Mirum (MIRM) Rises More Than 30% in Past 3 Months: Here's Why

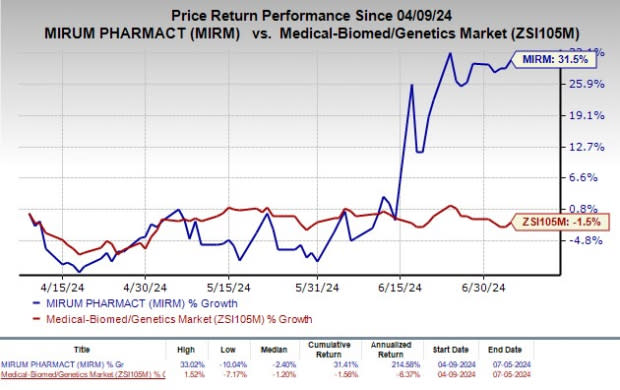

Shares of Mirum Pharmaceuticals, Inc. MIRM have rallied 31.5% in the past three months against the industry’s decrease of 1.5%.

Last month, the company submitted a new drug application (NDA) seeking approval for chenodiol for treating cerebrotendinous xanthomatosis (CTX) patients in the United States. The NDA filing was based on positive data from the phase III RESTORE study.

Data from the study showed that treatment with chenodiol significantly improved serum cholestanol. The RESTORE study met its primary endpoint of reduction in bile alcohols with high statistical significance.

Chenodiol is not currently approved but has received a medical necessity medicine status from the FDA for the treatment of CTX, a rare autosomal genetic disorder.

If approved, chenodiol would become the first and only medicine to be approved for treating CTX.

We remind investors that in August 2023, Mirum acquired all assets of Travere Therapeutics’ bile acid products, which added two other products to its commercial portfolio — Cholbam (cholic acid) capsules and Chenodal (chenodiol) tablets. Cholbam is approved for treating bile acid synthesis disorders and Zellweger spectrum disorders.

In June 2024, MIRM announced positive interim data from two phase IIb studies evaluating its pipeline candidate, volixibat, in patients with primary biliary cholangitis (PBC) and primary sclerosing cholangitis (PSC).

The phase IIb VISTAS study investigated volixibat for the treatment of PSC, while the phase IIb VANTAGE study evaluated volixibat for the treatment of PBC.

Interim data from the VANTAGE study showed that treatment with volixibat led to a statistically significant improvement in pruritus and a placebo-adjusted difference of -2.32 points in the primary endpoint of pruritus, as measured by the Adult ItchRO scale.

Per the company, the VISTAS PSC interim analysis exceeded the efficacy threshold for study continuation.

These could have been the factors driving the stock’s rise in the said time frame.

Image Source: Zacks Investment Research

Mirum’s lead product, Livmarli (maralixibat), an orally administered ileal bile acid transporter (“IBAT”) inhibitor, is approved for the treatment of cholestatic pruritus in patients with Alagille syndrome (ALGS) worldwide.

The FDA approved a label expansion for Livmarli oral solution to include the treatment of cholestatic pruritus in patients aged five years and older with progressive familial intrahepatic cholestasis (PFIC) in March 2024.

In the first quarter of 2024, Livmarli generated sales worth $42.8 million, reflecting an increase of almost 47% on a year-over-year basis. The FDA nod for the PFIC indication should drive sales further in 2024.

Recently, the European Commission approved Livmarli for the treatment of PFIC in patients aged three months and older.

A steady rise in Livmarli sales, a potential diversification of its commercial portfolio and the successful development of volixibat should push the stock upward in 2024.

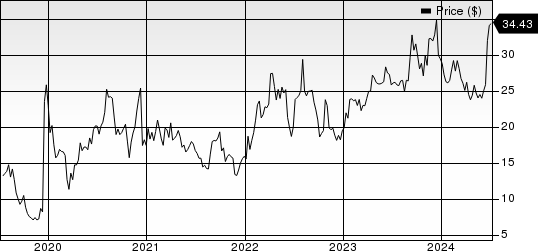

Mirum Pharmaceuticals, Inc. Price

Mirum Pharmaceuticals, Inc. price | Mirum Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Mirum currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Acrivon Therapeutics, Inc. ACRV, Aligos Therapeutics, Inc. ALGS and RAPT Therapeutics, Inc. RAPT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Acrivon Therapeutics’ 2024 loss per share have narrowed from $3.05 to $2.47. Loss per share estimates for 2025 have narrowed from $3.04 to $2.55. Year to date, ACRV shares have rallied 43.7%.

ACRV’s earnings beat estimates in three of the trailing four quarters and missed the same on the remaining one occasion, the average surprise being 3.56%.

In the past 60 days, estimates for Aligos Therapeutics’ 2024 loss per share have narrowed from 84 cents to 73 cents, while loss per share estimates for 2025 have narrowed from 82 cents to 71 cents. Year to date, ALGS shares have declined 39.2%.

Aligos’ earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 60 days, estimates for RAPT Therapeutics’ 2024 loss per share have narrowed from $3.19 to $2.93. Loss per share estimates for 2025 have narrowed from $2.40 to $2.05. Year to date, RAPT shares have declined 88.8%.

RAPT’s earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average surprise being 3.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mirum Pharmaceuticals, Inc. (MIRM) : Free Stock Analysis Report

Rapt Therapeutics (RAPT) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Acrivon Therapeutics, Inc. (ACRV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance