Millions of Brits will suffer in cashless society

A cashless society would make eight million people suffer, according to an independent review of consumer spending called Access to Cash.

The report details how Britain risks “sleepwalking” into becoming a cashless society and that, in turn, creates huge problems for the millions of people who live in rural areas or are in a lot of debt.

“We haven’t taken a view in this report about the merit of a cashless society,” said the author of the report Natalie Ceeney, the UK’s former chief financial ombudsman. “We haven’t concluded that it’s impossible, or even undesirable. But our research does show that if we fail to plan and prepare for it properly, a cashless society would do significant harm to the millions of people who would be left behind.”

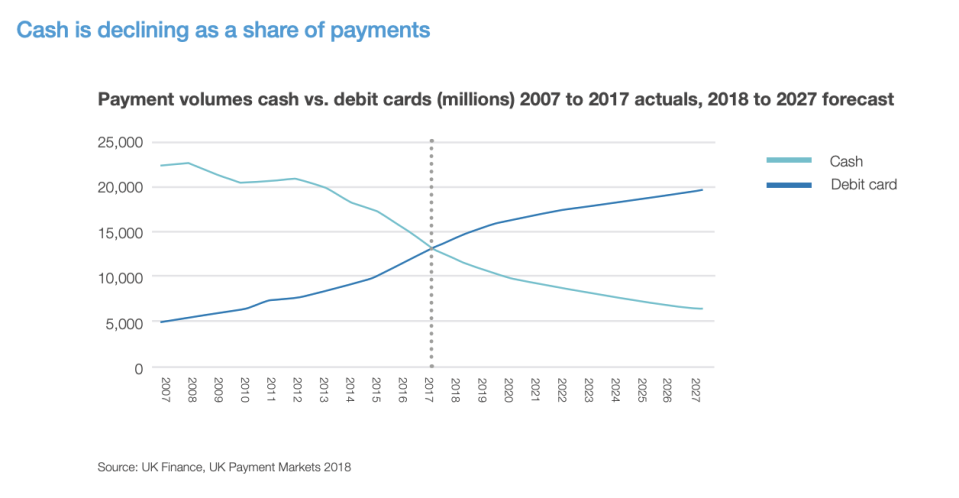

In June 2017, the trade body for the UK banking and financial services sector UK Finance, revealed that debit card payments overtook cash as the most popular form of payment in Britain for the first time. Card payment surged by 14% compared to the previous year. Meanwhile the number of cash transactions fell by 15% in the same period. Over the past decade, cash use has halved.

The Access to Cash report outlined how Britain “isn’t ready” for a cashless society and the further we move into a digital economy, these are all the people will would suffer as a result:

Rural communities: Poor broadband or mobile connectivity make it harder to set up card payment processes and therefore cash is king for people living in these areas.

People with physical or mental health problems: These members of society find it harder to use digital services.

The indebted: Those who need to budget find it easier to use cash.

Old people: Slow uptake on digital services can make them prone to hacking and scams.

Those in difficult or abusive relationships: Cash is a lifeline for those who have lost their independence.

“We don’t believe this is an acceptable outcome for Britain, and it’s not what the majority of people in the UK want,” said the Access to Cash report.

“To address these risks, we need to keep a reliable and effective cash infrastructure in place for those who need and choose to use cash, while developing digital solutions that work for everyone. As Britain moves towards a more cashless society, we must not leave anyone behind.”

Yahoo Finance

Yahoo Finance