Microtome Market by Product, Application, Technology, End-user and Region - Global Forecast to 2027

Global Microtome Market

Dublin, May 24, 2022 (GLOBE NEWSWIRE) -- The "Global Microtome Market by Product (Instruments, (Rotary), Accessories (Microtome Blades)), Application (Disease Diagnosis, Medical Research), Technology (Fully Automated, Semi-automated, Manual), End-user (Hospital, Clinical Labs), and Region - Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

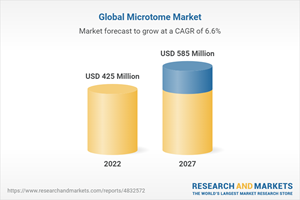

The microtomes market is projected to reach USD 585.2 million by 2027 from USD 425.4 million in 2022, at a CAGR of 6.6%.

Some of the key factors driving the growth of this market include the high prevalence of cancer, growing demand for digital pathology, and the increasing healthcare expenditure. In addition, the growing focus on personalized medicine and the untapped growth potential of emerging economies are expected to offer growth opportunities for players operating in the microtomes market. However, a lack of skilled professionals to operate microtomes is a key challenge for the growth of this market.

Based on end user the market is classified into hospital laboratories, clinical laboratories, and other end-users. The growth of this market is majorly driven by the increasing number of specialty diagnostic tests performed in hospital laboratories, rising number of in-house clinical diagnostic procedures in hospitals, rising number of hospitals across the globe, and the growing trend of establishing in-house clinical diagnostic capabilities in hospitals.

Microtome instruments in the product segment to witness the highest shares during the forecast period

Based on the product, the microtome market is segmented into Microtome Instruments: Rotary Microtomes, Cryostat Microtomes, Vibrating Microtomes, Other Microtomes, and Microtome Accessories. The microtome instruments segment is expected to dominate the microtome market. High expenditure on microtome instruments and their essential use in the histological diagnosis of various diseases are the key factors driving the growth of the automated microtome market.

Asia Pacific is estimated to register the highest CAGR during the forecast period

In this report, the microtome market is segmented into four major regional segments, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW). The market in Asia Pacific is projected to register the highest growth rate during the forecast period. The growth in this market is primarily driven by the rising disposable income of the middle-class population, infrastructural developments, and the rising penetration of diagnostic technologies in Asian countries such as India and China in addition, the rising incidence of cancer and the growing focus of global medical device companies on expanding their presence in emerging Asia Pacific countries are some of the key factors.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Microtomes Market Overview

4.2 Microtomes Market, by Product

4.3 Asia-Pacific: Microtomes Market, by Product and Country

4.4 Geographic Snapshot of Microtomes Market

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Prevalence of Cancer

5.2.1.2 Growing Demand for Digital Pathology

5.2.1.3 Recommendations for Cancer Screening

5.2.1.4 Availability of Reimbursement

5.2.2 Challenges

5.2.2.1 Lack of Skilled Professionals

5.2.2.2 Availability of Refurbished Products

5.2.3 Opportunities

5.2.3.1 Growing Focus on Personalized Medicine

5.2.3.2 Emerging Economies

5.3 Impact of COVID-19 on Microtomes Market

5.4 Ranges/Scenarios

5.4.1 Microtomes Market

5.5 Value Chain Analysis

5.6 Supply Chain Analysis

5.7 Technology Analysis

5.8 Porter's Five Forces Analysis

5.9 Key Stakeholders & Buying Criteria

5.9.1 Key Stakeholders in Buying Process

5.9.2 Buying Criteria

5.10 Regulatory Landscape

5.11 Patent Analysis

5.12 Key Conferences & Events in 2022

5.13 Pricing Analysis

5.14 Trade Analysis

5.15 Ecosystem Analysis

5.15.1 Role in Ecosystem

5.15.2 Key Players Operating in Microtomes Market

5.16 Trends/Disruptions Impacting Customers' Businesses

6 Microtomes Market, by Product

6.1 Introduction

6.2 Microtome Instruments

6.2.1 Rotary Microtomes

6.2.1.1 Rotary Microtomes are Widely Used in Histology Laboratories

6.2.2 Cryostat Microtomes

6.2.2.1 Cryostat Microtomes Provide Immediate Results by Quickly, Reliably, and Safely Cutting Accurate Frozen Sections

6.2.3 Vibrating Microtomes

6.2.3.1 Vibrating Microtomes are Designed to Cut Fresh Tissue Specimens

6.2.4 Other Microtomes

6.3 Microtome Accessories

6.3.1 Microtome Blades

6.3.1.1 Adoption of Disposable Blades Has Increased Among End-users

6.3.2 Other Microtome Accessories

7 Microtomes Market, by Technology

7.1 Introduction

7.2 Manual Microtomes

7.2.1 Lower Cost and User Comfort Associated with These Microtomes are Driving Their Adoption

7.3 Semi-Automated Microtomes

7.3.1 Semi-Automated Microtomes Segment to Register Highest Growth Rate During Forecast Period

7.4 Fully Automated Microtomes

7.4.1 Lack of Clinical Laboratory Technicians and High Prevalence of Cancer Have Driven Segment Growth

8 Microtomes Market, by Application

8.1 Introduction

8.2 Disease Diagnosis

8.2.1 Expanding Pool of Geriatric Patients and Increasing Diagnosis of Chronic Diseases Driving Segment Growth

8.3 Medical Research

8.3.1 Increasing Research Activities to Drive Adoption of Microtomes

9 Microtomes Market, by End-user

9.1 Introduction

9.2 Hospital Laboratories

9.2.1 Hospital Laboratories Accounted for Largest Market Share in 2021

9.3 Clinical Laboratories

9.3.1 Presence of Robust Infrastructure to Perform Tests in High Volumes is Estimated to Drive Market Growth

9.4 Other End-users

10 Microtomes Market, by Region

11 Competitive Landscape

11.1 Overview

11.2 Key Player Strategies/Right to Win

11.3 Market Share Analysis

11.4 Company Evaluation Matrix

11.4.1 Stars

11.4.2 Emerging Leaders

11.4.3 Pervasive Players

11.4.4 Participants

11.5 Company Evaluation Matrix for SMEs/Start-Ups

11.5.1 Progressive Companies

11.5.2 Starting Blocks

11.5.3 Responsive Companies

11.5.4 Dynamic Companies

11.6 Company Footprint Analysis

11.7 Competitive Benchmarking

11.8 Competitive Scenario

11.8.1 Product Launches

11.8.2 Deals

11.8.3 Other Developments

12 Company Profiles

12.1 Key Players

12.1.1 Danaher Corporation

12.1.2 PHC Holdings Corporation

12.1.3 Cardinal Health

12.1.4 Boeckeler Instruments, Inc.

12.1.5 Bright Instruments Ltd.

12.1.6 Erma Inc.

12.1.7 Histo-Line Laboratories

12.1.8 Jinhua Yidi Medical Appliance Co. Ltd.

12.1.9 Medimeas

12.1.10 Medite Medical GmbH

12.1.11 Microtec Laborgerate GmbH

12.1.12 Sakura Finetek Usa, Inc.

12.1.13 Slee Medical GmbH

12.1.14 SM Scientific Instruments Pvt. Ltd.

12.1.15 Ted Pella, Inc.

12.2 Other Players

12.2.1 AGD Biomedicals Pvt. Ltd.

12.2.2 Amos Scientific Pty Ltd.

12.2.3 Campden Instruments Ltd.

12.2.4 Diapath S.p.A.

12.2.5 Laboid International

12.2.6 Lafayette Instrument Company

12.2.7 Lupetec

12.2.8 Milestone Medical

12.2.9 RWD Life Science Co. Ltd.

12.2.10 Shenzhen Dakewei Biotechnology Co. Ltd.

13 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/39x845

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance