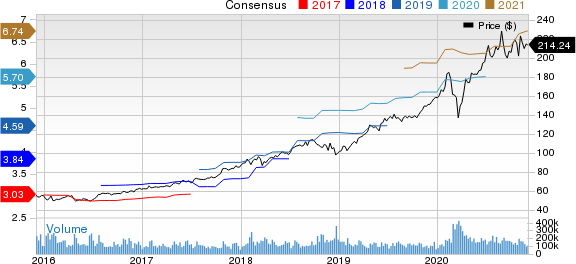

Microsoft Corporation Price and Consensus

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

The solution will also aid in compliance with privacy regulations. It will offer data officers valuable insights regarding the movement and storage of data as well as distribution of data across multiple environments.

Microsoft, currently carrying a Zacks Rank #2 (Buy), also announced the general availability of its Azure Synapse Analytics solution. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Launched in November 2019, Azure Synapse Analytics solution aids customers to analyze vast amount of data across all data sources and derive data-driven insights to augment business processes. The solution leverages the Power BI along with innovative technologies like Artificial Intelligence (AI), machine Learning (ML) and data analytics.

Microsoft stated that the number of customers deploying Azure Synapse Analytics for petabyte-scale workloads increased over five times since the product’s launch. FedEx FDX is one of the most prominent customers utilizing the Azure Synapse Analytics along with other products in the Azure ecosystem, added the company.

Exponential Growth in Data Bodes Well

There has been an explosive growth in data creation owing to acceleration in digital transformation among enterprises. Increasing migration of workloads to cloud by enterprises caused a spurt in the demand for cloud-based data management solutions.

Citing an IDC report, Microsoft added that the global datasphere is likely to reach 175 zettabytes by 2025. This bodes well for growth of enterprise data management solutions’ market.

The worldwide enterprise data management market is projected to reach $136.4 billion by 2026 at a CAGR of 10.5% between 2019 and 2026, per a Research Dive Report.

Enterprise data management services assist organizations to leverage the power of their extensive databases to boost business performance.

Apart from exponential growth in data due to digitalization, the adoption of emerging technologies like AI along with higher need for data compliance amid growing cybersecurity threat has increased demand for enterprise data management solutions, per a report from MarketsAndMarkets.

These projections bode well for Microsoft, which is trying to grab a larger share of this lucrative market.

However, the tough competition in this space is a concern. Oracle ORCL is one of the prominent players in the enterprise data management services market along with like SAP SE, and Teradata Corp. TDC.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Teradata Corporation (TDC) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance