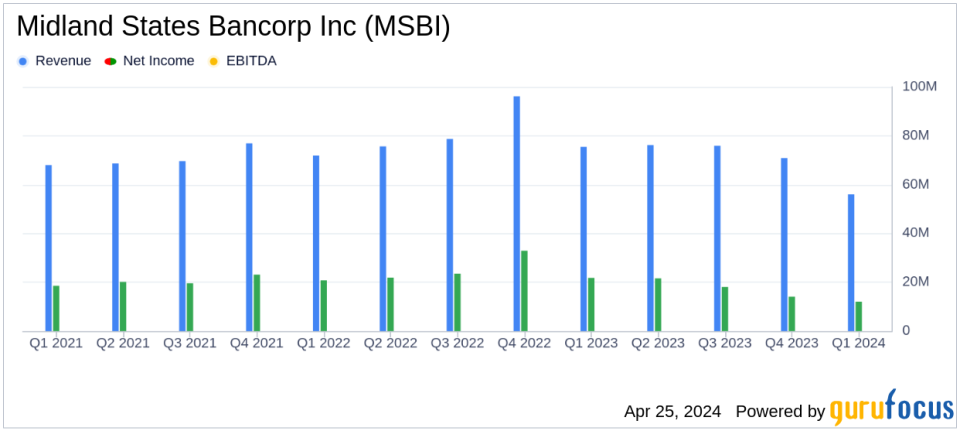

Midland States Bancorp Inc Reports Mixed Q1 2024 Results, Misses EPS Estimates

Net Income: Reported at $11.7 million, falling short of the estimated $15.65 million.

Earnings Per Share (EPS): Achieved $0.53 per diluted share, below the estimate of $0.73.

Revenue: Details not provided, comparison to the estimated $74.93 million cannot be made.

Pre-Tax, Pre-Provision Earnings: Amounted to $32.2 million, indicating operational performance before tax and loan loss provisions.

Net Interest Margin: Slightly decreased to 3.18% from 3.21% in the previous quarter.

Efficiency Ratio: Worsened to 58.0% from 55.2% in the prior quarter, indicating higher costs relative to revenue.

Common Equity Tier 1 Capital Ratio: Improved to 8.60% from 8.40%, strengthening the bank's capital position.

On April 25, 2024, Midland States Bancorp Inc (NASDAQ:MSBI) disclosed its first-quarter earnings for the year, revealing figures that fell short of analyst expectations. The company reported net income available to common shareholders of $11.7 million, translating to earnings of $0.53 per diluted share, a significant drop from the estimated earnings of $0.73 per share. This report comes as part of the company's latest 8-K filing.

Midland States Bancorp Inc, a diversified financial holding company, offers a wide array of banking and financial services. These include commercial and consumer banking products, business equipment financing, and wealth management services. The company's primary revenue-generating segment, the Banking division, focuses on a broad spectrum of financial products and services targeted at both individuals and businesses.

Quarterly Financial Highlights

The reported quarter saw a pre-tax, pre-provision earnings of $32.2 million. However, a substantial increase in provision expenses to $14.0 million, primarily due to a specific reserve of $8.0 million on a multi-family construction project, impacted the net income. This compares unfavorably to the provision expenses of $3.1 million in the first quarter of 2023.

Despite these challenges, the company noted improvements in its tangible book value, which increased by 0.4% from the previous quarter to $23.44, and a slight improvement in the common equity tier 1 capital ratio to 8.60%. The net interest margin slightly decreased to 3.18% from 3.21% in the prior quarter, reflecting the competitive and rising interest rate environment.

Operational and Strategic Developments

During the quarter, Midland States Bancorp continued to refine its loan portfolio, reducing its exposure to equipment finance loans and consumer loans, which saw a decrease of $54.5 million and $98.1 million, respectively. This strategic shift is part of the company's broader objective to manage balance sheet risks and enhance loan quality amidst economic uncertainties.

President and CEO Jeffrey G. Ludwig commented on the quarter's performance, stating,

Our first quarter reflects strong pre-tax, pre-provision results and our ongoing ability to deliver increased fee income and strong expense control. While our pre-tax pre-provision results generate solid profitability, we did increase our reserves to reflect an increase in nonperforming loans."

Asset and Loan Quality

The asset quality metrics showed some deterioration, with non-performing loans increasing to $105.0 million at the end of the quarter, up from $56.4 million at the end of 2023. This increase was mainly attributed to four loans totaling $47.4 million. The allowance for credit losses also saw an uptick, standing at $78.1 million or 1.31% of total loans, compared to 1.12% at the end of December 2023.

Looking Ahead

Despite the mixed financial results, Midland States Bancorp remains committed to its conservative lending strategy and the expansion of its wealth management division. The company's focus on maintaining a robust capital position and managing its expense base aligns with its long-term strategic goals aimed at shareholder value maximization.

For detailed financial figures and operational insights, stakeholders and interested parties are encouraged to review the full earnings report and supplementary data provided in the company's 8-K filing.

Explore the complete 8-K earnings release (here) from Midland States Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance