Middle Eastern powers are pushing the price of oil higher right before crucial midterm elections - and the White House is not happy about it

OPEC+'s output cut is complicating a hotly contested midterm election for the Biden administration.

The oil group, lead by Saudi Arabia and Russia, slashed its output target Wednesday by 2 million barrels per day.

The White House blasted the move and accused OPEC+ of "aligning with Russia."

OPEC+ is adding political pressure on the Biden administration ahead of a hotly contested midterm election as gasoline prices head back up.

The oil group on Wednesday slashed its oil production quota by 2 million barrels per day. Since several members are already pumping well below their quotas, the actual reduction in supply will likely be less than half that amount, borne primarily by de facto leader Saudi Arabia and key Middle Eastern allies like the UAE and Kuwait.

Still, the White House blasted the move and accused OPEC+ of "aligning with Russia." Underscoring the high stakes for the Biden administration, officials tried to stop OPEC+ from cutting back and drafted talking points to describe the move as a "total disaster" and a "hostile act," according to CNN.

In a note titled "OPEC+ takes on the West," analysts at Goldman Sachs also pointed out the quota cut is perhaps equally a political one as it is an attempt to grow short-term profits. "In addition, the speed at which such an agreement was formed suggests the accord was a political statement as well."

Goldman added that some OPEC+ members were displeased with increased flows from US strategic reserves, Western plans to cap prices in response to Russia's invasion of Ukraine, and efforts to revive the Iran nuclear deal, which would brings more oil supply back to the market.

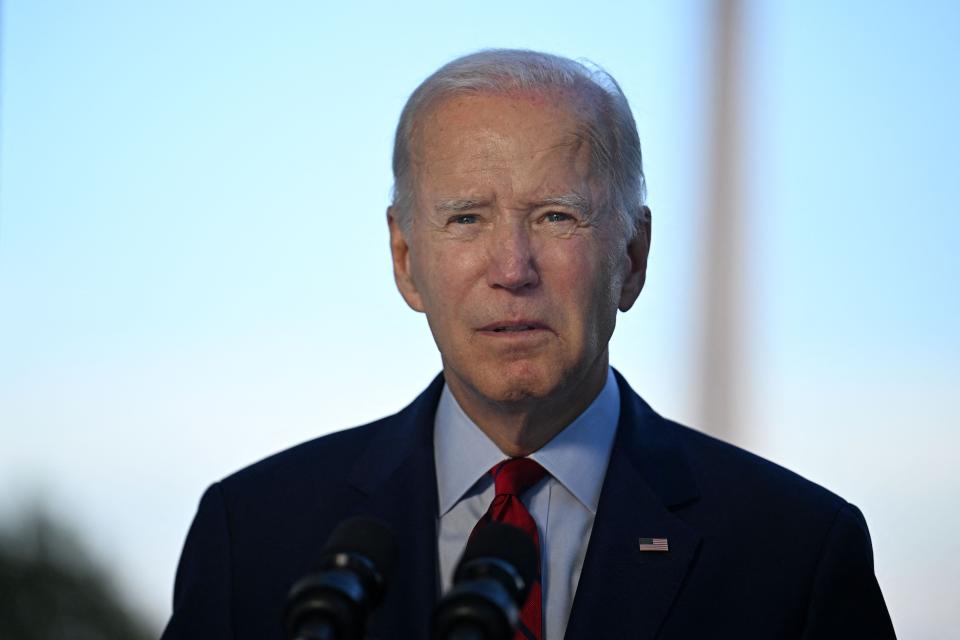

On Thursday, President Biden acknowledged he was disappointed by the OPEC+ decision but said "There's a lot of alternatives. We haven't made up our mind yet."

The White House indicated Wednesday that less oil production from OPEC+ could trigger more releases from the US Strategic Petroleum Reserve. And ahead of the OPEC+ meeting, Bloomberg reported that the White House asked the Energy Department to look into whether a ban on exports of gasoline would lower prices.

Biden has personally invested significant political capital in Saudi Arabia, which has spurned his requests to produce more oil and lower prices. In July, he visited the kingdom as part of a trip to the Middle East and met with Crown Prince Mohammed bin Salman, despite criticizing him previously for his reputed role in the murder of journalist Jamal Khashoggi in 2018.

The following month, OPEC+ announced in output increase of 100,000 barrels per day, an amount so small that experts said it would do little to move energy markets. In September, it trimmed production by 100,000 bpd, leading up to Wednesday's cut of 2 million bpd.

After the latest OPEC+ meeting, Goldman Sachs lifted its price target on oil to $110 a barrel from $100. But the effect on retail gas prices that motorists will pay is less straight forward, as the US fuel market is also swayed by maintenance outages and certain fuel blends at key regional refining hubs.

"The OPEC decision today will basically cause #gasprices only in a few regions to go up for now... East Coast, South, Northeast, Rockies potentially," Patrick De Haan, head of petroleum analysis at GasBuddy tweeted Wednesday. "West Coast, Great Lakes, Plains will see prices drop as refinery issues are addressed. Yes, very complex."

Still, oil prices are up 7% since reports of a production cut first emerged last week. And gas prices have been slowly creeping up again after falling by nearly 100 consecutive days over the summer. The current national average for a gallon of gas is $3.867, up 2.3% from a month ago, according to AAA.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance