MicroStrategy to Split Stock 10:1 After Share Price Triples in a Year on Bitcoin Rally

Nasdaq-listed software firm MicroStrategy (MSTR), the largest corporate holder of bitcoin {{BTC}} , announced a 10-for-1 stock split on Thursday.

The split will be effected on Aug. 1 and shares will be distributed after the Aug. 7 market close, the company said in a press release. Holders of class A and class B common shares will receive nine additional shares for each share they own.

The company said that the split will make the company's shares "more accessible to investors and employees."

$MSTR announces 10-for-1 Stock Split https://t.co/u7sIjWc9we

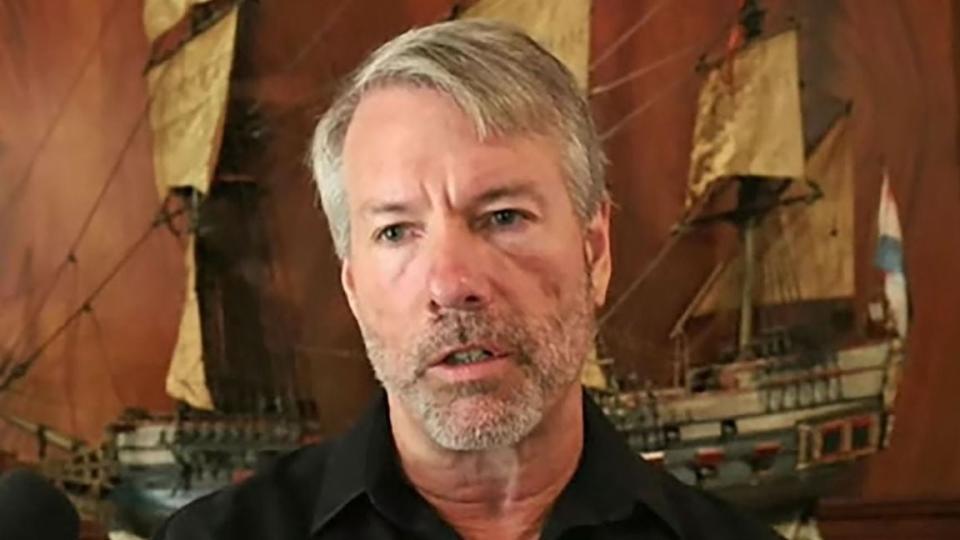

— Michael Saylor⚡️ (@saylor) July 11, 2024

The announcement comes after MicroStrategy's share price more than tripled over the past year, hitting an all-time record of over $1,900 in March as BTC rallied past $70,000. The shares rose 6.8% to $1,300 today.

MicroStrategy, led by executive chairman and widely followed bitcoin proponent Michael Saylor, is often viewed as a leveraged play on the price of bitcoin. The company regularly issues corporate debt to raise funds to buy more bitcoin for its treasury. After its latest purchase last month, the company held 226,331 BTC worth over $13 billion.

Read more: MicroStrategy Is Pioneering Bitcoin Capital Markets, Bernstein Says

Stock splits are common among public companies whose shares have significantly appreciated. While the split does not change the company's valuation, it could make the stock psychologically more accessible to smaller, retail investors by reducing the share price even at a time when many retail-facing trading platforms offer fractional shares. Most recently, chipmaker juggernaut Nvidia (NVDA) saw a 10:1 stock split last month after reaching a four-digit share price, tripling in a year fueled by the artificial intelligence-driven (AI) equities rally.

Yahoo Finance

Yahoo Finance