The mini-Budget is still inflicting maximum pain

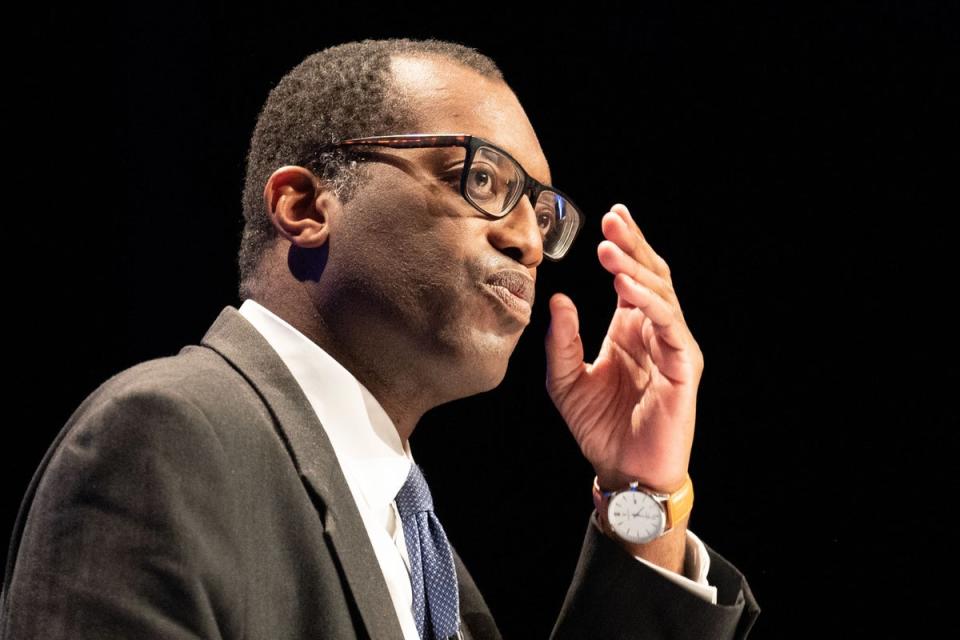

It was only 24 minutes long — but six months on Kwasi Kwarteng’s mini-Budget speech is still delivering the goods.Unfortunately far from the way the ill-fated former Chancellor might have hoped for.

Two major British companies, Persimmon and Aston Martin, today revealed how they have been badly damaged by the waves thrown up by the so called Growth Plan that ultimately did for Kwarteng and his boss Liz Truss.

The chaos in the gilts and mortgage markets that almost brought home-buying to a halt during the autumn is still holding back the housebuilding sector as we report today with an impact that will last long into 2023. Meanwhile the still resonating fallout has finally tipped property prices into negative territory for the first time since the pandemic.

Sterling was the other victim of the mini-Budget with the pound dropping to an all-time low and flirting with dollar parity.

That cost Aston Martin, one of Britain’s few remaining car makers with big dollar earnings, a tidy £156 million last year and helped push it to a loss of almost half a billion.

There are at least some encouraging signs that the economy is picking up more quickly than feared and may even give recession the swerve. But that is despite, not because, of the mini-Budget mayhem.

That speech — less than the length of a TV sitcom — may well prove to have been, minute for minute, one of the worst acts of economic self-harm in British political history. Not a plan for growth but for a charter for contraction.

Yahoo Finance

Yahoo Finance